Construction employment declined or stagnated in 101 metro areas between February 2020, the last month before the pandemic, and last month, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said that labor shortages and supply chain problems were keeping many firms from adding workers in many parts of the country.

“Typically, construction employment increases between February and June in all but 30 metro areas,” said Ken Simonson, the association’s chief economist. “The fact that more than three times as many metros as usual failed to add construction jobs, despite a hot housing market, is an indication of the continuing impact of the pandemic on both demand for nonresidential projects and the supply of workers.”

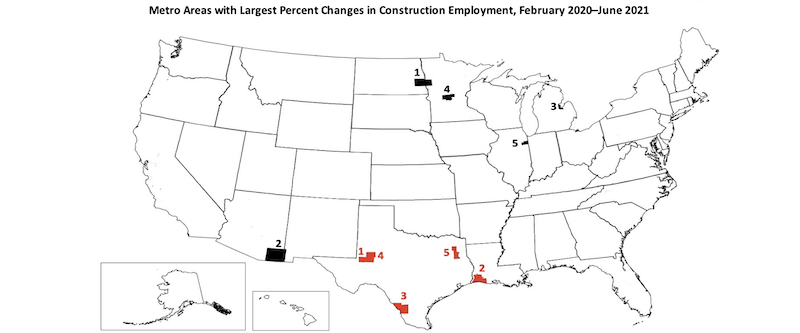

Eighty metro areas had lower construction employment in June 2021 than February 2020, while industry employment was unchanged in 21 areas. Houston-The Woodlands-Sugar Land, Texas lost the most jobs: 33,400 or 14%. Major losses also occurred in New York City (-22,000 jobs, -14%); Midland, Texas (-9,300 jobs, -24%); Odessa, Texas (-7,900 jobs, -38%) and Baton Rouge, La. (-7,700 jobs, -16%). Odessa had the largest percentage decline, followed by Lake Charles, La. (-34%, -6,700 jobs); Laredo, Texas (-25%, -1,000 jobs); Midland; and Longview, Texas (-22%, -3,300 jobs).

Of the 257 metro areas—72%—added construction jobs over the February 2020 level, Chicago-Naperville-Arlington Heights, Ill. added the most construction jobs over 16 months (14,300 jobs, 12%), followed by Minneapolis-St. Paul-Bloomington, Minn.-Wis. (13,800 jobs, 18%); Indianapolis-Carmel-Anderson, Ind. (10,700 jobs, 20%); Warren-Troy-Farmington Hills, Mich. (9,300 jobs, 18%); and Pittsburgh, Pa. (7,600 jobs, 13%). Fargo, N.D.-Minn. had the highest percentage increase (50%, 3,700 jobs), followed by Sierra Vista-Douglas, Ariz. (48%, 1,200 jobs); Bay City, Mich. (45%, 500 jobs); St. Cloud, Minn. (39%, 2,400 jobs) and Kankakee, Ill. (36%, 400 jobs).

Association officials urged Congress and the Biden administration to make new investments in workforce development and to take steps to address supply chain issues. “They called for additional funding for career and technical education; they noted that craft training receives only one-sixth as much federal funding as college preparation.” They also continued to call on the president to remove tariffs on key construction materials like steel and aluminum.

“Federal officials may talk about the value of craft careers like construction, but they are failing to put their money where their mouth is,” said Stephen E. Sandherr, the association’s chief executive officer. “Until we expose more people to construction careers, and get a handle on soaring materials prices, the construction industry is likely to have a hard time recovering from the pandemic.”

Related Stories

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

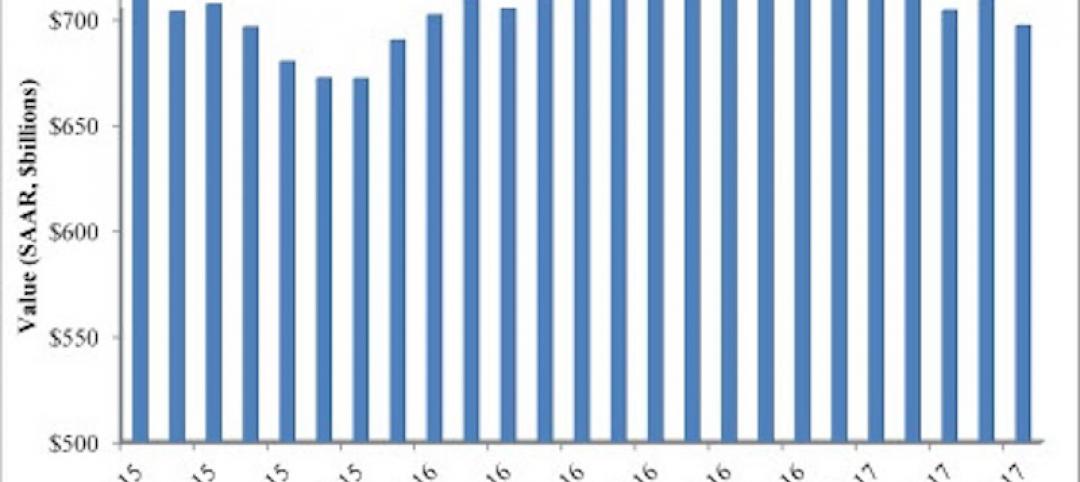

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 20, 2017

Some suburban office markets are holding their own against corporate exodus to cities

An analysis of mortgage-backed loans suggests that demand remains relatively steady.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

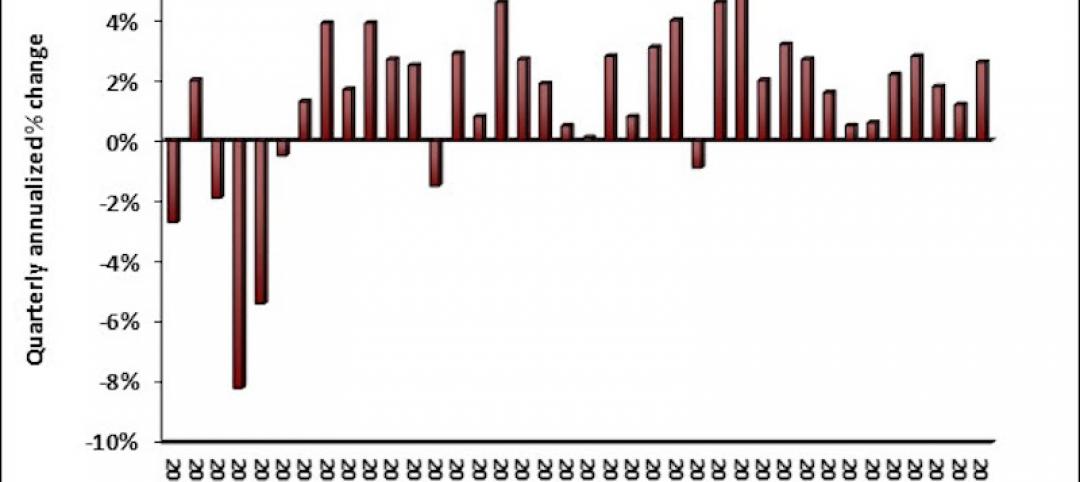

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.