Construction companies remain consistent in their concern about risk exposure in 2016, with respondents reporting in a new survey that their “risk sentiment” has remained steady at 4.4 on a scale of 1-10 (it was at 4.4 at the end of 2015 as well). The latest “Sterling Risk Sentiment Index” shows that most report improving profit margins, but while they say their concerns about staffing are decreasing, access to adequate numbers of employees continues as the No. 1 business risk.

Businesses were also surveyed about how the current election cycle is affecting their businesses. A majority said “election year uncertainty” was having an impact and most felt that the election of a Republican President would improve their business.

The survey noted other key issues of concern. Financial & cash flow issues saw a significant jump (up 8%), with increased competition and government regulation remaining high.

Highlights from the Summer 2016 Sterling Risk Sentiment Index

Note: Where noted, comparisons are with the December 2015 Sterling Risk Sentiment Index

● The #1 risk issue is remains overwhelmingly staffing, with construction companies struggling to have enough employees to handle projects. But the percentage is at 47 percent, down from 60 percent in Fall 2015 Risk Index. Economic issues ranked a distant second at 20 percent.

● Staffing again was the issue companies reported they felt least prepared to deal with right now (30 percent). Health care costs were next (15 percent), followed by cash flow and financial issues (9 percent).

● 64 percent say their company’s exposure for risk is lower than a year ago, a drop from December’s 71 percent.

● 86 percent of respondents say they have formal strategies in place to manage their risk, up from 74 percent in December.

● 75 percent have reviewed their risk management plans in the last 12 months, down from 69 percent.

The new survey also asked construction companies several general questions:

● 80 percent of those surveyed said that they’d see an improvement in their business if a Republican was elected President. Just seven (7) percent said Democrat and ten (10) percent said Libertarian.

● 45 percent said the election year uncertainty affected their businesses. Thirty-seven percent said no and 18 percent didn’t know.

Additional Survey Results

● 84 percent say their profit margins are better today than a year ago

● 88 percent say their pipeline of opportunities is better today than a year ago

● 78 percent say they are able to build adequate contingencies into their project budgets

The Summer 2016 Sterling Risk Sentiment Index surveyed 86 top executives in Atlanta’s construction industry using SurveyMonkey.com. The survey was conducted between July and August 2016.

Related Stories

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.

K-12 Schools | Nov 30, 2022

School districts are prioritizing federal funds for air filtration, HVAC upgrades

U.S. school districts are widely planning to use funds from last year’s American Rescue Plan (ARP) to upgrade or improve air filtration and heating/cooling systems, according to a report from the Center for Green Schools at the U.S. Green Building Council. The report, “School Facilities Funding in the Pandemic,” says air filtration and HVAC upgrades are the top facility improvement choice for the 5,004 school districts included in the analysis.

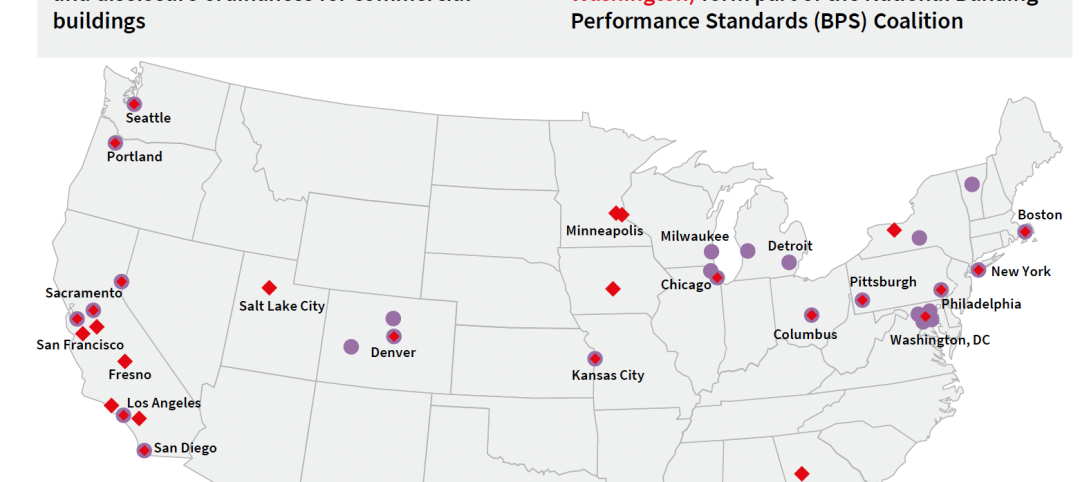

Industry Research | Nov 8, 2022

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Multifamily Housing | May 11, 2022

Kitchen+Bath AMENITIES – Take the survey for a chance at a $50 gift card

MULTIFAMILY DESIGN + CONSTRUCTION is conducting a research study on the use of kitchen and bath products in the $106 billion multifamily construction sector.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.