JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

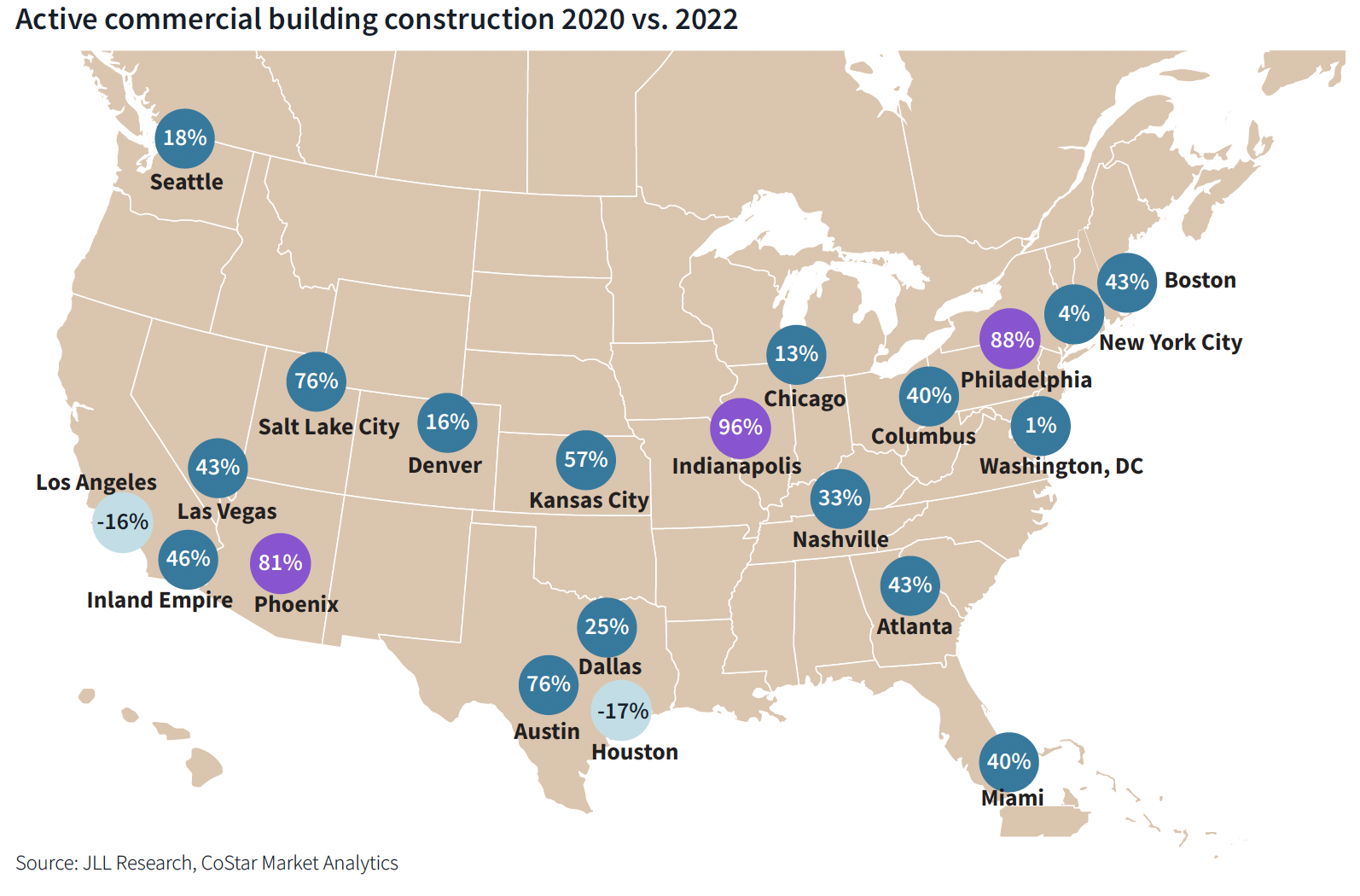

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn.

That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook, which is subtitled “Navigating a changed reality.” This is JLL’s first outlook to include Canada.

JLL sees a robust construction pipeline, but also economic indicators that point to broader uncertainty with more volatile swings in supply chain and pricing. “We expect 2023 construction costs to moderate alongside broader inflation, falling closer to the average historical rate,” the report states.

