Greystar, a global leader in the investment, development, and management of institutional quality rental housing, announced the formation of a long-term property management services relationship with Wood Partners, a top five national developer and builder of multifamily housing in the United States.

Under the terms of the agreement, all property management operations of Wood will be transferred to Greystar and Wood Property Management associates will become Greystar team members. Greystar and Wood have also entered into a long-term preferred management services provider agreement, whereby Greystar will serve as property manager for all current and future Wood developed and owned assets.

Greystar takes over Wood Partners properties

Wood’s managed portfolio includes over 130 multifamily properties totaling 38,000 units under management and spanning 17 states, including both operating and planned projects. The combination is complementary to Greystar’s existing platform and will add additional resources and capabilities for clients, partners, and residents of Wood communities.

The combined portfolio grows Greystar’s property management presence to over 895,000 units across over 3,200 communities, and Greystar’s team to over 24,000 team members.

“Across Wood Partners’ property management business, we recognize an impressive team of professionals sharing a similar operating philosophy, core values, and a ‘people-centered’ approach,” said Mike Clow, Executive Managing Director of Greystar’s U.S. Real Estate Services.

Jones Lang LaSalle Securities, LLC, an affiliate of Jones Lang LaSalle Americas, Inc., served as financial advisor to Wood Partners in connection with the transaction. Terms of the transaction were not disclosed.

Related Stories

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.

Mixed-Use | Apr 13, 2024

Former industrial marina gets adaptive reuse treatment

At its core, adaptive reuse is an active reimagining of the built environment in ways that serve the communities who use it. Successful adaptive reuse uncovers the latent potential in a place and uses it to meet people’s present needs.

MFPRO+ News | Apr 12, 2024

Legal cannabis has cities grappling with odor complaints

Relaxed pot laws have led to a backlash of complaints linked to the odor emitted from smoking and vaping. To date, 24 states have legalized or decriminalized marijuana and several others have made it available for medicinal use.

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.

MFPRO+ News | Apr 10, 2024

5 key design trends shaping tomorrow’s rental apartments

The multifamily landscape is ever-evolving as changing demographics, health concerns, and work patterns shape what tenants are looking for in their next home.

Mixed-Use | Apr 9, 2024

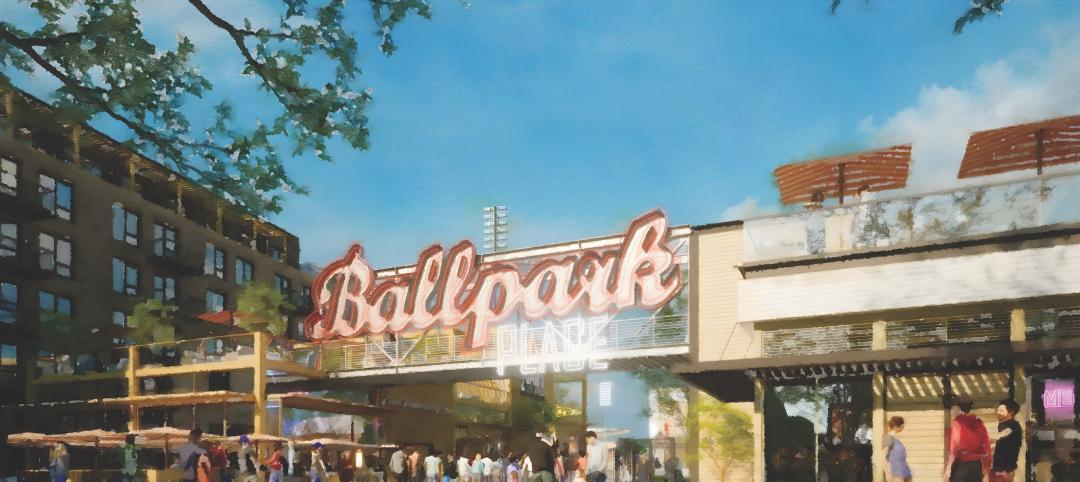

A surging master-planned community in Utah gets its own entertainment district

Since its construction began two decades ago, Daybreak, the 4,100-acre master-planned community in South Jordan, Utah, has been a catalyst and model for regional growth. The latest addition is a 200-acre mixed-use entertainment district that will serve as a walkable and bikeable neighborhood within the community, anchored by a minor-league baseball park and a cinema/entertainment complex.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Affordable Housing | Apr 1, 2024

Biden Administration considers ways to influence local housing regulations

The Biden Administration is considering how to spur more affordable housing construction with strategies to influence reform of local housing regulations.