The New York metropolitan area is on track to generate $1.797 trillion in gross domestic product in 2019, which would rank first among all metros in the United States by a wide margin. New York is projected to hold onto that ranking through at least 2035, when its GDP could reach $2.511 trillion, according to the annual Global Cities report published by Oxford Economics, a London-based independent global advisory firm.

The change in New York’s GDP would represent 2% annual growth, driven by a finance and business services sector that is the largest of any major world city. However, Oxford Economics projects that San Jose, Calif., with its high-tech and entrepreneurial ecosystem, will lead all American metros in annual GDP growth through 2035, at 3%, followed by Portland, Ore., and Austin, Texas (2.6%), and Seattle, Charlotte, N.C., Nashville, and San Francisco (2.4%).

Oxford believes that San Jose’s greatest asset is the “scale and diversity of its technical workforce.” This metro’s annual GDP growth averaged 7.4% during the years 2013-17. In Portland, where manufacturing accounts for roughly 40% of its annual growth, high-tech production is expected to sustain its robust economy.

Nashville, whose population has roughly doubled in the last 40 years, was recently chosen by Amazon for a new operations center that will employ 5,000 people. Apple plans to invest $1 billion in Austin, where the tech giant could eventually employ 15,000 people.

Behind New York, the cities that rank highest for projected GDP for 2019 and 2035 are Tokyo, Los Angeles, and London. L.A.’s GDP is expected to hit $1.093 trillion next year, and expand by 41.4% to $1.545 trillion in 2035. Oxford expressed some surprise about L.A.’s likely position, given that its financial and business services sector only accounts for 39% of its economy. But L.A.’s west-coast location and economic diversity are surely benefits.

Oxford also considers urban economies in terms of industrial output. On that score, two Texas cities, Houston and Dallas, are being driven by their low-tax, low-regulation model, and relatively abundant land, to achieve strength in moderately high-value manufacturing segments. (Dallas and Houston are ranked 4th and 7th, respectively, in projected 2019 and 2035 GDP.)

Conversely, Oxford wonders about Chicago’s prospects. The Windy City ranks third in projected GDP for both years tracked, but its financial and business services sector, relative to the city’s size, is actually smaller than Boston’s, San Francisco’s, and Washington D.C.’s.

“Fundamentally, it is tough being a Midwest city such as Chicago: regional growth is not so strong; many corporate headquarters and production facilities have moved south in search of lower taxes, laxer regulations, cheaper costs and more sun; and the start-up and tech scenes are elsewhere,” writes Oxford. On the other hand, Oxford points out that naysayers who wrote off Chicago in past years have been proven wrong because Chicago continues to offer “acceptable compromises,” such as affordability, livability, and opportunity, that keep it competitive nationally and globally.

While a large share of America’s GDP is clustered within its 10 largest cities, Oxford Economics notes that around two-thirds of U.S. economic output still comes from medium- and small-sized cities and towns. Of the top 20 metros by forecasted GDP growth through 2022, nine have fewer than 500,000 people. Many of these cities are located in the Southwest and Mountain regions, and benefit from an improved energy sector, immigration (although that remains an uncertainty, given the current political climate), and an evolving economic base.

Fastest growing U.S. cities 2019-35

Rank City avg. annual % growth

1 San Jose 3.0

2 Portland 2.6

3 Austin 2.6

4 Seattle 2.4

5 Charlotte 2.4

6 Nashville 2.4

7 San Francisco 2.4

8 Orlando 2.3

9 Dallas 2.3

10 Salt Lake 2.3

Top U.S. cities by size of economy

Rank 2035 Rank 2019 City GDP GDP % chg.

