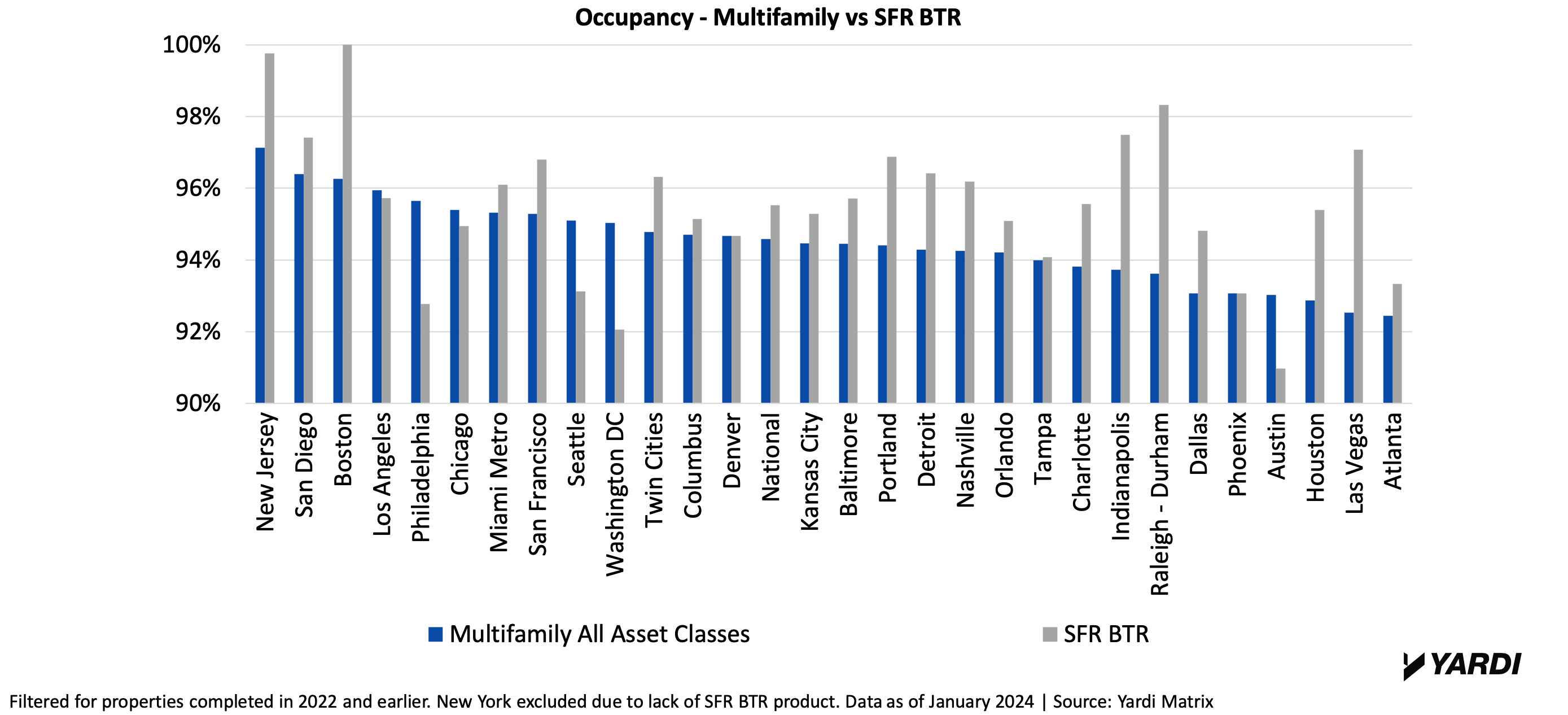

The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.

4 Biggest Demand Drivers for Single-Family Rentals

But aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.

1. Renters working from home

Because more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.

2. Household formation growth during the pandemic

Demand is also driven by household formation growth during the pandemic as a result of:

- Employment/wage growth.

- Stimulus payments.

- Increased savings.

