ConstructConnect announced today the release of its Q3 2017 Forecast Quarterly Report. The U.S. grand total construction starts growth projection for 2017 over 2016 in ConstructConnect’s Q3 report has been revised down slightly to +4.5% from +4.8%. 2018 remains about the same at +5.9% year over year (y/y). Earlier, it had been estimated at +6.0%.

“The outlook for U.S. construction starts, as calculated by ConstructConnect, has diminished slightly in the short term,” said to Chief Economist Alex Carrick. “Prospects for some private sector project initiations (e.g., in retail) have stalled, while high hopes for an early launch of a much-needed super-infrastructure program, to be sponsored, promoted and perhaps largely financed by the new administration in Washington, have been deflated.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows the type-of-structure sub-categories among non-residential building starts that will have banner years in 2017:

- Hotels/motels (+38.2%)

- Warehouses (+16.3%)

- Sports stadiums (+47.3%)

- Courthouses (+110.0%)

The 2017 forecast for non-residential building starts was adjusted to -0.8% y/y, versus a flat (0.0%) performance that was expected in Q2’s forecast report. According to the forecast, non-residential building starts in 2018 will rebound to +3.3%, with private office buildings and industrial/manufacturing doing better with less downward drag being exerted by retail and medical projects. The boom in hotel/motel work will begin to lose steam.

Based on a heightened record of ‘actual’ starts through the first half of this year (+25.2%), civil/engineering starts in 2017 were revised upwards to +16.5% y/y from +8.9% in Q2’s report. 2018 growth in this category has also been raised, to +7.4% (from +5.8%).

The forecast includes a few notable high points in the 2017 y/y engineering sub-categories:

- Airports (+38.0%)

- Roads (+14.0%)

- Bridges (+31.0%)

- Power/oil and gas (+30.8%)

The report states among major sub-sectors, residential construction’s 2017 y/y increase has been scaled down to +4.8% from +8.1%. The robust multi-family market of the last several years has been pulling back of late, as rental rates in many regions soared. Single-family starts also stalled, despite a need for substantial growth activity, since they declined so horrendously in the Great Recession. Also, new family formations, specifically among millennials, point to a tremendous potential that for the moment is not being realized.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

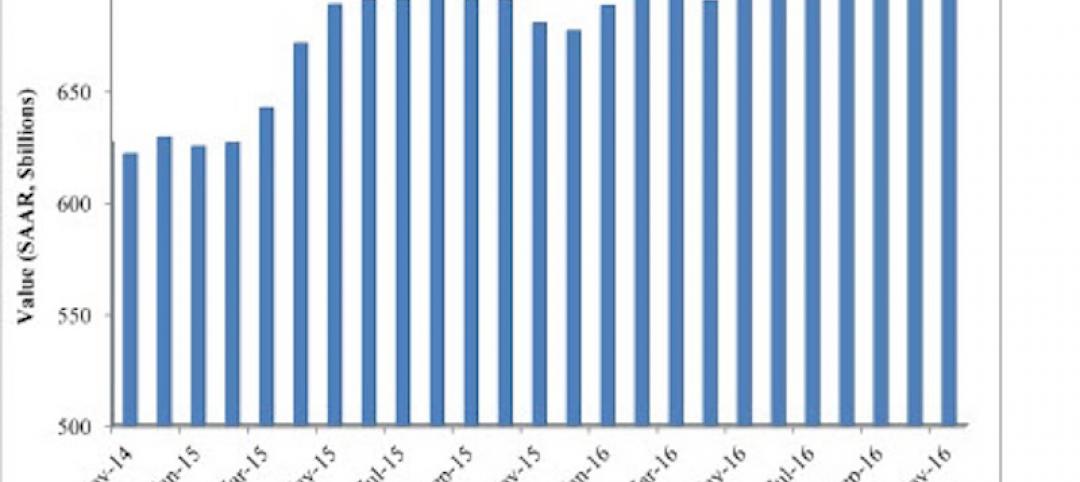

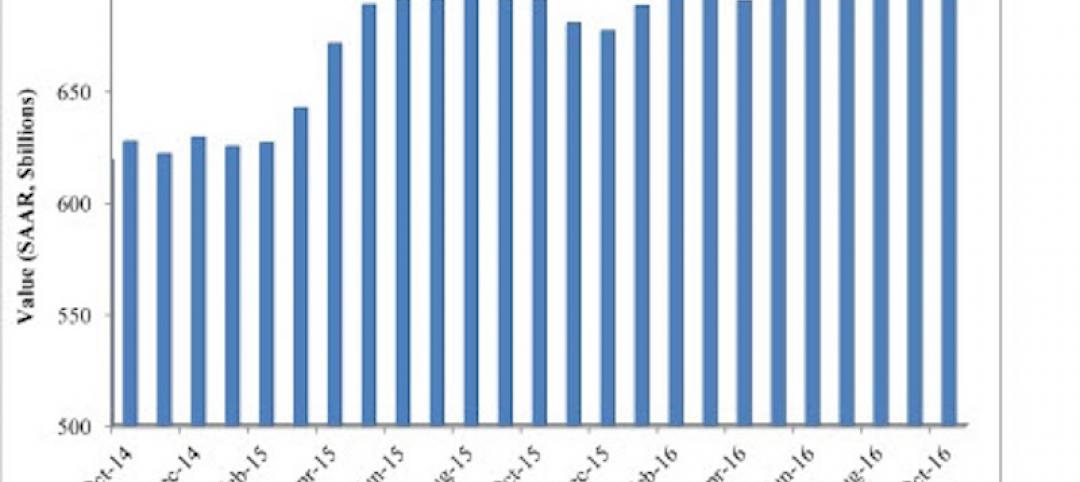

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

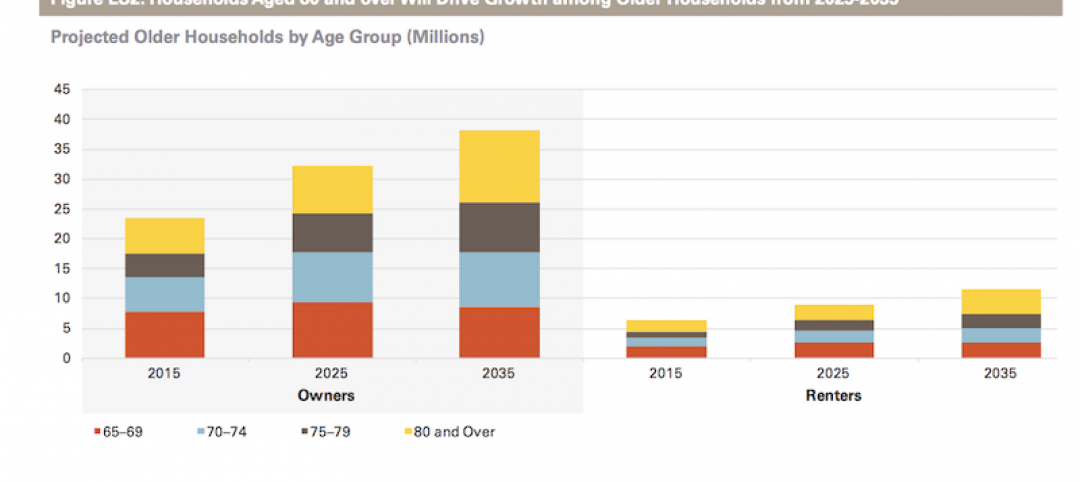

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.