Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

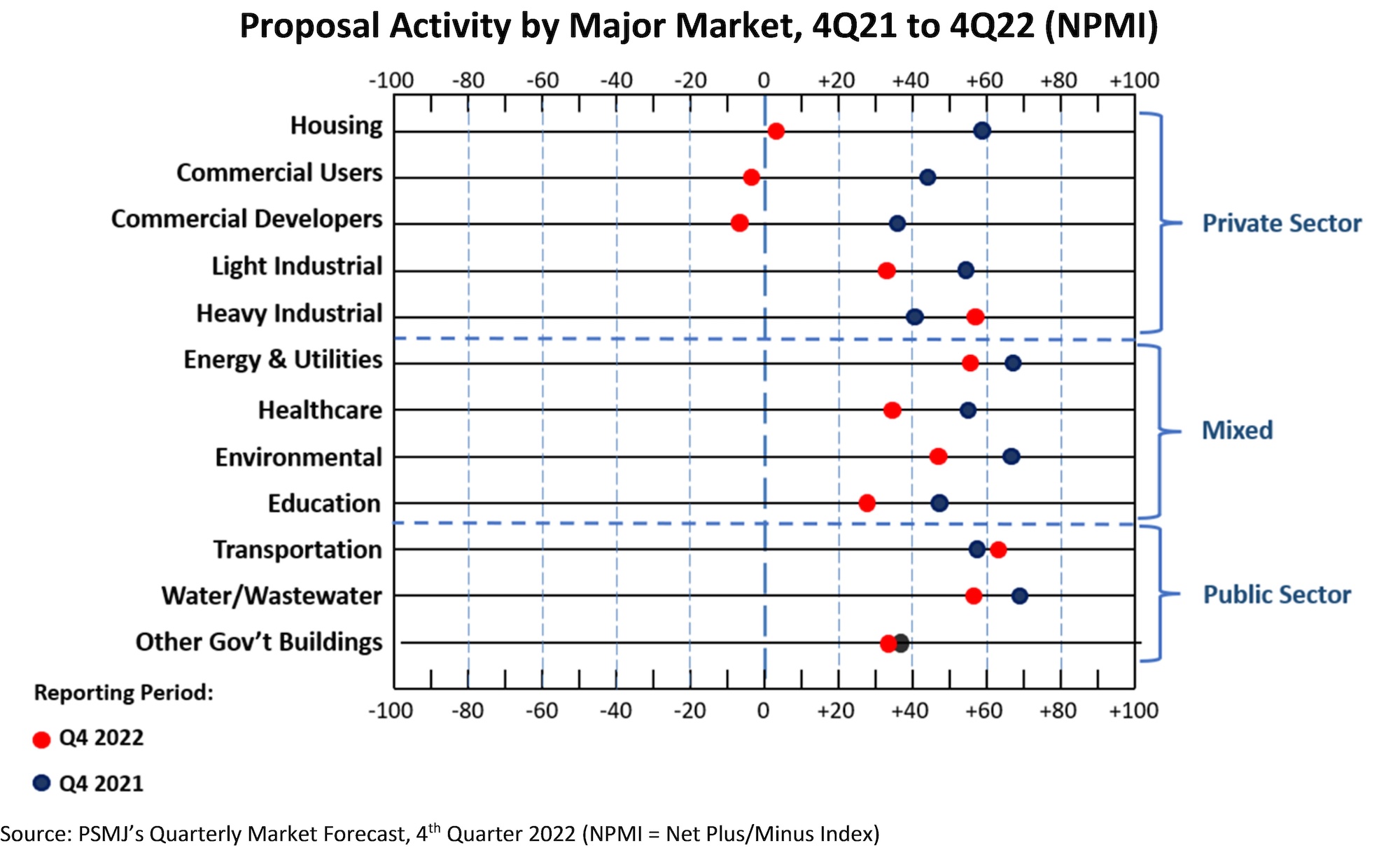

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| May 30, 2012

Hill International to manage construction of Al Risafa Stadium in Iraq

The three-year contract has an estimated value to Hill of approximately $3.3 million.

| May 29, 2012

Torrance Memorial Medical Center’s pediatric burn patients create their version of new Patient Tower using Legos

McCarthy workers joined the patients, donning construction gear and hard hats, to help with their building efforts.

| May 29, 2012

Reconstruction Awards Entry Information

Download a PDF of the Entry Information at the bottom of this page.

| May 29, 2012

AIA expands Documents-On-Demand service??

Six new documents added, DOD offers nearly 100 contract documents.

| May 29, 2012

Legrand achieves over 20% energy-intensity reduction in Presidential Challenge

West Hartford headquarters announced as Better Buildings, Better Plants “Showcase” site.

| May 29, 2012

Thornton Tomasetti/Fore Solutions provides consulting for Phase I of Acadia Gateway Center

Project receives LEED Gold certification.

| May 24, 2012

2012 Reconstruction Awards Entry Form

Download a PDF of the Entry Form at the bottom of this page.

| May 24, 2012

Gilbane’s Spring 2012 economic report identifies multiple positive economic and market factors

Anticipating increasing escalation in owner costs through 2014.

| May 24, 2012

Construction backlog declines 5.4% in the first quarter of 2012?

The nation’s nonresidential construction activity will remain soft during the summer months, with flat to declining nonresidential construction spending.