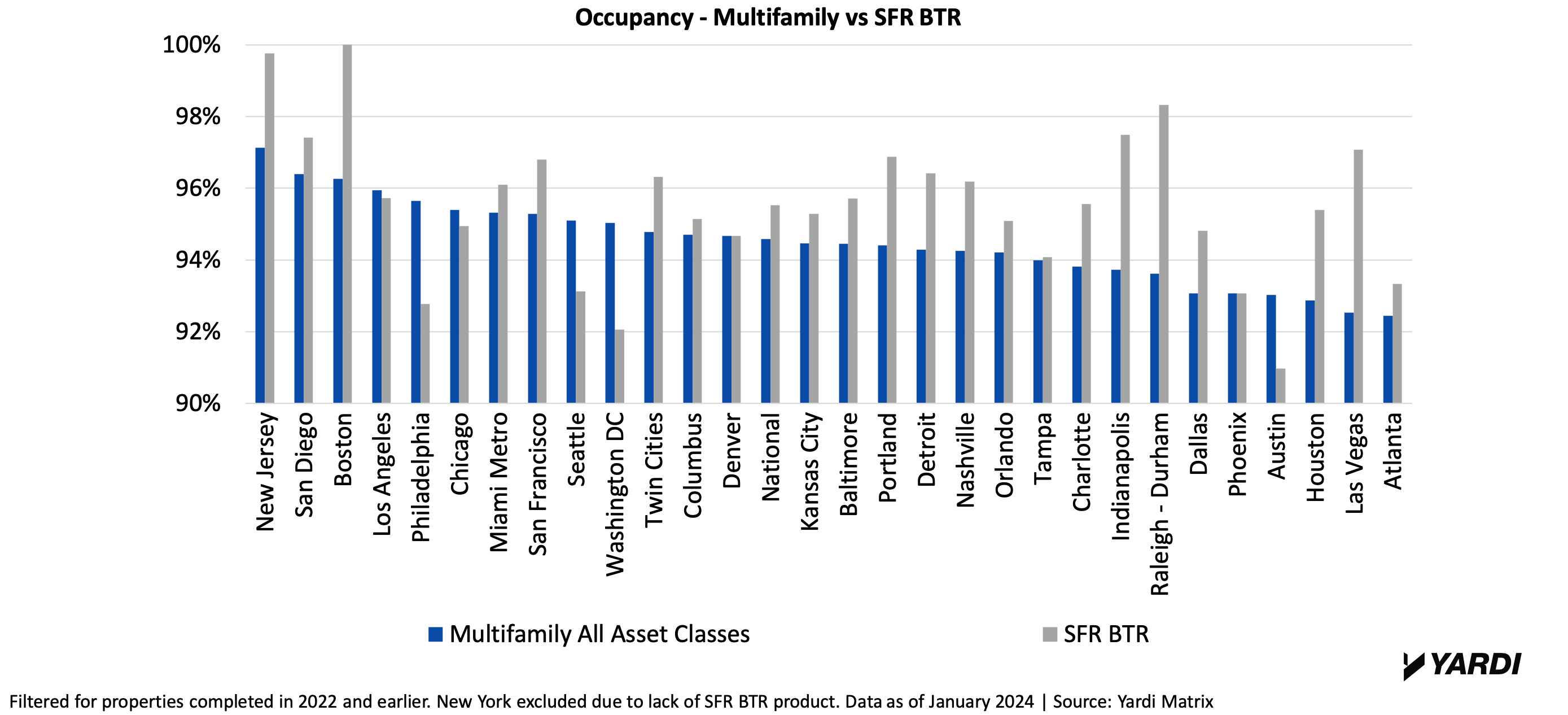

The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.

4 Biggest Demand Drivers for Single-Family Rentals

But aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.

1. Renters working from home

Because more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.

2. Household formation growth during the pandemic

Demand is also driven by household formation growth during the pandemic as a result of:

- Employment/wage growth.

- Stimulus payments.

- Increased savings.