JLL is projecting a 5.9% increase in construction deliveries in the U.S. in 2023, and a 5% gain in construction activity.

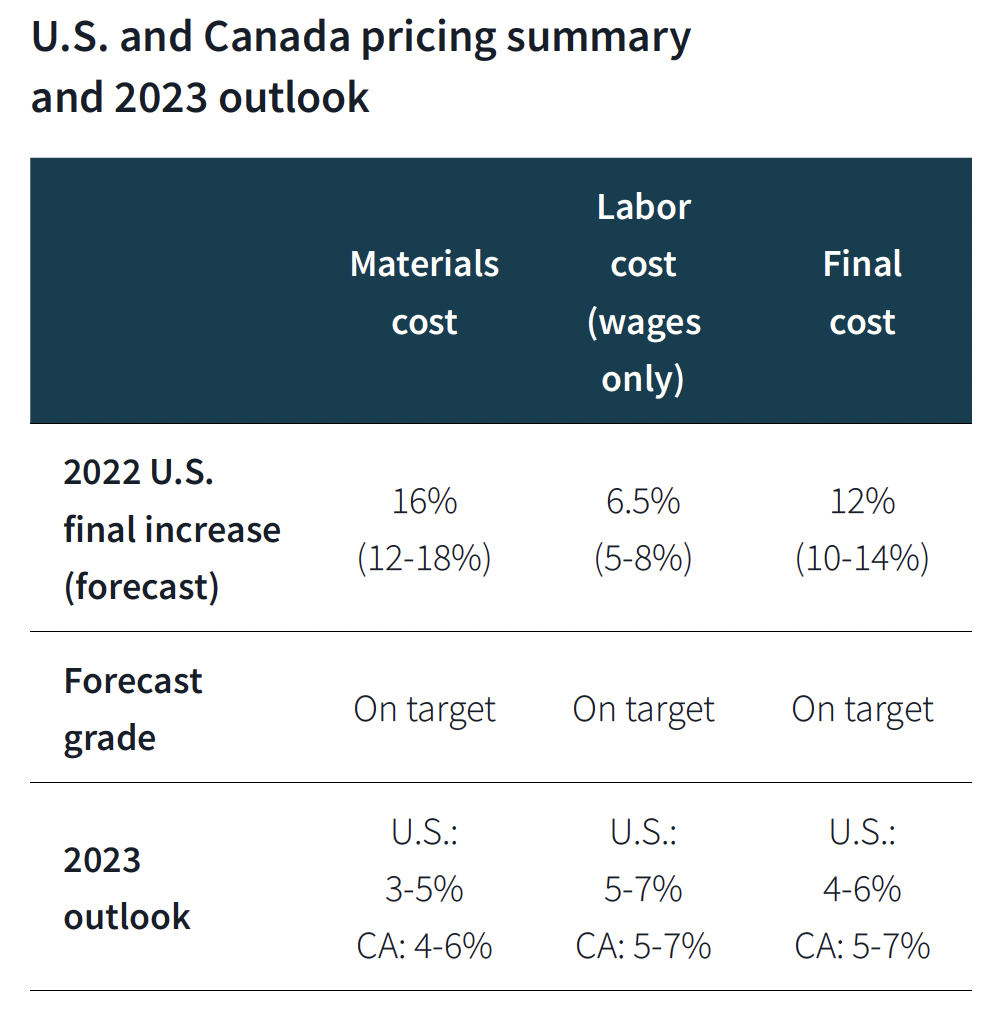

Price increases leveling off

The outlook assesses an industry that is coming off a relatively strong year. In 2022, nonresidential construction inputs in the U.S. and Canada were above historical rates by roughly 7.2% and 12.5% year over year, respectively.

Materials prices still saw considerable inflation, though, as average prices in 2022 were 16% higher than in 2021.

Aggregate net construction input volatility is down 60% from the peak inflationary period but remains 50% above long run pre-pandemic levels. However, several materials have returned to historical pre-pandemic volatility, so JLL expects overall price changes to stay more reasonably paced in 2023.

