Associated Builders and Contractors (ABC) Chief Economist Anirban Basu, American Institute of Architects (AIA) Chief Economist Kermit Baker and National Association of Home Builders (NAHB) Chief Economist Robert Dietz predicted continued growth for the construction industry in 2017 during a joint economic forecast this week (download the PDF slidedeck; watch the archived presentation).

Each economist discussed leading, present, and future indicators for sector performance, including ABC’s Construction Backlog Indicator (CBI), AIA’s latest Architecture Billings Index (ABI) and Construction Consensus Forecast, and the NAHB/Wells Fargo Housing Market Index (HMI).

The economists’ comments can be read below.

Anirban Basu, ABC Chief Economist: "Nonresidential construction spending growth will continue into the next year with an estimated increase in the range of 3 to 4 percent. Growth will continue to be led by privately financed projects, with commercial construction continuing to lead the way. Energy-related construction will become less of a drag in 2017, while public spending will continue to be lackluster."

Robert Dietz, NAHB Chief Economist: "Our forecast shows single-family production expanding by more than 10 percent in 2016, and the robust multifamily sector leveling off. Historically low mortgage interest rates and favorable demographics should keep the housing market moving forward at a gradual pace, but residential construction growth will be constrained by shortages of labor and lots and rising regulatory costs."

Kermit Baker, AIA Chief Economist: "Revenue at architecture firms continues to grow, so prospects for the construction industry remain solid over the next 12 to 18 months. Given current demographic trends, the single-family residential and the institutional building sectors have the greatest potential for further expansion at present."

