Associated Builders and Contractors (ABC) Chief Economist Anirban Basu, American Institute of Architects (AIA) Chief Economist Kermit Baker and National Association of Home Builders (NAHB) Chief Economist Robert Dietz predicted continued growth for the construction industry in 2017 during a joint economic forecast this week (download the PDF slidedeck; watch the archived presentation).

Each economist discussed leading, present, and future indicators for sector performance, including ABC’s Construction Backlog Indicator (CBI), AIA’s latest Architecture Billings Index (ABI) and Construction Consensus Forecast, and the NAHB/Wells Fargo Housing Market Index (HMI).

The economists’ comments can be read below.

Anirban Basu, ABC Chief Economist: "Nonresidential construction spending growth will continue into the next year with an estimated increase in the range of 3 to 4 percent. Growth will continue to be led by privately financed projects, with commercial construction continuing to lead the way. Energy-related construction will become less of a drag in 2017, while public spending will continue to be lackluster."

Robert Dietz, NAHB Chief Economist: "Our forecast shows single-family production expanding by more than 10 percent in 2016, and the robust multifamily sector leveling off. Historically low mortgage interest rates and favorable demographics should keep the housing market moving forward at a gradual pace, but residential construction growth will be constrained by shortages of labor and lots and rising regulatory costs."

Kermit Baker, AIA Chief Economist: "Revenue at architecture firms continues to grow, so prospects for the construction industry remain solid over the next 12 to 18 months. Given current demographic trends, the single-family residential and the institutional building sectors have the greatest potential for further expansion at present."

Related Stories

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

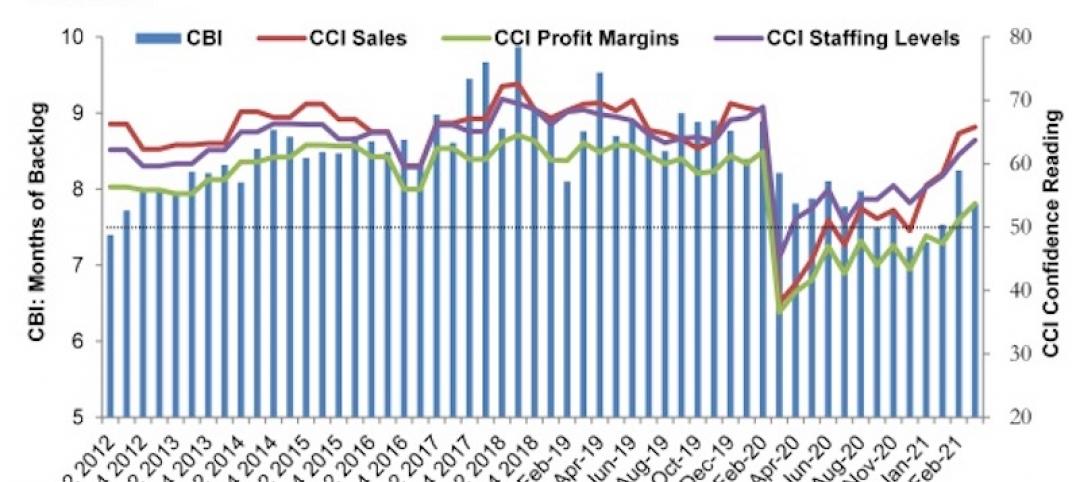

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.