Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

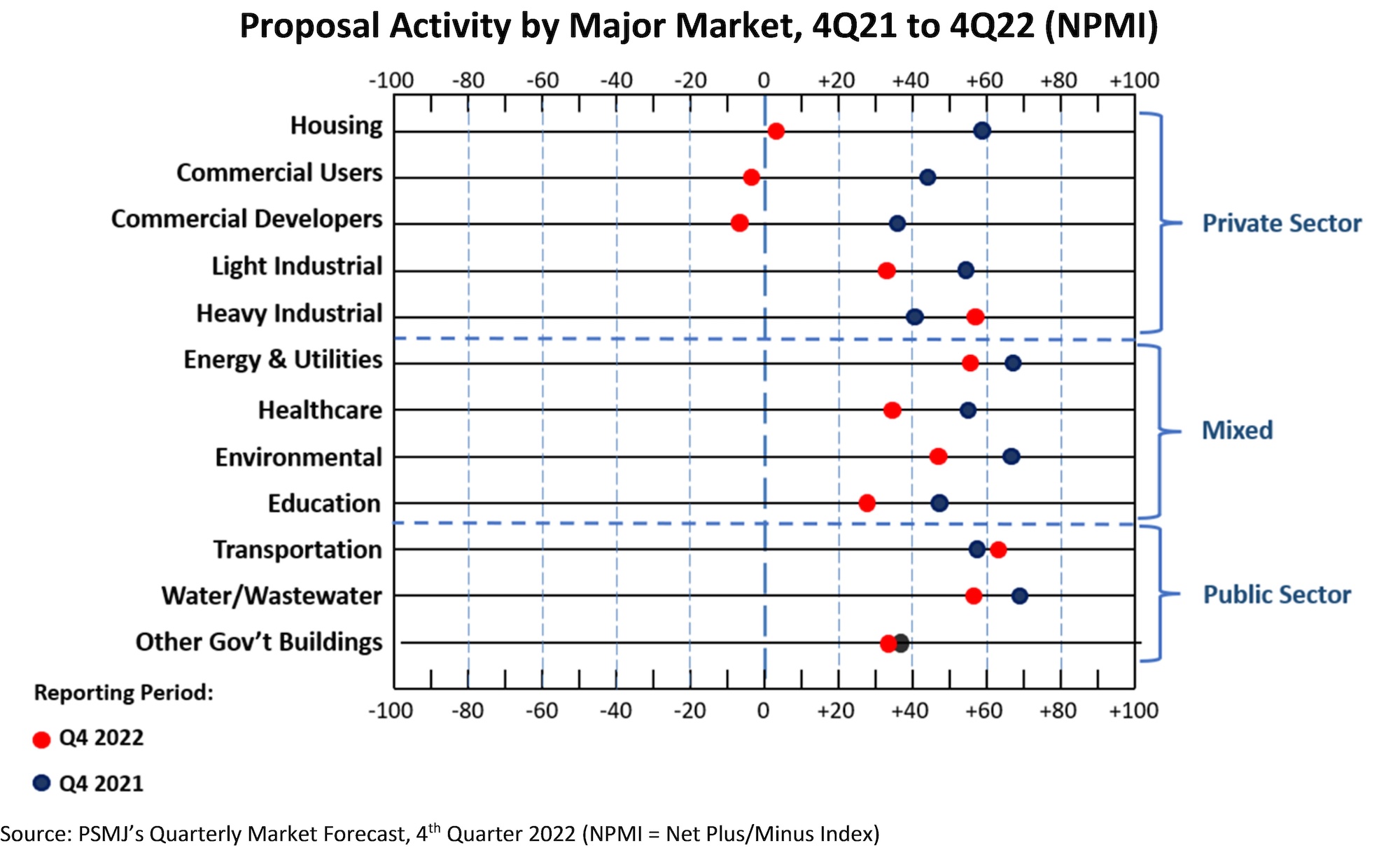

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| Jun 1, 2012

AIA 2030 Commitment Program reports new results

The full report contains participating firm demographics, energy reduction initiatives undertaken by firms, anecdotal accounts, and lessons learned.

| Jun 1, 2012

Robert Wilson joins SmithGroupJJR

Wilson makes the move to SmithGroupJJR from VOA Associates, Inc., where he served as a senior vice president and technical director in its Chicago office.

| Jun 1, 2012

Gilbane Building's Sue Klawans promoted

Industry veteran tasked with boosting project efficiency and driving customer satisfaction, to direct operational excellence efforts.

| Jun 1, 2012

Ground broken for Children’s Hospital Colorado South Campus

Children’s Hospital Colorado expects to host nearly 80,000 patient visits at the South Campus during its first year.

| Jun 1, 2012

K-State Olathe Innovation Campus receives LEED Silver

Aspects of the design included a curtain wall and punched openings allowing natural light deep into the building, regional materials were used, which minimized the need for heavy hauling, and much of the final material included pre and post-consumer recycled content.

| Jun 1, 2012

New York City Department of Buildings approves 3D BIM site safety plans

3D BIM site safety plans enable building inspectors to take virtual tours of construction projects and review them in real-time on site.

| May 31, 2012

Product Solutions June 2012

Curing agents; commercial faucets; wall-cladding systems.

| May 31, 2012

8 steps to a successful BIM marketing program

It's not enough to have BIM capability--you have to know how to sell your BIM expertise to clients and prospects.

| May 31, 2012

3 Metal Roofing Case Studies Illustrate Benefits

Metal roofing systems offer values such as longevity, favorable life cycle costs, and heightened aesthetic appeal.

| May 31, 2012

AIA Course: High-Efficiency Plumbing Systems for Commercial and Institutional Buildings

Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.