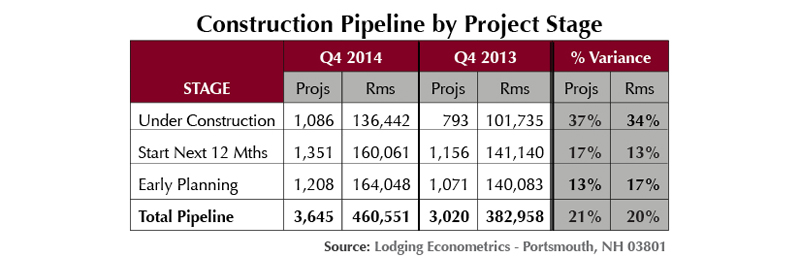

Lodging Econometrics reports that with 3,645 projects (totaling 460,551 rooms), the 2014 total U.S. lodging construction pipeline stands at its highest level in six years.

After a three-year bottoming formation, the pipeline has now posted five consecutive quarters of double-digit year-over-year (YOY) growth. In both the third and fourth quarters, increases were particularly impressive, exceeding 20%.

Although the breakout might appear robust, pipeline totals are still a long way from the peak of 5,438 projects/718,387 rooms set in 2007.

Projects under construction, the most important predictor of near-term supply growth, has catapulted forward to 1,086 projects/136,442 rooms—the highest level in more than five years. The number of units under construction is up 37% by projects and 34% by rooms (YOY).

Projects scheduled to start construction in the next 12 months have risen strongly, to 1,351 projects/160,061 rooms, up 17% and 13% YOY, respectively.

The growing number of projects in early planning is only just beginning. The cyclical bottom for projects in early planning just occurred in the second quarter of 2014. It bounced back smartly in the second half of the year, adding 221 projects, and ended 2014 at 1,208 projects/164,048 rooms.

Projects in early planning directly influence the number of hotels that will open three to five years outward. Projects that enter the pipeline in early planning are generally larger hotels in downtown or resort locations. Most are upscale select-service projects, while others are upper upscale and luxury full-service hotels that are frequently part of mixed-use developments.

Planning and permitting these larger, more complex projects is typically more protracted and also comes with longer construction periods. These projects generally open near the end of a real estate cycle, often times after the cycle has already peaked and begun to decline.

Project counts in early planning are expected to spurt forward over the next two to three years and make significant additions to new supply towards the end of the decade.

Related Stories

MFPRO+ News | Mar 1, 2024

Housing affordability, speed of construction are top of mind for multifamily architecture and construction firms

The 2023 Multifamily Giants get creative to solve the affordability crisis, while helping their developer clients build faster and more economically.

Multifamily Housing | Feb 29, 2024

Manny Gonzalez, FAIA, inducted into Best in American Living Awards Hall of Fame

Manny Gonzalez, FAIA, has been inducted into the BALA Hall of Fame.

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 28, 2024

New download: BD+C's 2023 Multifamily Amenities report

New research from Building Design+Construction and Multifamily Pro+ highlights the 127 top amenities that developers, property owners, architects, contractors, and builders are providing in today’s apartment, condominium, student housing, and senior living communities.

AEC Tech | Feb 28, 2024

How to harness LIDAR and BIM technology for precise building data, equipment needs

By following the Scan to Point Cloud + Point Cloud to BIM process, organizations can leverage the power of LIDAR and BIM technology at the same time. This optimizes the documentation of existing building conditions, functions, and equipment needs as a current condition and as a starting point for future physical plant expansion projects.

Data Centers | Feb 28, 2024

What’s next for data center design in 2024

Nuclear power, direct-to-chip liquid cooling, and data centers as learning destinations are among the emerging design trends in the data center sector, according to Scott Hays, Sector Leader, Sustainable Design, with HED.

Windows and Doors | Feb 28, 2024

DOE launches $2 million prize to advance cost-effective, energy-efficient commercial windows

The U.S. Department of Energy launched the American-Made Building Envelope Innovation Prize—Secondary Glazing Systems. The program will offer up to $2 million to encourage production of high-performance, cost-effective commercial windows.

AEC Innovators | Feb 28, 2024

How Suffolk Construction identifies ConTech and PropTech startups for investment, adoption

Contractor giant Suffolk Construction has invested in 27 ConTech and PropTech companies since 2019 through its Suffolk Technologies venture capital firm. Parker Mundt, Suffolk Technologies’ Vice President–Platforms, recently spoke with Building Design+Construction about his company’s investment strategy.

Performing Arts Centers | Feb 27, 2024

Frank Gehry-designed expansion of the Colburn School performing arts center set to break ground

In April, the Colburn School, an institute for music and dance education and performance, will break ground on a 100,000-sf expansion designed by architect Frank Gehry. Located in downtown Los Angeles, the performing arts center will join the neighboring Walt Disney Concert Hall and The Grand by Gehry, forming the largest concentration of Gehry-designed buildings in the world.

Construction Costs | Feb 27, 2024

Experts see construction material prices stabilizing in 2024

Gordian’s Q1 2024 Quarterly Construction Cost Insights Report brings good news: Although there are some materials whose prices have continued to show volatility, costs at a macro level are returning to a level of stability, suggesting predictable historical price escalation factors.