Video may have killed the radio star, but has e-commerce done the same to your local retail establishment? Will the rise of everything from Amazon to Zappos take down the bookstore up the street, your local shoe store? Don’t bet on it.

While the much-touted demise of good old fashioned, bricks-and-mortar stores makes for good headlines, it’s not actually based in fact.

According to JLL’s Cross Sector Outlook released this spring, despite e-commerce’s leaps and bounds over the last few years, it still represents a relatively small percentage of total retail sales—6.0% to be exact. Your shoe store is safe for now, and probably well into the future.

“Remember catalogs? Flipping through the pages, dialing up a call center and placing an order? Web sales are really just replacing that,” said Kris Cooper, Managing Director, JLL Capital Markets. “People still need to see and touch things; the instant gratification of an in-store purchase can’t be discounted. Retailers who want to thrive will need to incorporate it all—hands-on goods, e-commerce and mobile-commerce.”

Despite these emerging structural challenges and newly-announced store closings, such as those of Radio Shack, Office Depot, and Coldwater Creek, the U.S. retail sector has continued on its solid recovery and is exhibiting tightening market conditions.

Cap rates compressed by approximately 20 basis points in 2013 as rent growth is expected to increase to 2.7% in 2014. Vacancy rates are also expected to compress another 20 basis points by the end of this year.

Right now, power centers, in particular, are punching above their weight class, experiencing the tightest overall market conditions with a total vacancy rate of just 5.1%.

A FEEDING FRENZY

What does this mean for the health of the retail investment sales and financing market? Investors have wasted no time hopping back on the retail bandwagon, particularly in core markets where new product often produces a “feeding frenzy.”

In February, Savanna purchased 10 Madison Square West in New York for more than $2,900 per square foot ($60 million). Price appreciation for retail product was outstanding in 2013; the Moody’s/RCA CPPI for retail is expected to post a 23% increase for the year—and reach similar numbers by the end of 2014.

“Right now, it’s all about high-quality, grocery-anchored centers and trophy malls," said Margaret Caldwell, Managing Director, JLL’s Capital Markets. "Demand for those asset types is incredible right now—if only we could convince all the owners to bring those to market. Investment in the gateway cities is strong, as always—but watch for a few dark horses to emerge in the coming months. Markets like Phoenix and Indianapolis could make some real headway by the end of the year.”

In the financing arena, debt is plentiful as balance sheet lenders such as life insurance companies are increasing their allocations in 2014 and remain competitive, while domestic banks continue to report stronger demand for commercial property loans. CMBS money is also plentiful, with retail collateralizing 20 percent of all CMBS deals in the first quarter of 2014.

“Watch for equity to make some significant strides in the retail space in the coming year, as well,” said Mark Brandenburg, Executive Vice President, JLL’s Capital Markets. “For a long time, equity sponsors were holding back, waiting to see if retail would survive the e-commerce invasion. Now that things have settled down a bit, many of those JV equity players are under allocated in the retail space and they’ll need to make some big plays to balance things out.”

Brandenburg also advises investors to keep their eyes on secondary markets as the borrowing rates for primary versus secondary markets don’t vary much.

“Leveraged yields into secondary and tertiary markets will be higher for the same quality real estate due to positive leverage between borrowing rates and cap rates,” he concluded.

About JLL's Retail Group

JLL’s Retail Group serves as the industry’s leader in retail real estate services. The firm’s more than 850 dedicated retail experts in the Americas partner with investors and occupiers around the globe to support and shape investment and site selection strategies.

Its retail specialists provide independent and expert advice to clients, backed by industry-leading research that delivers maximum value throughout the entire lifecycle of an asset or lease. The firm has more than 80 retail brokerage experts spanning 20 major markets, representing more than 100 retail clients. As the largest third party retail property manager in the United States, JLL’s retail portfolio has 305 centers, totaling 65.7 million square feet under management in regional malls, lifestyle centers, grocery-anchored centers, power centers, central business districts, transportation facilities and mixed-use projects.

For more, visit www.jllretail.com.

Related Stories

Sports and Recreational Facilities | Mar 14, 2024

First-of-its-kind sports and rehabilitation clinic combines training gym and healing spa

Parker Performance Institute in Frisco, Texas, is billed as a first-of-its-kind sports and rehabilitation clinic where students, specialized clinicians, and chiropractic professionals apply neuroscience to physical rehabilitation.

