Associated Builders and Contractors (ABC) Chief Economist Anirban Basu, American Institute of Architects (AIA) Chief Economist Kermit Baker and National Association of Home Builders (NAHB) Chief Economist Robert Dietz predicted continued growth for the construction industry in 2017 during a joint economic forecast this week (download the PDF slidedeck; watch the archived presentation).

Each economist discussed leading, present, and future indicators for sector performance, including ABC’s Construction Backlog Indicator (CBI), AIA’s latest Architecture Billings Index (ABI) and Construction Consensus Forecast, and the NAHB/Wells Fargo Housing Market Index (HMI).

The economists’ comments can be read below.

Anirban Basu, ABC Chief Economist: "Nonresidential construction spending growth will continue into the next year with an estimated increase in the range of 3 to 4 percent. Growth will continue to be led by privately financed projects, with commercial construction continuing to lead the way. Energy-related construction will become less of a drag in 2017, while public spending will continue to be lackluster."

Robert Dietz, NAHB Chief Economist: "Our forecast shows single-family production expanding by more than 10 percent in 2016, and the robust multifamily sector leveling off. Historically low mortgage interest rates and favorable demographics should keep the housing market moving forward at a gradual pace, but residential construction growth will be constrained by shortages of labor and lots and rising regulatory costs."

Kermit Baker, AIA Chief Economist: "Revenue at architecture firms continues to grow, so prospects for the construction industry remain solid over the next 12 to 18 months. Given current demographic trends, the single-family residential and the institutional building sectors have the greatest potential for further expansion at present."

Related Stories

Market Data | Jun 16, 2021

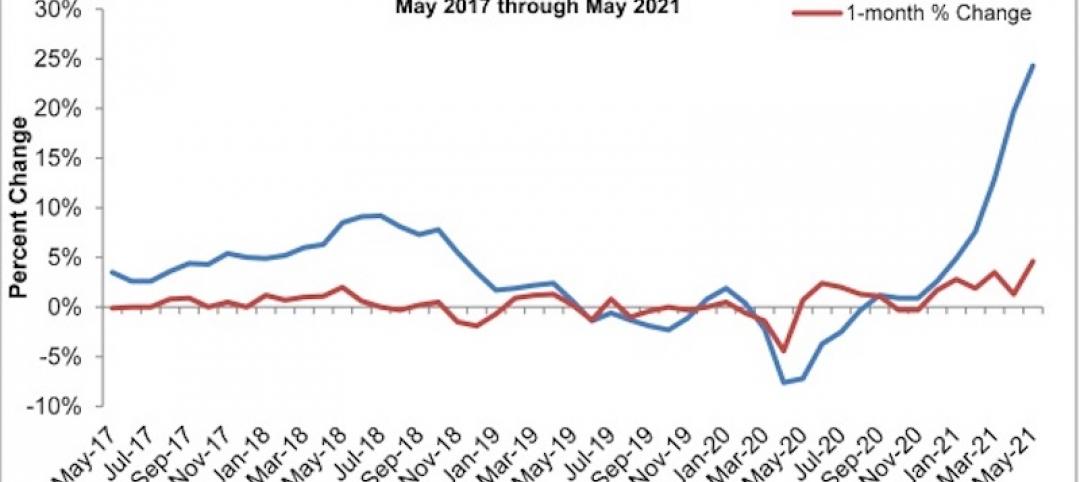

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

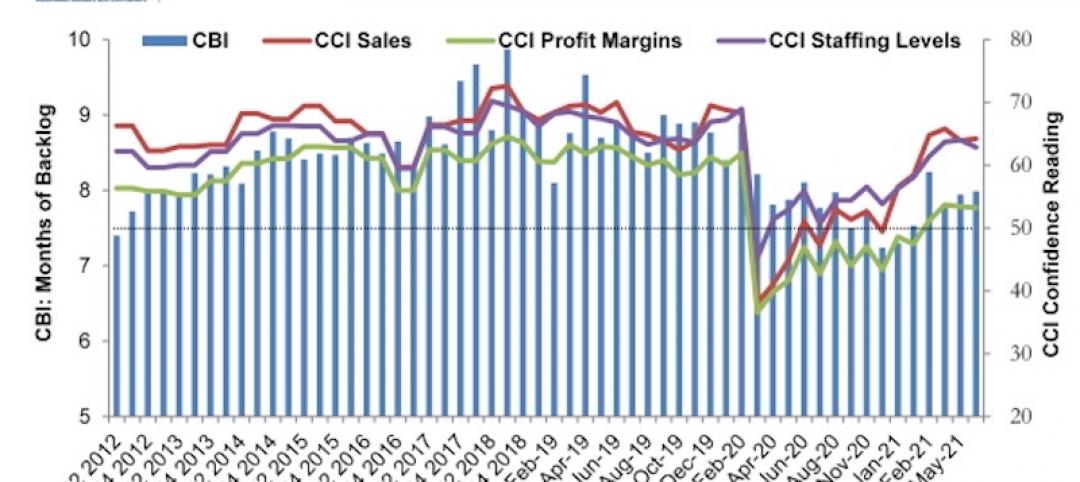

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.

Market Data | Jun 11, 2021

The countries with the most green buildings

As the country that set up the LEED initiative, the US is a natural leader in constructing green buildings.

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

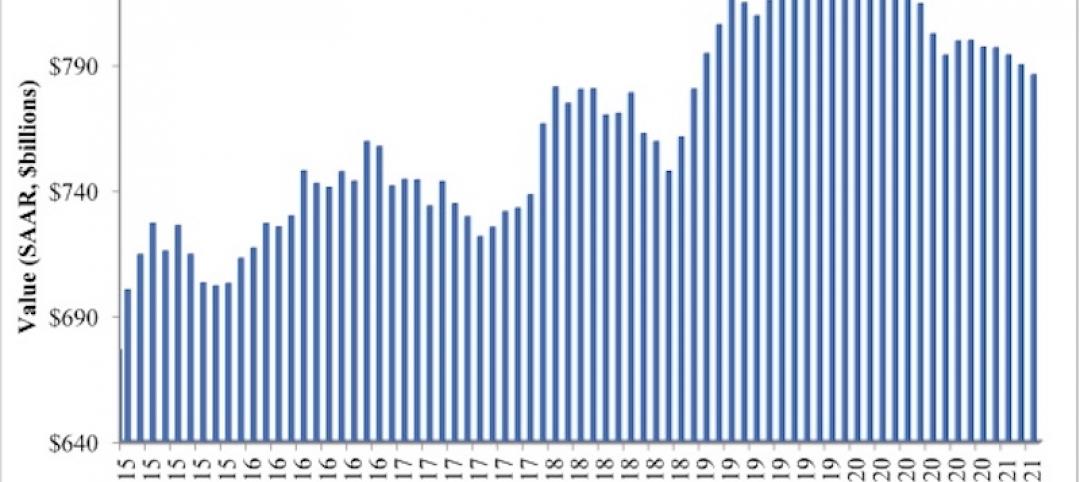

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.