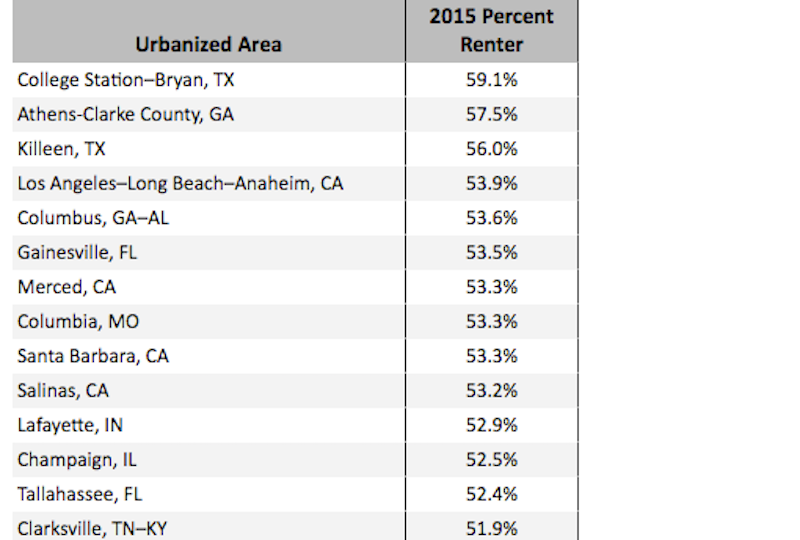

Quick quiz: Which city has the highest percentage of renters: Chicago, Miami, or College Station, Texas? Believe it or not, it's College Station, with 59.1% renters. Chicago and Miami are both predominantly homeowner cities. Chicago has only 36.1% renters, Miami, 41.49%.

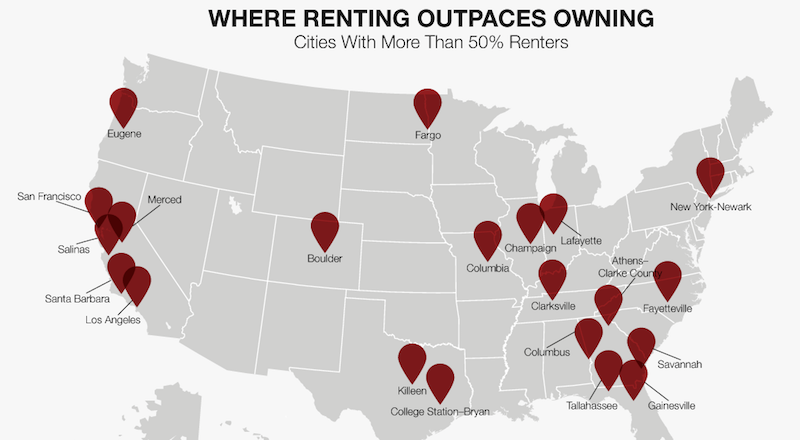

Of more than 400 urbanized areas around the country with a population greater than 100,000, just 21 are composed of at least 50% renters, according to data from the U.S. Census Bureau's 2015 American Community Survey. The full report was compiled by ADOBO and is based on data from The U.S. Census Bureau’s 2015 American Community Survey about occupied housing units in Urbanized Areas with a population of at least 100,000.

Not far behind is Athens-Clarke County, GA, with 57.5%, and Killeen, TX, with 56.0%. Other somewhat surprising cities include Columbus, GA (53.6%); Clarksville, TN (51.9%); Fayetteville, NC (51.2%); and Fargo, ND (50.2%). A number of big cities do make the list of majority rentals. Most housing units (53.9%) in the Los Angeles area are rented, not owned. The same goes for New York (50.7%) and San Francisco (50.9%). Five California cities make the list, more than any other state.

Many of the nation’s largest cities are unexpectedly absent from this list. Dallas, Houston, Washington, D.C., and Philadelphia are still dominated by homeowners. Both Dallas and Houston are hovering around the 43% renters' mark, while Washington, D.C., is 40.42% and Philadelphia is just 33.8% renters.

WHO'S RENTING, WHO OWNS A HOME?

A cursory glance at the age or renters hews to conventional wisdom, according to the ADOBO report. The majority of renters in the list of 21 renter-dominated cities are under 44 years old, with the highest percentage (24.29%) falling between the ages of 25 and 34. Owners tend to be older — 77.16% are over 45.

But a closer look at the age breakdown reveals some interesting divisions, especially on the renting side. In renter-dominated cities, the percentages are more equally spread across age groups for renting than for owning a home. Although over 50% of renters are 15 to 44 in age, a sizable percentage are older: 18.62% are 45 to 54, and another 14.13% are 55 to 64. A higher percentage of renters are 65 to 74 (8.32%) or 75-plus (6.96%) than 15 to 24 (5.9%).

These are all demographic factors that developers of rental apartments and condominiums - and their design and construction teams - need to keep in mind as they pursue future multifamily projects.

Related Stories

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.

MFPRO+ News | Apr 10, 2024

5 key design trends shaping tomorrow’s rental apartments

The multifamily landscape is ever-evolving as changing demographics, health concerns, and work patterns shape what tenants are looking for in their next home.

Mixed-Use | Apr 9, 2024

A surging master-planned community in Utah gets its own entertainment district

Since its construction began two decades ago, Daybreak, the 4,100-acre master-planned community in South Jordan, Utah, has been a catalyst and model for regional growth. The latest addition is a 200-acre mixed-use entertainment district that will serve as a walkable and bikeable neighborhood within the community, anchored by a minor-league baseball park and a cinema/entertainment complex.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Affordable Housing | Apr 1, 2024

Biden Administration considers ways to influence local housing regulations

The Biden Administration is considering how to spur more affordable housing construction with strategies to influence reform of local housing regulations.

Affordable Housing | Apr 1, 2024

Chicago voters nix ‘mansion tax’ to fund efforts to reduce homelessness

Chicago voters in March rejected a proposed “mansion tax” that would have funded efforts to reduce homelessness in the city.

Standards | Apr 1, 2024

New technical bulletin covers window opening control devices

A new technical bulletin clarifies the definition of a window opening control device (WOCD) to promote greater understanding of the role of WOCDs and provide an understanding of a WOCD’s function.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.