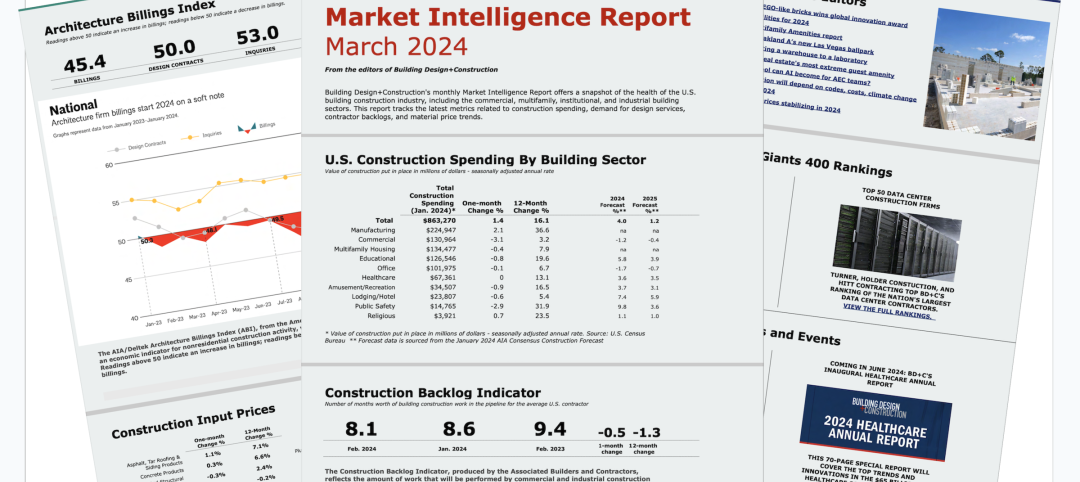

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Apartments | Mar 13, 2024

A landscaped canyon runs through this luxury apartment development in Denver

Set to open in April, One River North is a 16-story, 187-unit luxury apartment building with private, open-air terraces located in Denver’s RiNo arts district. Biophilic design plays a central role throughout the building, allowing residents to connect with nature and providing a distinctive living experience.

Sustainability | Mar 13, 2024

Trends to watch shaping the future of ESG

Gensler’s Climate Action & Sustainability Services Leaders Anthony Brower, Juliette Morgan, and Kirsten Ritchie discuss trends shaping the future of environmental, social, and governance (ESG).

Affordable Housing | Mar 12, 2024

An all-electric affordable housing project in Southern California offers 48 apartments plus community spaces

In Santa Monica, Calif., Brunson Terrace is an all-electric, 100% affordable housing project that’s over eight times more energy efficient than similar buildings, according to architect Brooks + Scarpa. Located across the street from Santa Monica College, the net zero building has been certified LEED Platinum.

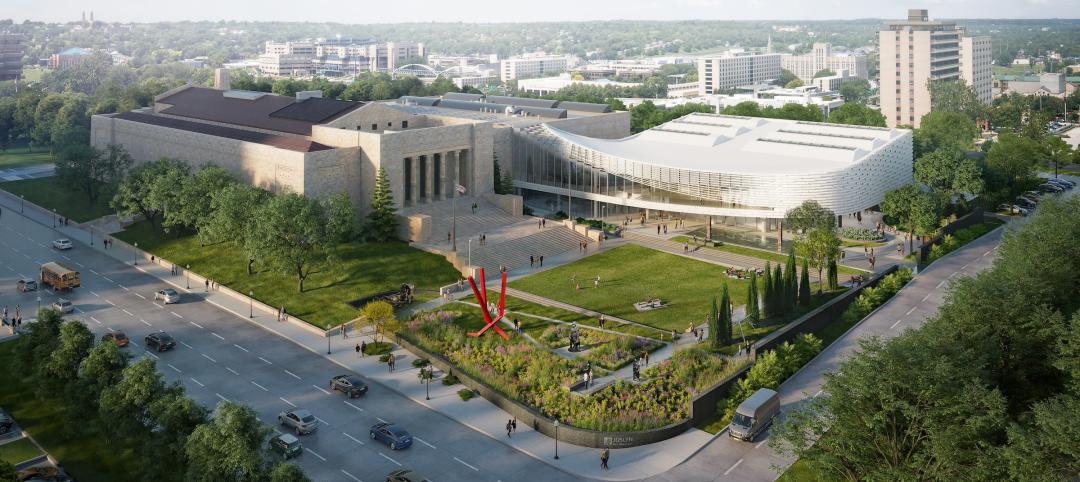

Museums | Mar 11, 2024

Nebraska’s Joslyn Art Museum to reopen this summer with new Snøhetta-designed pavilion

In Omaha, Neb., the Joslyn Art Museum, which displays art from ancient times to the present, has announced it will reopen on September 10, following the completion of its new 42,000-sf Rhonda & Howard Hawks Pavilion. Designed in collaboration with Snøhetta and Alley Poyner Macchietto Architecture, the Hawks Pavilion is part of a museum overhaul that will expand the gallery space by more than 40%.

Affordable Housing | Mar 11, 2024

Los Angeles’s streamlined approval policies leading to boom in affordable housing plans

Since December 2022, Los Angeles’s planning department has received plans for more than 13,770 affordable units. The number of units put in the approval pipeline in roughly one year is just below the total number of affordable units approved in Los Angeles in 2020, 2021, and 2022 combined.

BIM and Information Technology | Mar 11, 2024

BIM at LOD400: Why Level of Development 400 matters for design and virtual construction

As construction projects grow more complex, producing a building information model at Level of Development 400 (LOD400) can accelerate schedules, increase savings, and reduce risk, writes Stephen E. Blumenbaum, PE, SE, Walter P Moore's Director of Construction Engineering.

AEC Tech | Mar 9, 2024

9 steps for implementing digital transformation in your AEC business

Regardless of a businesses size and type, digital solutions like workflow automation software, AI-based analytics, and integrations can significantly enhance efficiency, productivity, and competitiveness.

Office Buildings | Mar 8, 2024

Conference room design for the hybrid era

Sam Griesgraber, Senior Interior Designer, BWBR, shares considerations for conference room design in the era of hybrid work.