Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

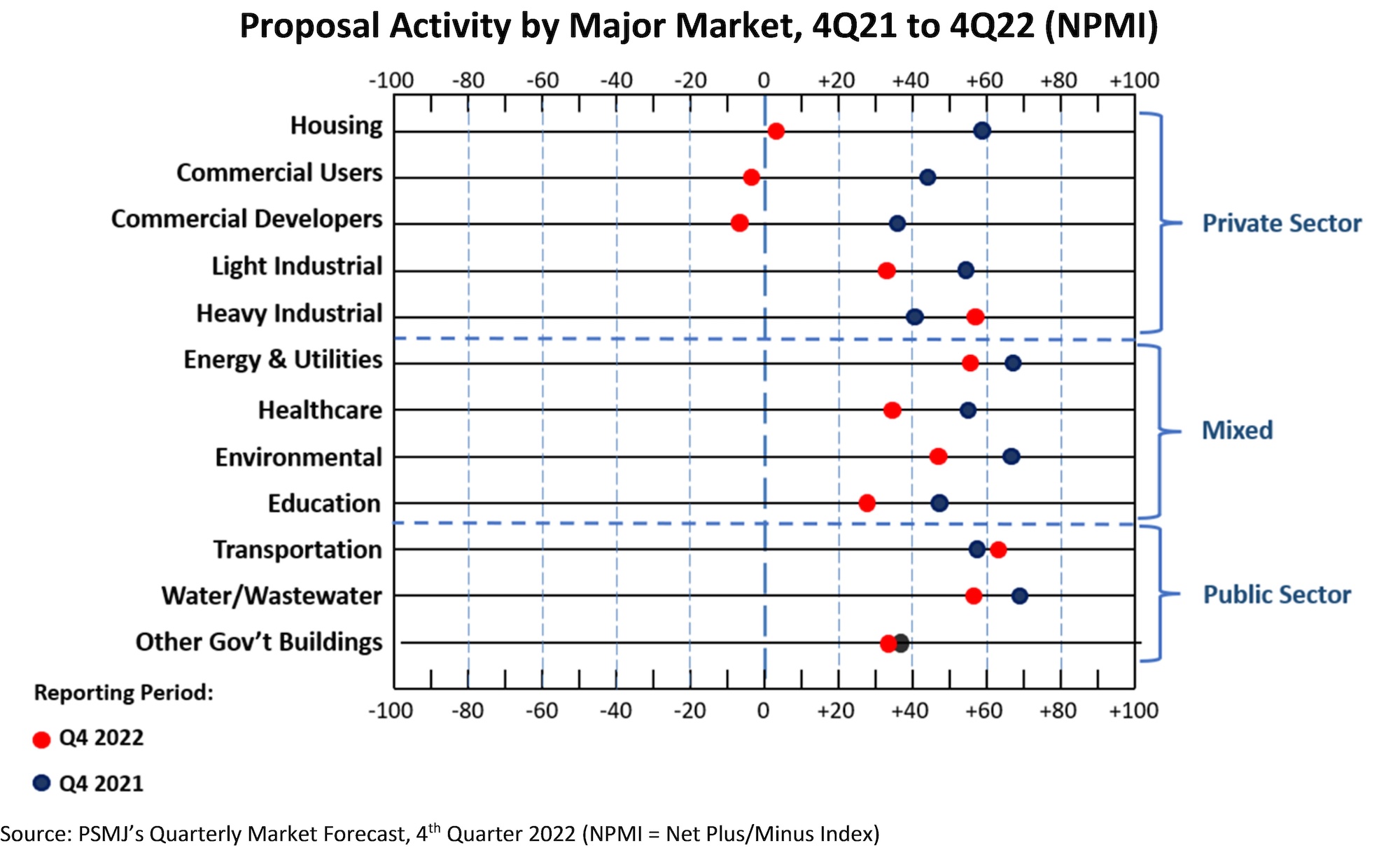

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| May 15, 2012

Suffolk selected for Rosenwald Elementary modernization project

The 314-student station elementary school will undergo extensive modernization.

| May 15, 2012

Don’t be insulated from green building

Examining the roles of insulation and manufacturing in sustainability’s growth.

| May 15, 2012

National Tradesmen Day set for Sept. 21

IRWIN Tools invites the nation to honor "The Real Working Hands that Build America and Keep it Running Strong".

| May 15, 2012

SAGE Electrochromics to become wholly owned subsidiary of Saint-Gobain

This deal will help SAGE expand into international markets, develop new products and complete construction of the company’s new, state-of-the-art manufacturing facility in Faribault, Minn.

| May 14, 2012

Codes harvest rainwater

IAPMO’s Green Plumbing and Mechanical Code Supplement could make rainwater harvesting systems commonplace by clearly outlining safe installation and maintenance practices.

| May 14, 2012

Plumbing research coalition to study drainline transport issue

The effort is aimed at determining if decreasing levels of water flow––caused by increasingly efficient plumbing fixtures––are sufficient to clear debris from plumbing pipes.

| May 14, 2012

SOM to break ground on supertall structure in China

The 1,740-feet (530-meter) tall tower will house offices, 300 service apartments and a 350-room, 5-star hotel beneath an arched top.

| May 14, 2012

Adrian Smith + Gordon Gill Architecture design Seoul’s Dancing Dragons

Supertall two-tower complex located in Seoul’s Yongsan International Business District.

| May 14, 2012

SMPS and Deltek announce alliance

A/E/C industry leaders partner to advance technology’s role in design firm marketing and business development.

| May 14, 2012

ArchiCAD e-Specs integration unveiled

Architects, engineers and construction professionals use InterSpec’s e-SPECS products on thousands of projects annually to maintain synchronization between construction models, drawings, and project specifications.