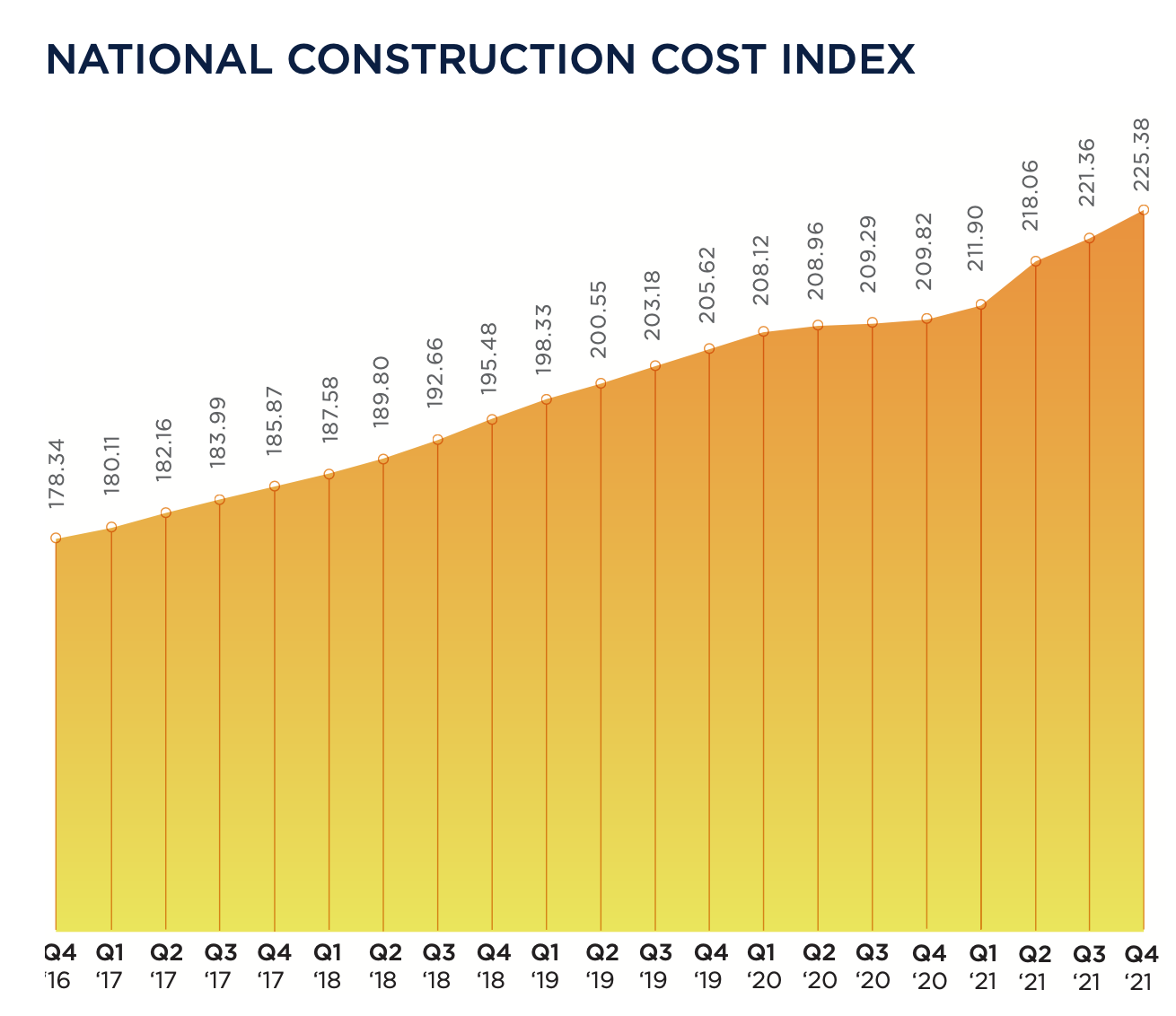

In the 12 months ended December 2021, bid construction costs rose 7.42 percent. “These increases are reminiscent of the sort of cost increases that we saw in the period 2004 to 2007,” wrote Julian Anderson, FRICS, President-North America for the construction advisory firm Rider Levett Bucknall (RLB), which today released its Fourth Quarter 2021 North America Construction Cost Report.

RLB’s National Construction Cost Index for the fourth quarter stood at 225.38, 7.4 percent higher than the Index for the fourth quarter of 2020, and 1.8 percent higher than last year’s third quarter. In his essay for this report, Anderson was optimistic about the eventual positive impact of the recently passed Bipartisan Infrastructure bill on construction and repair.