$B 2019 $B 2035

1 1 New York 1,797 2,511 39.7

2 2 Los Angeles 1,093 1,545 41.4

3 3 Chicago 713 957 34.3

4 4 Dallas 573 839 46.4

5 6 San Francisco 532 796 49.6

6 5 Washington 559 779 39.3

7 7 Houston 529 758 43.2

8 9 Boston 461 656 42.5

9 8 Philadelphia 467 650 39.4

10 10 Atlanta 402 575 42.9

Source: Oxford Economics

Related Stories

Market Data | Apr 11, 2023

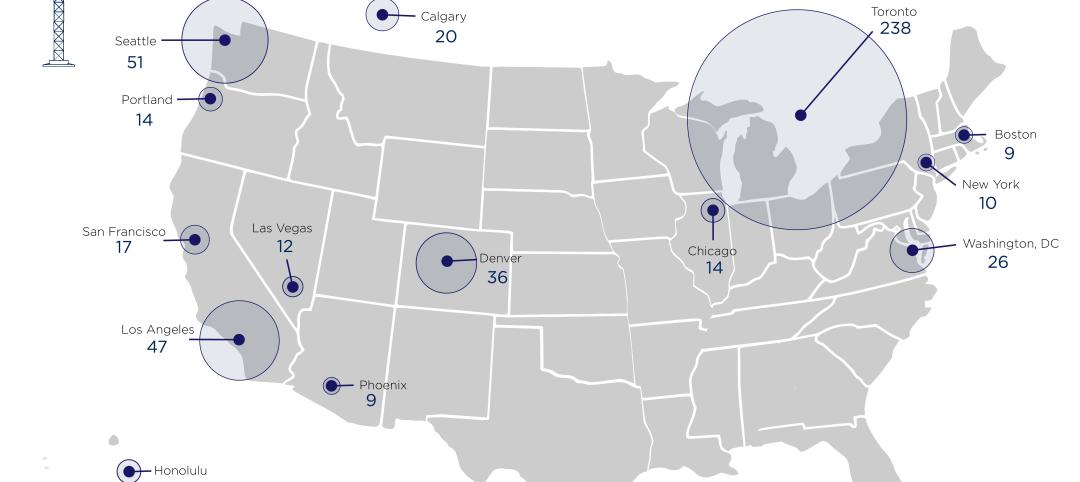

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

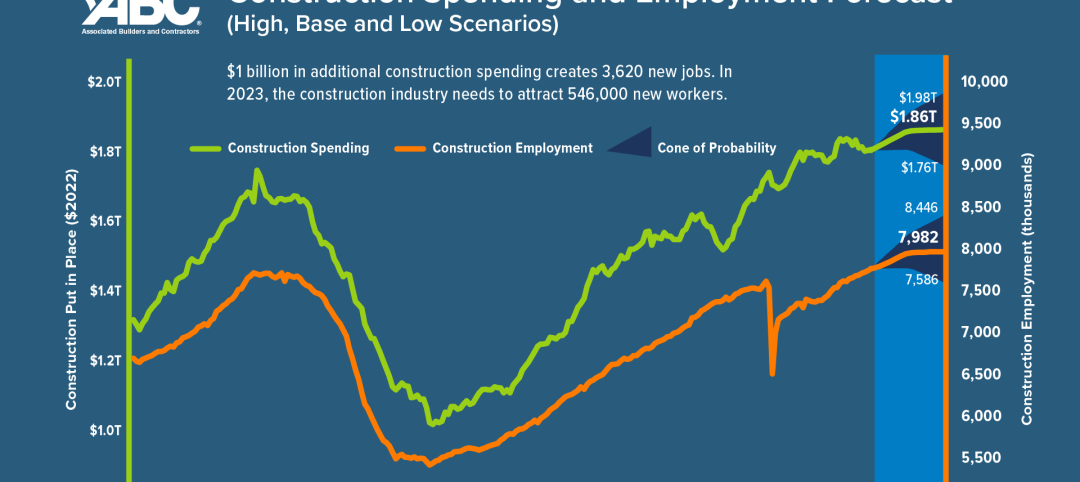

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

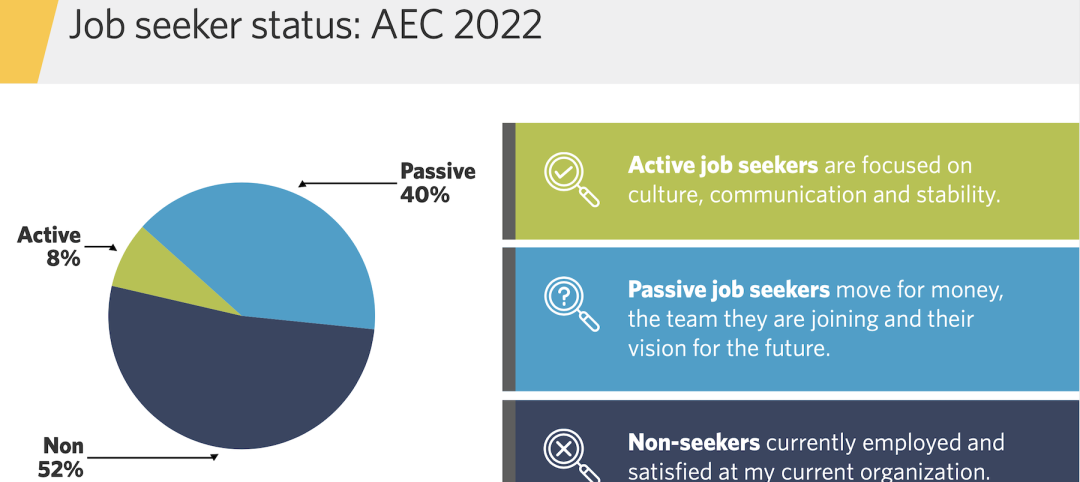

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.