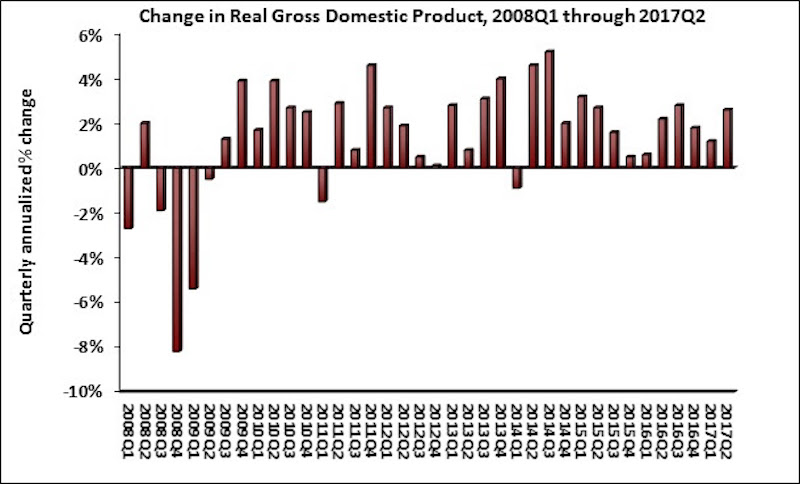

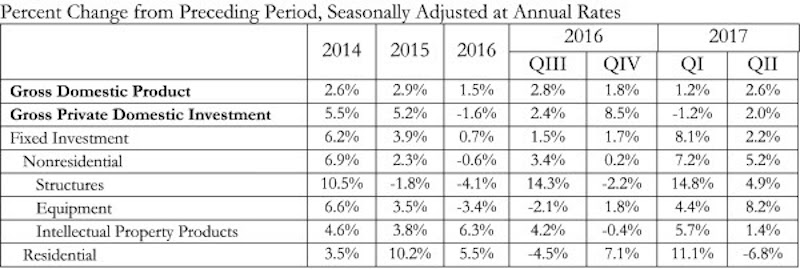

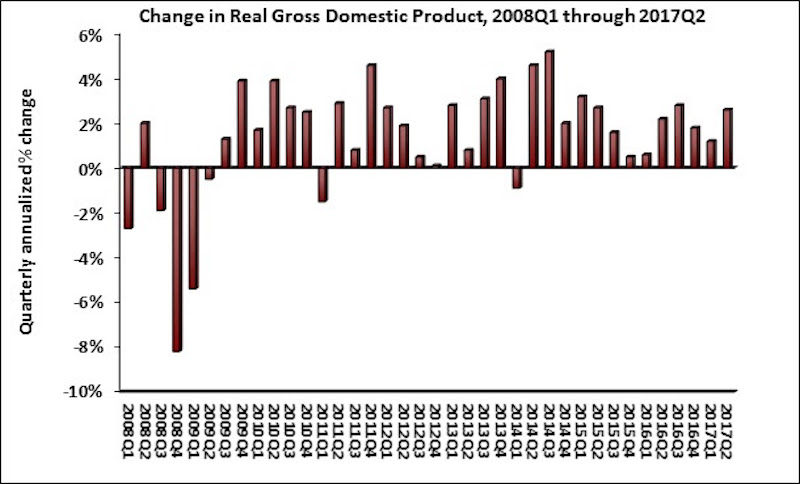

Real gross domestic product (GDP) expanded by 2.6% on a seasonally adjusted annualized basis during the year’s second quarter, according to Associated Builders and Contractors’ analysis of data released today by the Bureau of Economic Analysis. Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate. This follows a 7.2% expansion during the first quarter.

The expansion in nonresidential fixed investment indicates that growth in business outlays continues to support the ongoing economic recovery, now in its ninth year. The expansion of nonresidential fixed investment contributed more than sixth-tenths of a percentage point to GDP growth. This was due in large measure to an uptick in investment in construction equipment. The other two components of nonresidential fixed investment—investment in structures and intellectual property—also expanded, but at a slower pace.

“This was a good report from the perspective of the nation’s nonresidential construction firms, particularly those primarily engaged in private as opposed to public construction,” says ABC Chief Economist Anirban Basu in a release. “The uptick in investment in construction equipment is particularly noteworthy because it signals a general belief that construction activity will continue to recover in America. Backlog among many nonresidential construction firms is already healthy, and today’s report suggests that backlog is not set to decline in any meaningful way anytime soon.

