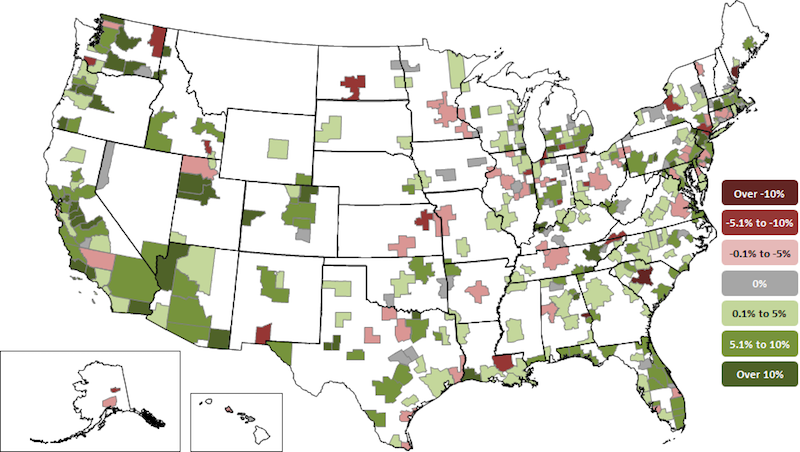

Construction employment increased in 256 out of 358 metro areas between April 2017 and April 2018, declined in 63 and was unchanged in 39, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the data showed a continuation of strong labor demand amid shortages of qualified workers.

"Industry demand is still showing strength, as construction employment reached a new high in 54 metro areas," said Ken Simonson, the association's chief economist. "However, despite these signs, further growth in the industry may increasingly be stymied by a lack of qualified workers."

Dallas-Plano-Irving, Texas added the most construction jobs during the past year (12,400 jobs, 9%), followed by Houston-The Woodlands-Sugar Land, Texas (12,200 jobs, 6%); Phoenix-Mesa-Scottsdale, Ariz. (11,000 jobs, 10%); Midland, Texas (8,000 jobs, 31%) and Las Vegas-Henderson-Paradise, Nevada (7,700 jobs, 13%). The largest percentage gains occurred in the Midland, Texas metro area, followed by Merced, Calif. (29%, 700 jobs); New Bedford, Mass. (20%, 500 jobs); Atlantic City-Hammonton, N.J. (19%, 1,000 jobs) and Weirton-Steubenville, W.Va.-Ohio (19%, 300 jobs).

The largest job losses from April 2017 to April 2018 were in St. Louis, Mo.-Ill. (-3,100 jobs, -5%), followed by Middlesex-Monmouth-Ocean, N.J. (-2,900 jobs, -7%); Montgomery County-Bucks County-Chester County, Penn. (-2,800 jobs, -5%); Minneapolis-St. Paul-Bloomington, Minn.-Wis. (-2,400 jobs, -3%) and Columbia, S.C. (-2,200 jobs, -11%). The largest percentage decreases for the year were in Bloomington, Ill. (-16%, -500 jobs), followed by Bismarck, N.D. (-15%, -800 jobs), Auburn-Opelika, Ala. (-14%, -400 jobs); Battle Creek, Mich. (-12%, -200 jobs); and Columbia, S.C.

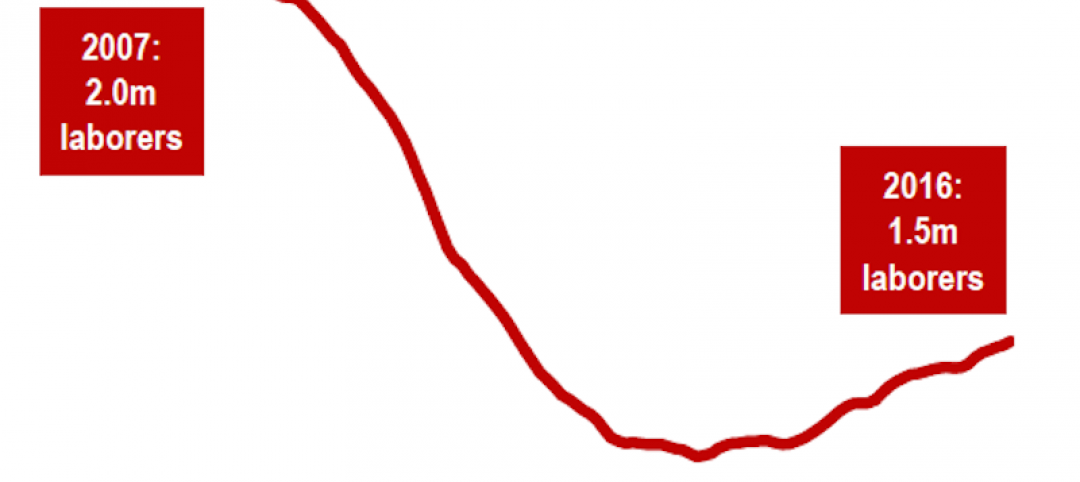

Association officials said that despite these widespread employment increases, many contractors report difficulty in finding qualified workers. With the national unemployment rate at a 17-year low and many metro unemployment rates at new record lows for April, finding workers is not expected to get easier in the near future. They added that education and training initiatives are the best way to increase the pool of skilled workers, creating a new generation of carpenters, electricians, and others, while giving Americans access to highly rewarding work.

"The good news is that the strong economy is driving demand for many types of construction projects," said Stephen E. Sandherr, the association's chief executive officer. "All that economic activity means that there are fewer, qualified, workers available for construction firms to hire to keep pace with demand."

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

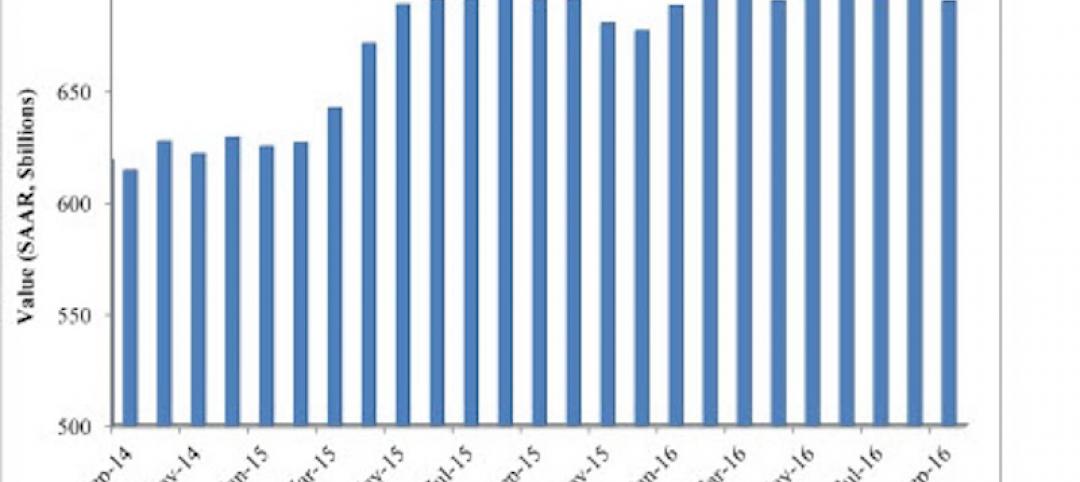

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.