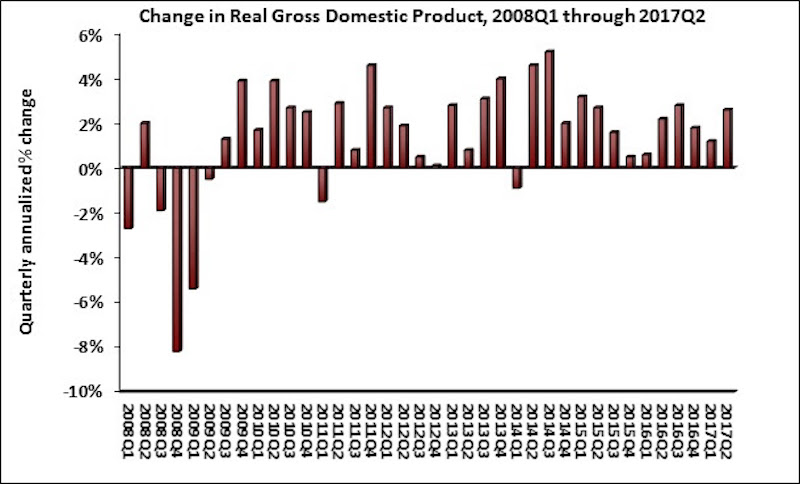

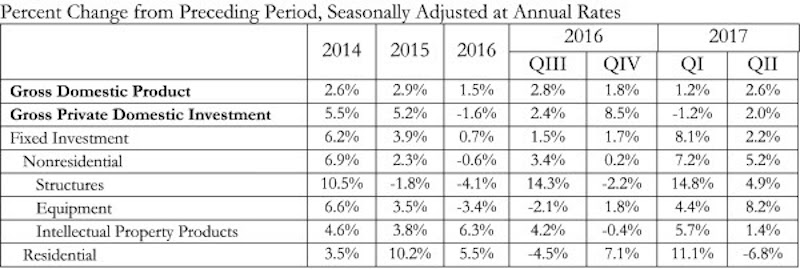

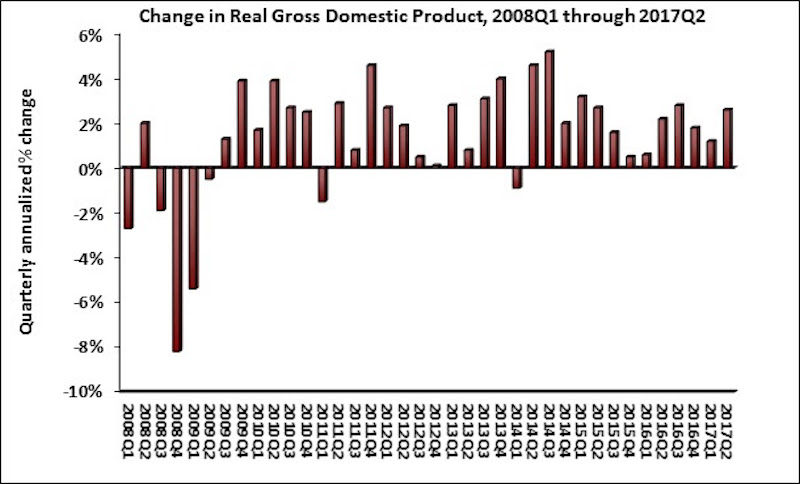

Real gross domestic product (GDP) expanded by 2.6% on a seasonally adjusted annualized basis during the year’s second quarter, according to Associated Builders and Contractors’ analysis of data released today by the Bureau of Economic Analysis. Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate. This follows a 7.2% expansion during the first quarter.

The expansion in nonresidential fixed investment indicates that growth in business outlays continues to support the ongoing economic recovery, now in its ninth year. The expansion of nonresidential fixed investment contributed more than sixth-tenths of a percentage point to GDP growth. This was due in large measure to an uptick in investment in construction equipment. The other two components of nonresidential fixed investment—investment in structures and intellectual property—also expanded, but at a slower pace.

“This was a good report from the perspective of the nation’s nonresidential construction firms, particularly those primarily engaged in private as opposed to public construction,” says ABC Chief Economist Anirban Basu in a release. “The uptick in investment in construction equipment is particularly noteworthy because it signals a general belief that construction activity will continue to recover in America. Backlog among many nonresidential construction firms is already healthy, and today’s report suggests that backlog is not set to decline in any meaningful way anytime soon.

“One might wonder why construction firms remain so busy in an economic environment still characterized by roughly 2 percent growth,” says Basu. “There are many factors at work, including the ongoing boom of the e-commerce economy, which has continued to trigger demand for massive fulfillment and distribution centers even as stores close in massive numbers at America’s malls. The influx of global investment to a number of segments, including hotel and office construction, also helps explain disproportionate growth in certain private categories. With global fixed-income yields remaining so low, investors from around the world, including from the United States, are likely to continue to seek out opportunities for higher rates of return in commercial real estate, which thus far has had the impact of increasing property values and triggering construction.

“For the broader economy to accelerate, policymakers in Washington, D.C., will need to begin to make progress on corporate tax relief and infrastructure,” says Basu.

Related Stories

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.

Market Data | Oct 15, 2020

6 must reads for the AEC industry today: October 15, 2020

Chicago's Bank of America Tower opens and altering facilities for a post-COVID-19 world.

Market Data | Oct 14, 2020

6 must reads for the AEC industry today: October 14, 2020

Thailand's new Elephant Museum and the Art Gallery of New South Wales receives an expansion.

Market Data | Oct 13, 2020

5 must reads for the AEC industry today: October 13, 2020

Miami Beach Convention Center renovation completes and guidance offered for K-12 schools to support students with asthma.

Market Data | Oct 12, 2020

Majority of contractors fear long-term business implications of COVID-19, according to Construction Executive survey

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning.

Market Data | Oct 12, 2020

6 must reads for the AEC industry today: October 12, 2020

4 challenges of realizing BIM's value for an owner and Florida office property is designed for a post-Covid world.

Market Data | Oct 8, 2020

6 must reads for the AEC industry today: October 8, 2020

The first rendering of the National Medal of Honor Museum is unveiled and seven urgent changes needed to fix senior living.

Market Data | Oct 7, 2020

6 must reads for the AEC industry today: October 7, 2020

Water-filled windows' effect on energy and construction begins on PGA of America HQ.

Market Data | Oct 6, 2020

Construction sector adds 26,000 workers in September but nonresidential jobs stall

Many commercial firms experience project cancellations.

Market Data | Oct 6, 2020

6 must reads for the AEC industry today: October 6, 2020

Construction rises 1.4% in August while nonresidential construction spending falls slightly.