Low volatility product categories are likely to include flat glass, aluminum mill shapes, insulation, lumber and plywood. Plastics, concrete, steel mill products are expected to have medium price volatility. And gypsum products, copper and brass mill shapes, and #2 diesel fuel could see high volatility, the report suggests.

Concrete, plumbing, electrical, masonry, and HVAC are increasing in price; metals, openings, finishes, and furnishings are stabilizing; and wood/plastics/composites, thermal, energy, and transportation are projected to decline in price.

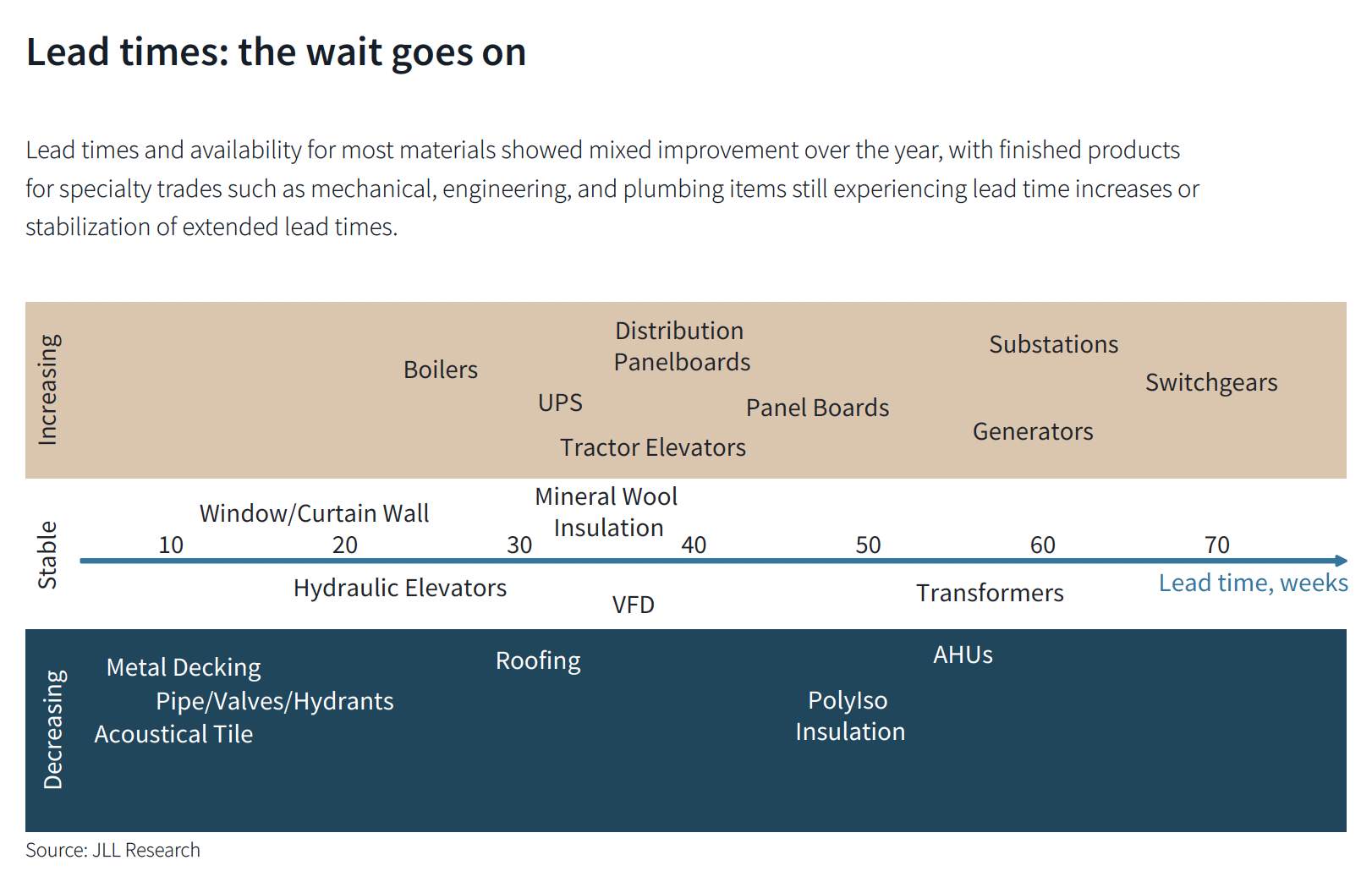

While the global supply chain knot has loosened, some products are still hard to get, like generators, switch gears, and substations. On the other hand, lead times are lessening for such products as metal decking, pipe/valves/hydraulics, and acoustical tile.