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

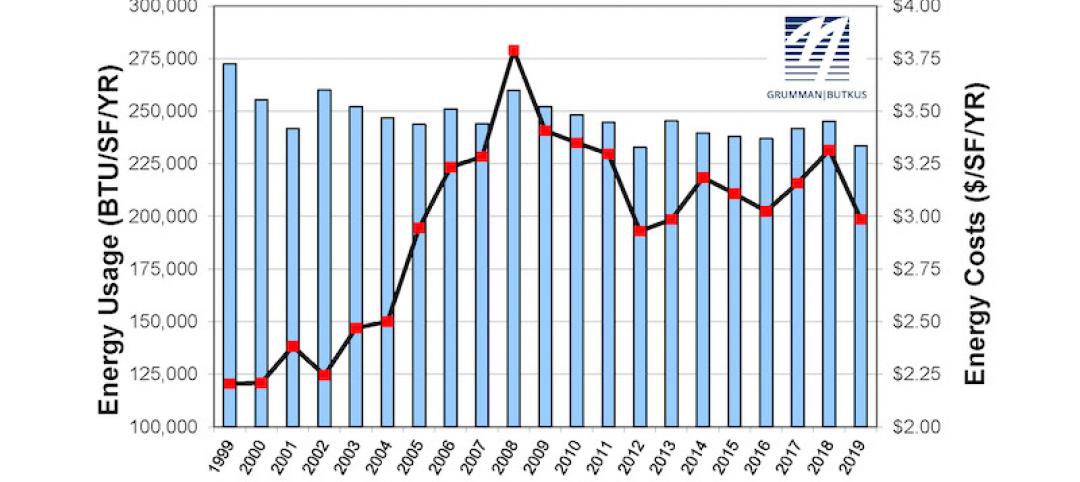

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

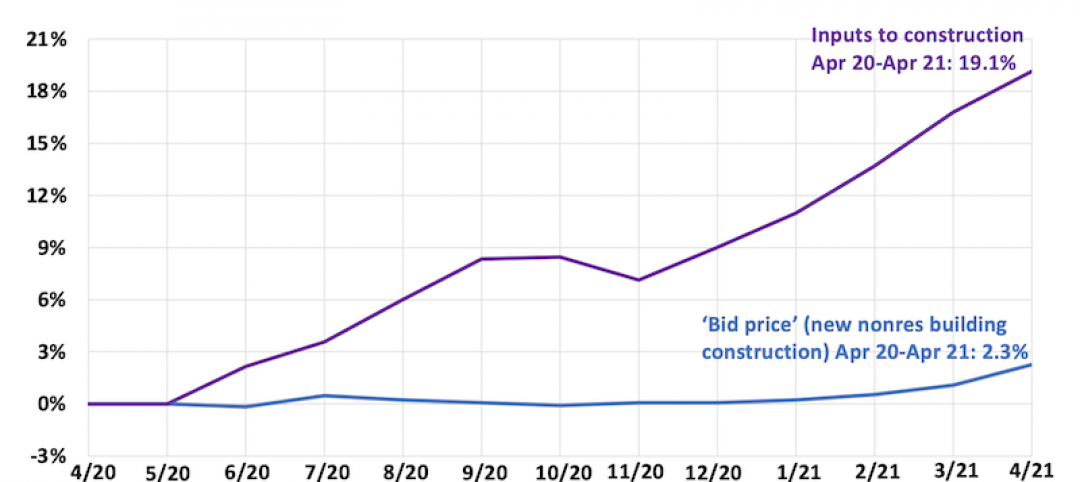

Market Data | May 13, 2021

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

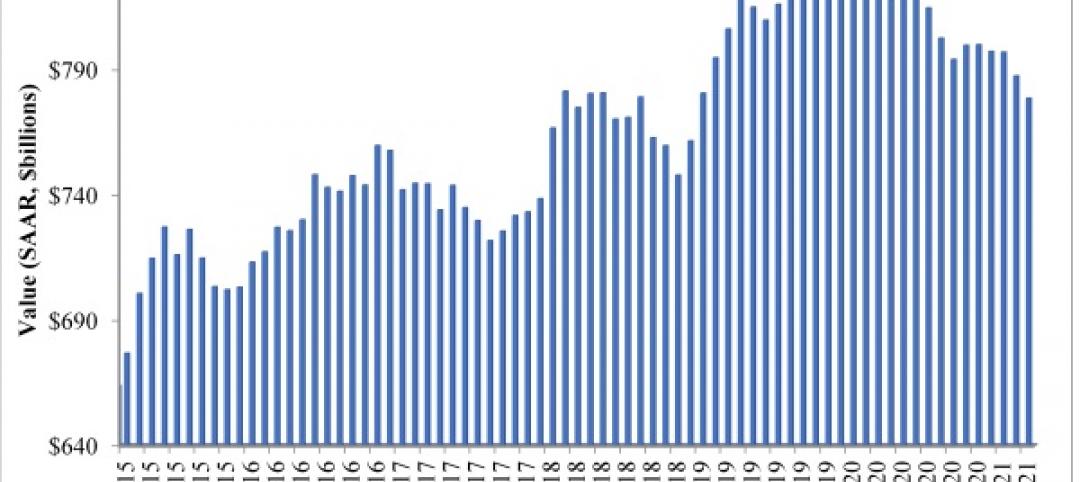

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

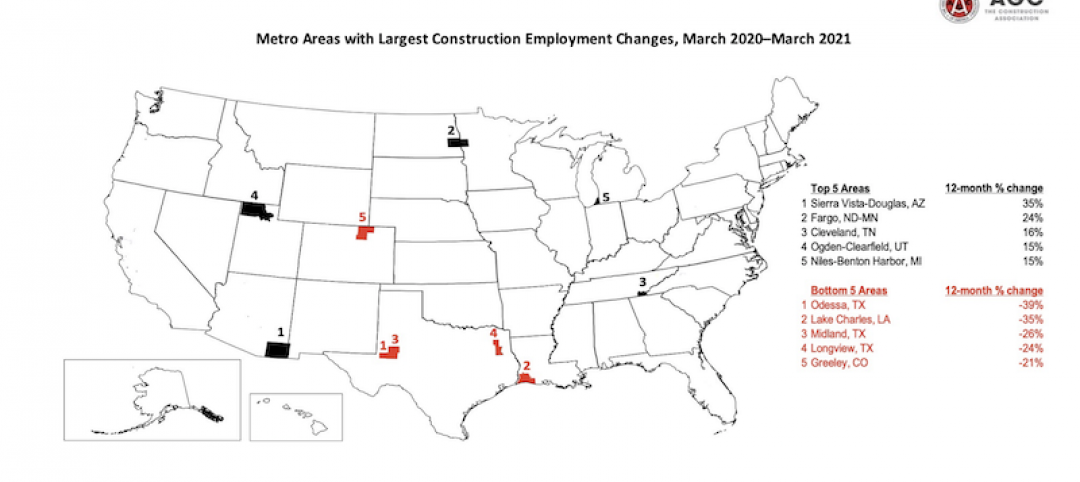

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.