3. Declining homebuying affordability

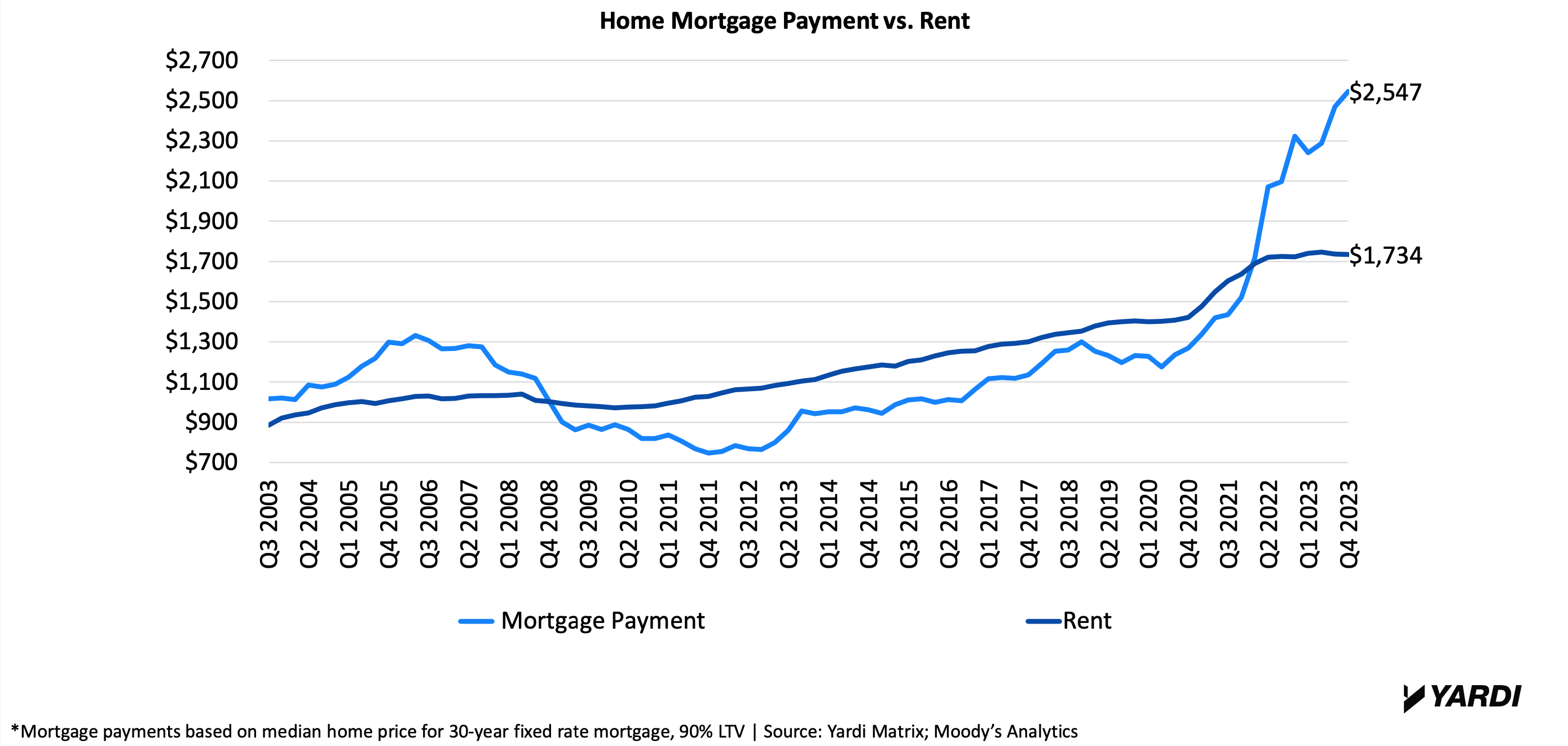

According to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.

As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.

4. Specific demographics

Those averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.

SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.

RELATED: Multifamily rent remains flat at $1,710 in January

Development Trends

The four biggest single-family rental development trends as of 2024 include:

- Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.

- Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.

- Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.

- Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.

Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.

Related Stories

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Sponsored | Multifamily Housing | Sep 29, 2023

Win-Win Scenarios for Residents and Property Managers

Discover how proptech is opening open new paths to revenue for owners and property managers, while bringing desirable amenities and conveniences for renters. Check out my thoughts on profitable, resident-centric proptech.

Products and Materials | Sep 29, 2023

Top building products for September 2023

BD+C Editors break down 15 of the top building products this month, from smart light switches to glass wall systems.

Multifamily Housing | Sep 26, 2023

Midwest metros see greatest rent increase in September 2023

While the median monthly price of rent has increased by 0.71% in August, the year-over-year estimates show a national change of -0.06 percent.

Affordable Housing | Sep 25, 2023

3 affordable housing projects that serve as social catalysts

Trish Donnally, Associate Principal, Perkins Eastman, shares insights from three transformative affordable housing projects.

Sponsored | Multifamily Housing | Sep 25, 2023

Six3Tile helps The Sherbert Group bring an abandoned Power House back to life