JLL notes that while roofing, acoustical tile, and polyiso insulation materials—which had periods of extreme procurement difficulties in 2022—are seeing lead times trend down, they have yet to return to historical timelines. “Current activity levels and revised procurement strategies, including some stockpiling and early orders, will continue to pressure production lines and limit availability through at least the first half of 2023,” the report states.

Global events shadow product access

Product availability for North American construction, to a greater or lesser degree, is a function of global forces and events. JLLL believes, for example, that the pace of China’s construction and manufacturing industries will determine the trajectory of core items and overall materials pricing amid escalating international tensions.

The report also expects trade disputes between major economies and their allies to significantly impact the global construction industry, limiting the flow of raw and finished materials.

Product demand will be further boosted by the rebuilding of war-torn Ukraine and earthquake-ravaged Turkey and Syria (Over 100,000 structures were destroyed or damaged in the recent earthquake. Turkey is a major exporter of cement and clinker, accounting for 40% of U.S. imports or 11% of total usage.)

Industrial sector leads construction drive

The U.S. construction market is slowly but surely expected to reap the benefits of federal government spending. JLL notes that $198 billion funding from the Infrastructure Investment and Jobs Act was injected into the market in 2022.

In 2022, U.S. nonresidential construction value in place rose 7.4% year over year, driven by manufacturing and commercial sectors with 35% and 21% increases, respectively. Compared to pre-pandemic levels, these two sectors were up 56% and 38% on a seasonally adjusted annual rate. The value of nonresidential construction put in place is expected to expand by roughly 6% in 2023, with the industrial sector leading the way. However, JLL also predicts that strategic investment in urban logistics and changing manufacturing trends will require a net decline in industrial construction square footage.

JLL also offers its take on three other sectors, including multifamily, where rents are coming down with a boom of product hitting the market, but where affordability is still a problem. In the retail sector, shopper preferences have shifted quickly, presenting opportunities to convert outmoded mall and middle-of-the-road retail space to something more in demand. And the construction pipeline for offices continues to fall amid rising construction and financing costs and work-from-home trends; JLL is already seeing a flight to quality.

“Final” project costs could rise 5% this year

The Architectural Billing Index’s contraction in the last quarter of 2022 could augur a slowdown of construction starts in Q2-Q3 2023. Though cancellations and delays are increasing, most impacted projects cite cost pressures rather than a lack of interest. Individual sectors are facing various pressures, in addition to the rising cost of capital and input prices.

JLL sees the following key trends in U.S. construction emerging or persisting:

•Market participants’ willingness to wait out interest rate fluctuations is slowing down starts, but demand remains elevated.

•Construction activity in contracting, as the current pipeline stabilizes around pre-pandemic levels by late 2024

•Demand for materials and labor will remain strong during this lull in starts.

•Billings are expected to surge once economic recovery releases pent-up demand.