3. Declining homebuying affordability

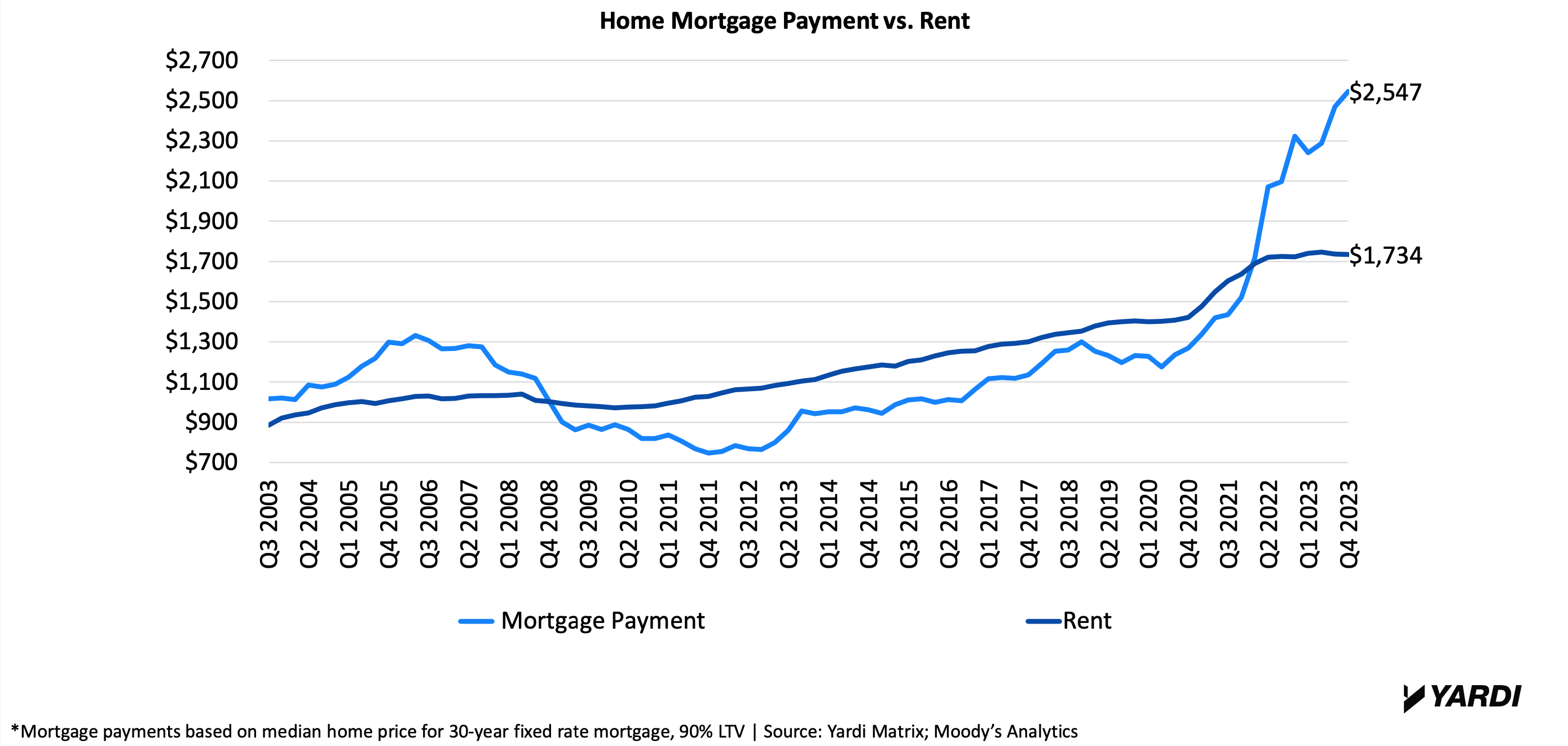

According to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.

As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.

4. Specific demographics

Those averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.

SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.

RELATED: Multifamily rent remains flat at $1,710 in January

Development Trends

The four biggest single-family rental development trends as of 2024 include:

- Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.

- Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.

- Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.

- Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.

Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.

Related Stories

Giants 400 | Dec 20, 2023

Top 30 Student Housing Engineering Firms for 2023

Kimley-Horn, Wiss, Janney, Elstner Associates, KPFF Consulting Engineers, and Olsson head BD+C's ranking of the nation's largest student housing facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 90 Student Housing Architecture Firms for 2023

Niles Bolton Associates, Solomon Cordwell Buenz, BKV Group, and Humphreys and Partners Architects top BD+C's ranking of the nation's largest student housing facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

MFPRO+ News | Dec 18, 2023

Berkeley, Calif., raises building height limits in downtown area

Facing a severe housing shortage, the City of Berkeley, Calif., increased the height limits on residential buildings to 12 stories in the area close to the University of California campus.

Sponsored | Multifamily Housing | Dec 13, 2023

Mind the Gap

Incorporating temporary expansion joints on larger construction projects can help avoid serious consequences. Here's why and how.

Giants 400 | Dec 12, 2023

Top 35 Military Facility Construction Firms for 2023

Hensel Phelps, DPR Construction, Walsh Group, and Whiting-Turner top BD+C's ranking of the nation's largest military facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 50 Military Facility Engineering Firms for 2023

Jacobs, Burns & McDonnell, WSP, and AECOM head BD+C's ranking of the nation's largest military facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 40 Military Facility Architecture Firms for 2023

Michael Baker International, HDR, Whitman, Requardt & Associates, and Stantec top BD+C's ranking of the nation's largest military facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.

MFPRO+ News | Dec 7, 2023

7 key predictions for the 2024 multifamily rental housing market

2024 will be the strongest year for new apartment construction in decades, says Apartment List's chief economist.