However, the force of that legislation could be stymied, or at least delayed, by supply chain problems that continue to plague the industry. Bottlenecks at western ports and chronic shortages of skilled labor still contribute to this volatility. Cost increases are also a function of rising inflation, as the Consumer Price Index registered a year-over-year increase of 5.38 percent.

On the positive side, America’s Gross Domestic Product, which measures output, returned to 2.1 percent, which was about where it was in the pre-pandemic fourth quarter of 2019. And the rate of unemployment for the construction sector dipped to 4.5 percent in Q421, versus 9.6 percent in Q420. Construction tracked national unemployment that has also been on a downward trend.

SEVERAL METROS BUCKED QUARTERLY COST TREND

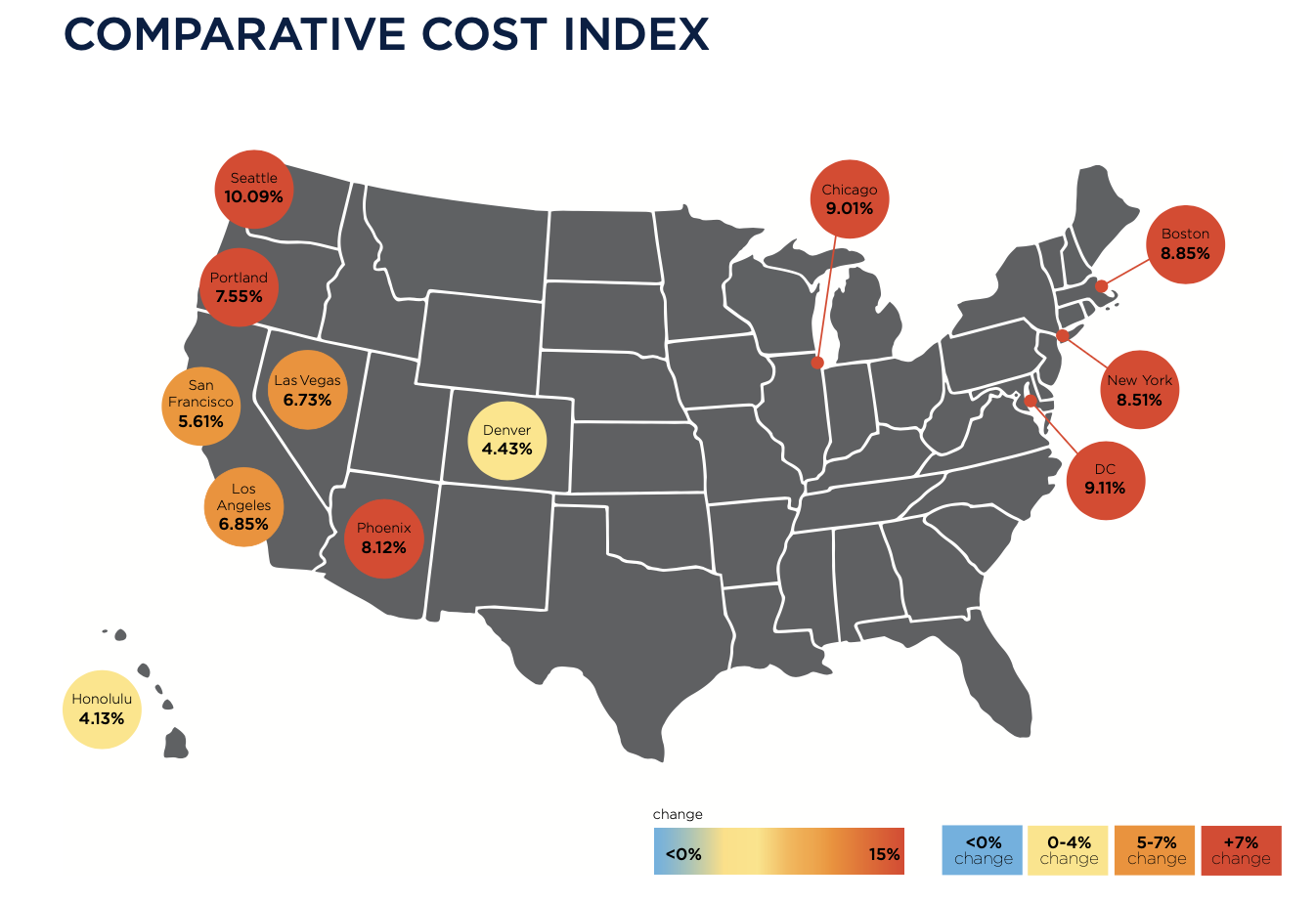

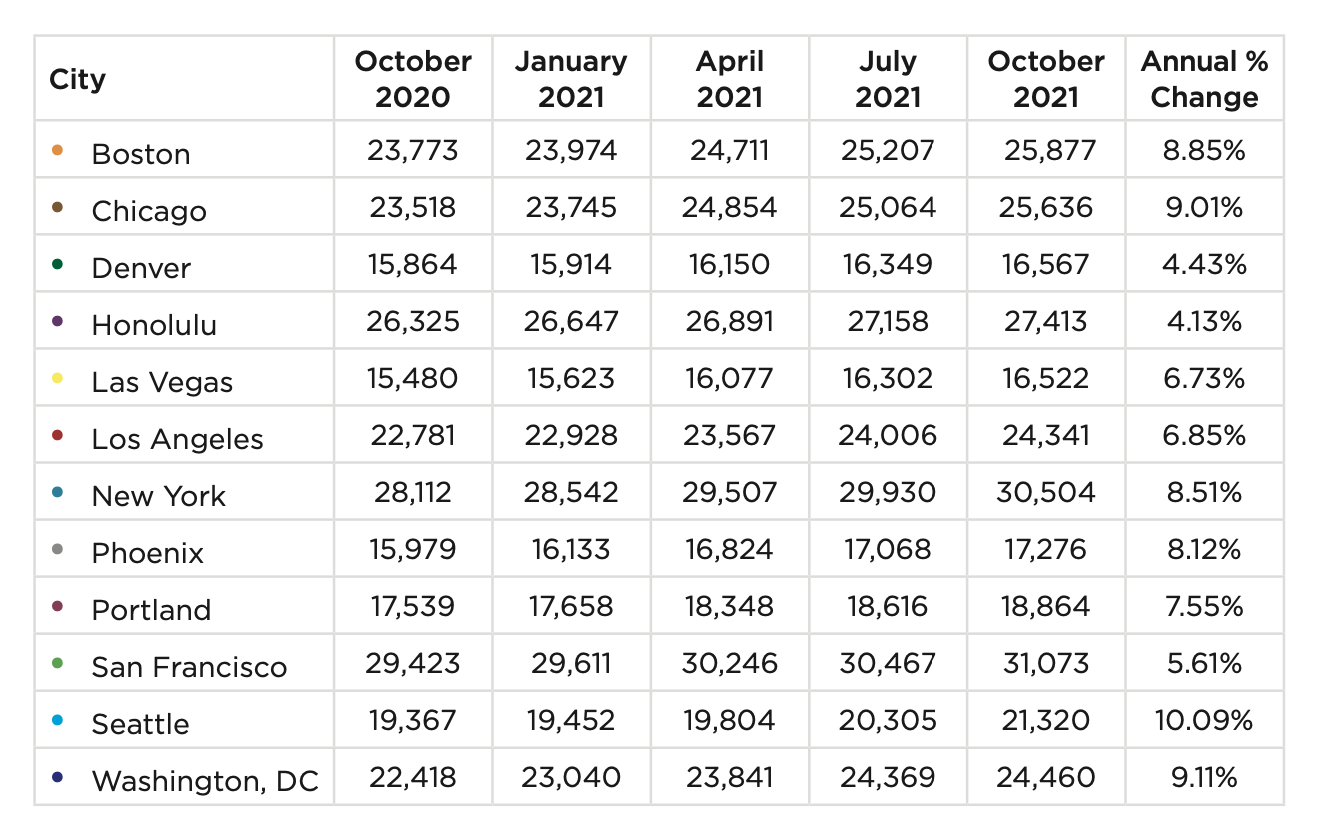

Nonresidential construction spending in November 2021, the latest month for which data were available from the Census Bureau, stood at $820.6 billion, 3.4 percent higher than the same month in 2021. But materials and labor keep getting more expensive, too. RLB’s Comparative Cost Index found that, from October 2020 through October 2021, construction costs rose by 10.09 percent in Seattle, by 9.11 percent in Washington DC, by 9.01 percent in Chicago, by 8.85 percent in Boston, and by 8.51 percent in New York.

Indexed by building type, construction costs were among the highest in New York for offices, shopping malls, hospitals, single-family homes, and high schools. San Francisco’s construction costs exceeded the other markets RLB tracked for five-star hotels, hospitals, warehouses, parking structures, multifamily homes, high schools, and universities.

Honolulu is the most expensive market in which to build elementary schools. But that market, along with Denver, Las Vegas, Los Angeles, Phoenix, Portland, and Washington DC, experienced overall cost increases between July 1 and October 1 that were less than the national average for that period, according to RLB estimates.

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.