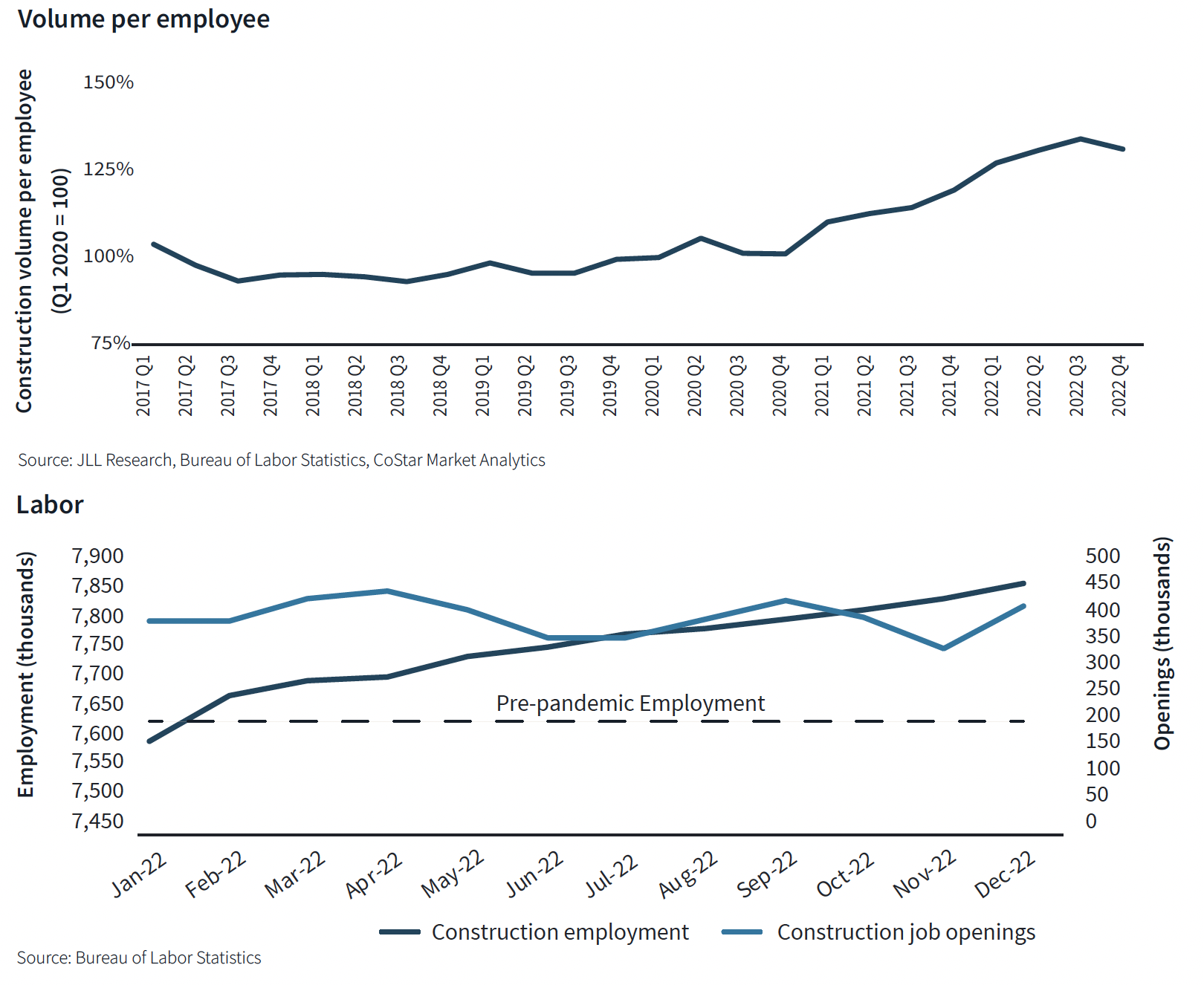

•Labor remains an issue despite high demand and hiring activity.

With regard to that last bullet point, construction jobs and hires are at peak levels, with demand for labor exceeding supply. Seventy percent of contractors say their staffing is low relative to their backlogs. Returning to pre-pandemic levels of delivery capacity will require 320,000 more commercial building construction employees.

To attract and retain workers, construction firms have been increasing their compensation packages. But has it been enough? JLL notes that wages barely beat inflation at a 6.5% increase for nonresidential building construction and specialty trades employees and a 5% increase in wages for heavy and civil engineering construction. While construction continues to command a wage premium, sectors competing for similar labor pools offered wage gains above inflation in 2022. These competing positions also benefit from lower perceived barriers to entry, physical risk, and difficulty.

JLL is forecasting a 5-7% increase in construction labor costs in 2023. That, in turn, will cut into profits, which construction firms are grappling to maintain.

The report states that firms are taking pragmatic approaches that cement connections between labor and clients, boost predictability, and minimize risk. Strong backlogs, careful bids and retention goals for quality labor will keep costs high for clients even if there is a downturn. Small and mid-sized contractors without extensive work lined up may offer competitive pricing, but final bids will continue to increase in step with material and labor availability.

JLL’s “final cost” projection for the U.S. construction industry in 2023 falls in the plus 4-6% range. JLL observes that construction firms’ current plans involve maintaining and gradually expanding capacity, with a cautious approach to increasing prices only as the market can handle them.