“One might wonder why construction firms remain so busy in an economic environment still characterized by roughly 2 percent growth,” says Basu. “There are many factors at work, including the ongoing boom of the e-commerce economy, which has continued to trigger demand for massive fulfillment and distribution centers even as stores close in massive numbers at America’s malls. The influx of global investment to a number of segments, including hotel and office construction, also helps explain disproportionate growth in certain private categories. With global fixed-income yields remaining so low, investors from around the world, including from the United States, are likely to continue to seek out opportunities for higher rates of return in commercial real estate, which thus far has had the impact of increasing property values and triggering construction.

“For the broader economy to accelerate, policymakers in Washington, D.C., will need to begin to make progress on corporate tax relief and infrastructure,” says Basu.

Related Stories

Market Data | Nov 2, 2020

More contractors report canceled projects than starts, survey finds

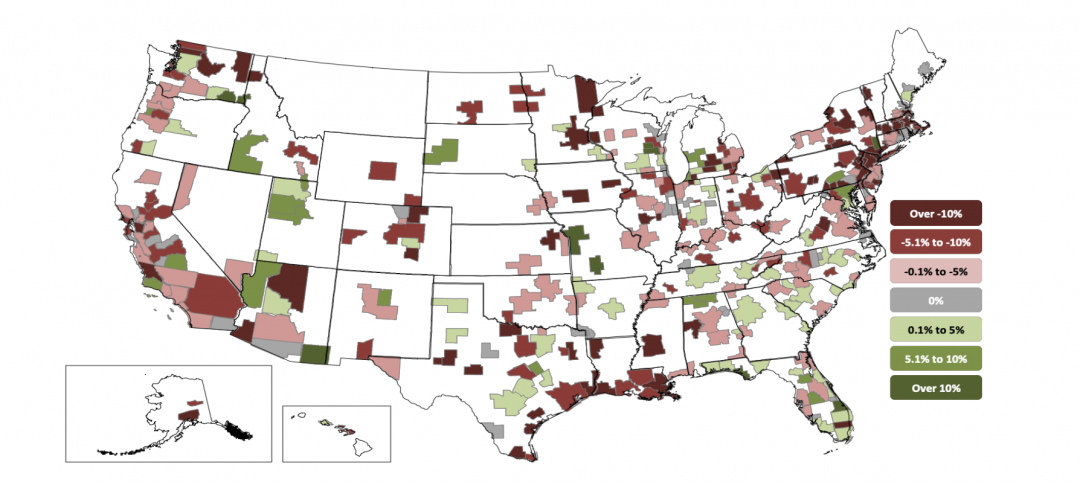

Construction employment declined in most metros in latest 12 months.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

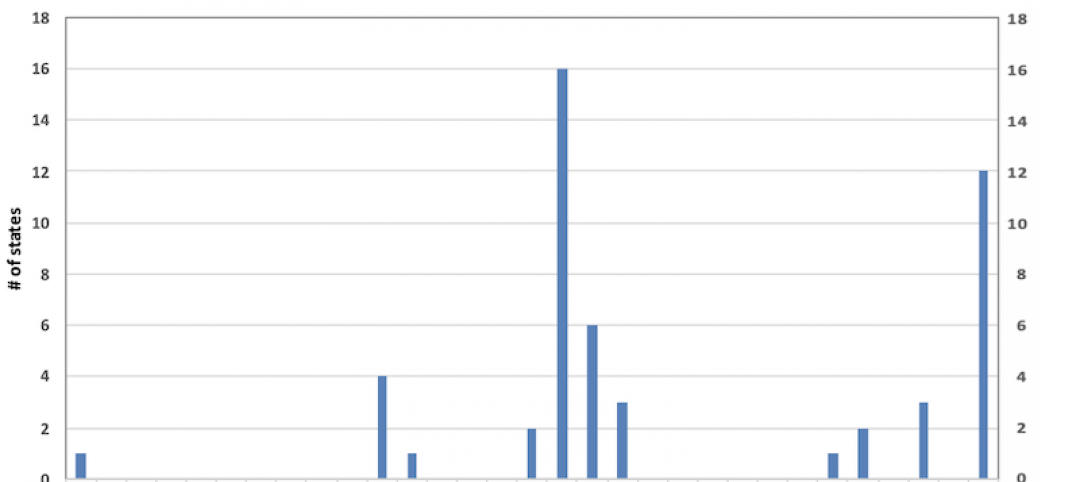

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.