Construction companies remain consistent in their concern about risk exposure in 2016, with respondents reporting in a new survey that their “risk sentiment” has remained steady at 4.4 on a scale of 1-10 (it was at 4.4 at the end of 2015 as well). The latest “Sterling Risk Sentiment Index” shows that most report improving profit margins, but while they say their concerns about staffing are decreasing, access to adequate numbers of employees continues as the No. 1 business risk.

Businesses were also surveyed about how the current election cycle is affecting their businesses. A majority said “election year uncertainty” was having an impact and most felt that the election of a Republican President would improve their business.

The survey noted other key issues of concern. Financial & cash flow issues saw a significant jump (up 8%), with increased competition and government regulation remaining high.

Highlights from the Summer 2016 Sterling Risk Sentiment Index

Note: Where noted, comparisons are with the December 2015 Sterling Risk Sentiment Index

● The #1 risk issue is remains overwhelmingly staffing, with construction companies struggling to have enough employees to handle projects. But the percentage is at 47 percent, down from 60 percent in Fall 2015 Risk Index. Economic issues ranked a distant second at 20 percent.

● Staffing again was the issue companies reported they felt least prepared to deal with right now (30 percent). Health care costs were next (15 percent), followed by cash flow and financial issues (9 percent).

● 64 percent say their company’s exposure for risk is lower than a year ago, a drop from December’s 71 percent.

● 86 percent of respondents say they have formal strategies in place to manage their risk, up from 74 percent in December.

● 75 percent have reviewed their risk management plans in the last 12 months, down from 69 percent.

The new survey also asked construction companies several general questions:

● 80 percent of those surveyed said that they’d see an improvement in their business if a Republican was elected President. Just seven (7) percent said Democrat and ten (10) percent said Libertarian.

● 45 percent said the election year uncertainty affected their businesses. Thirty-seven percent said no and 18 percent didn’t know.

Additional Survey Results

● 84 percent say their profit margins are better today than a year ago

● 88 percent say their pipeline of opportunities is better today than a year ago

● 78 percent say they are able to build adequate contingencies into their project budgets

The Summer 2016 Sterling Risk Sentiment Index surveyed 86 top executives in Atlanta’s construction industry using SurveyMonkey.com. The survey was conducted between July and August 2016.

Related Stories

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

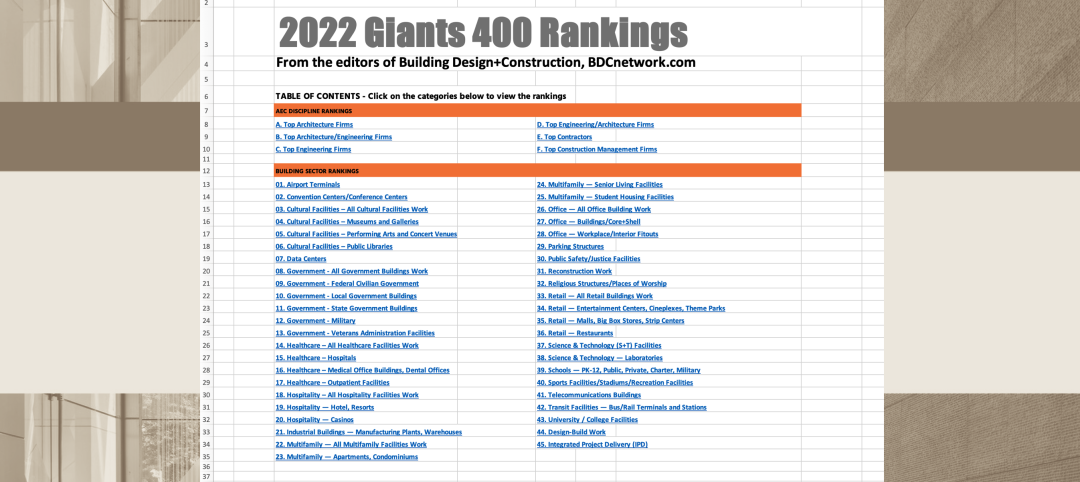

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.