In the $90 billion U.S. office construction sector, Class A and Class A+ properties are the darlings of every major metro market. Owners and developers of these amenity-rich, high-performance buildings are competing to lure top-notch companies willing to pay the most lucrative lease rates—and to keep them there long-term.

There’s certainly plenty of money to be made in building and rehabbing Class A office buildings. But what about their less-flashy counterparts, Class B and Class C properties?

A new Urban Land Institute report, researched in partnership with the Rocky Mountain Institute and the Building Owners and Managers Association (BOMA), suggests that there is significant “hidden value” waiting to be unlocked by owners of Class B/C properties—and plenty of work for AEC firms that cater to these segments of the office market.

For myriad reasons, these properties are woefully outdated and in serious need of a tune-up to meet baseline energy efficiency standards. The ULI report found that even the simplest of energy efficiency measures—low- and no-cost tactics such as upgrading general office illumination to LED fixtures, optimizing HVAC schedules and setpoints, performing routine preventative maintenance, and engaging tenants in occupant behavior measures—could net an immediate 15% savings in energy costs.

Larger capital investments—such as improvements to the building envelope and roof system, or installation of high-efficiency building systems, sensors/controls, or solar panels—could slash energy use by 35% or more, with paybacks in the three-year range. “That can reduce a property’s operating expenses by $0.26 to $0.61 per square foot, increase net operating income by 1.9% to 4.3%, and boost property value by approximately $4 to $8 per square foot,” said the authors.

Why haven’t more Class B/C property owners taken steps to improve the energy performance of their buildings? The report pinpoints three primary reasons: limited working capital to pay for project costs, inadequate staff capacity to implement these measures, and a lack of priority versus other business activities.

Furthermore, by successfully instituting a green lease program, owners can recoup a sizable portion of the initial investment, which would further improve the financial outcomes for the property.

If all of this is so elementary, as the report outlines, why haven’t more Class B/C property owners taken steps to improve the energy performance of their buildings? The report pinpoints three primary reasons: limited working capital to pay for project costs, inadequate staff capacity to implement these measures, and a lack of priority versus other business activities.

“Staff working at Class B/C buildings wear multiple hats. Rarely do they have dedicated third-party management or building engineering staff with time to focus on identifying, championing, and implementing energy efficiency efforts,” said the authors.

The report offers a roadmap for getting started.

For a free PDF download of the ULI report, “Unlocking Hidden Value in Class B/C Office Buildings,” visit BDCnetwork.com/ClassBC.

Related Stories

| Feb 8, 2013

5 factors to consider when designing a shade system

Designing a shade system is more complex than picking out basic white venetian blinds. Here are five elements to consider when designing an interior shade system.

| Feb 6, 2013

RSMeans cost comparisons: office buildings and medical offices

RSMeans' February 2013 Cost Comparison Report breaks down the average construction costs per square foot for four types of office buildings across 25 metro markets.

| Feb 1, 2013

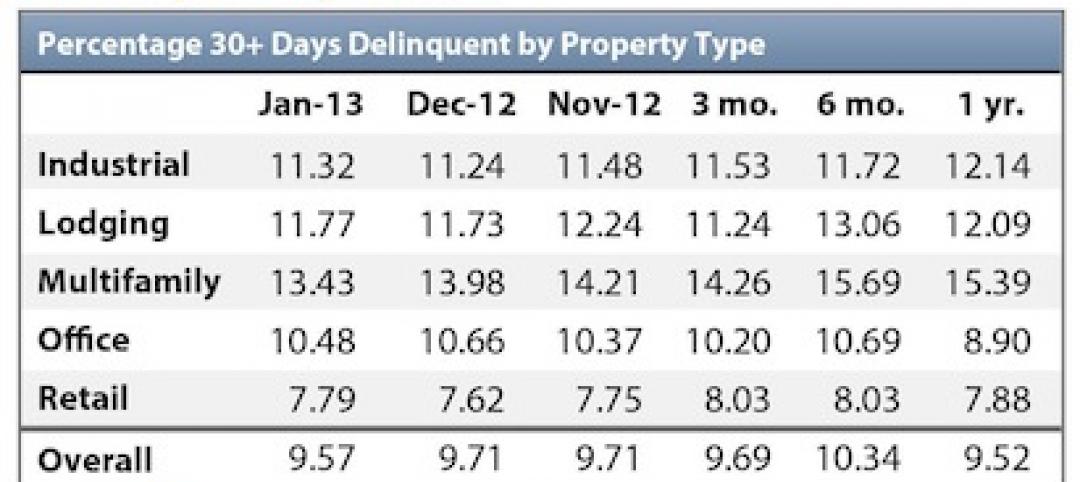

Delinquency rate for U.S. commercial real estate loans hits 11-month low

The delinquency rate for U.S. commercial real estate loans in CMBS fell 14 basis points in January to 9.57%. This is the lowest level in 11 months, according to Trepp, LLC's latest U.S. CMBS Delinquency Report.

| Jan 31, 2013

The Opus Group completes construction of corporate HQ for Church & Dwight Co.

The Opus Group announced today the completion of construction on a new 250,000-square-foot corporate headquarter campus for Church & Dwight Co., Inc., in Ewing Township, near Princeton, N.J.

| Jan 31, 2013

More cities requiring large buildings to use EPA’s energy management and reporting

In 2012, Philadelphia joined several other U.S. cities in passing a requirement that large buildings use Portfolio Manager, the Environmental Protection Agency’s energy management tool, to measure and report energy performance.

| Jan 29, 2013

Astellas' New Headquarters for the Americas Earns LEED Gold Certification

The new headquarters for Astellas in the Americas in Northbrook, Ill., has been awarded LEED Gold certification by the USGBC.

| Jan 16, 2013

SOM’s innovative Zhengzhou Greenland Plaza opens

The 2.59-million-square-feet building houses a mixed-use program of offices on its lower floors and a 416-room hotel.

| Dec 9, 2012

The owner’s perspective: high-rise buildings

Douglas Durst on the practicalities of development: “You must think about a building from the inside out.”

| Nov 28, 2012

Project team to showcase design for first mixed-use retail center of its kind in Mexico City

Project reaching construction milestone, offering national model for urban development in Mexico.