Construction employment increased in nearly two out of three U.S. metro areas between November 2020 and November 2021, according to an analysis by the Associated General Contractors of America of new government employment data. Association officials said the job gains were welcome news for the industry but cautioned that it will be difficult for construction levels to return to pre-pandemic levels amid tight labor market conditions.

“It isn’t surprising that construction employment has picked up in most metros over the past year, given the strong economic rebound most of the country has experienced,” said Ken Simonson, the association’s chief economist. “But with record job openings in construction, it’s clear that even more metros should be in the plus column if contractors could find the workers they need and get materials delivered on schedule.”

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months. Sacramento--Roseville--Arden-

Construction employment declined from a year earlier in 74 metros and was flat in 47. Nassau County-Suffolk County, N.Y. lost the most jobs (-6,300 or -8%), followed by Orange-Rockland-Westchester counties, N.Y. (-3,900 jobs, -9%); Calvert-Charles-Prince George’s counties, Md. (-2,700 jobs, -8%); Houston-The Woodlands-Sugar Land, Texas (-2,600 jobs, -1%) and Nashville-Davidson-

Association officials said most construction firms report they are struggling to find enough qualified workers to hire. The officials called on the Biden administration to boost funding for career and technical education to expose more students to construction career opportunities. They noted that federal officials put six dollars into collegiate education and preparation for every dollar they currently invest in career and technical education.

“The gap in federal funding for career and technical education is making it hard for sectors like construction, manufacturing and shipping to find workers interested in those career tracks,” said Stephen E. Sandherr, the association’s chief executive officer. “We are doing everything we can to recruit people into high-paying construction careers but exposing more students to construction skills will certainly help.”

View the metro employment data, rankings, top 10, and new highs and lows.

Related Stories

Senior Living Design | May 9, 2017

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

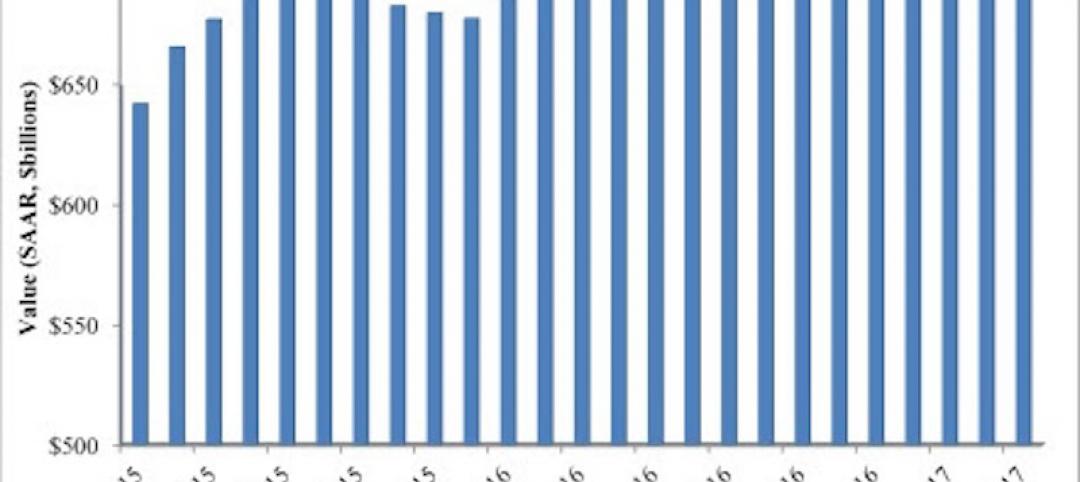

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

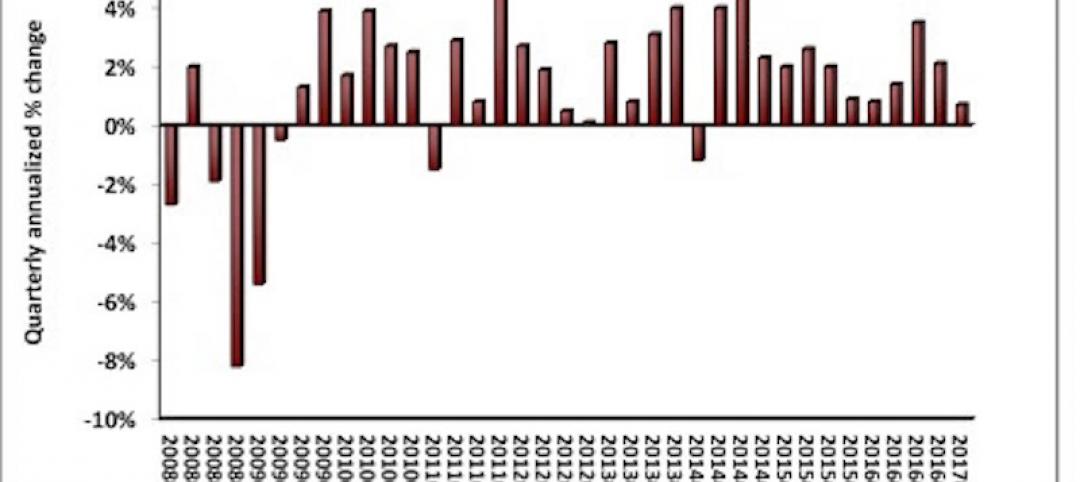

Market Data | May 1, 2017

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

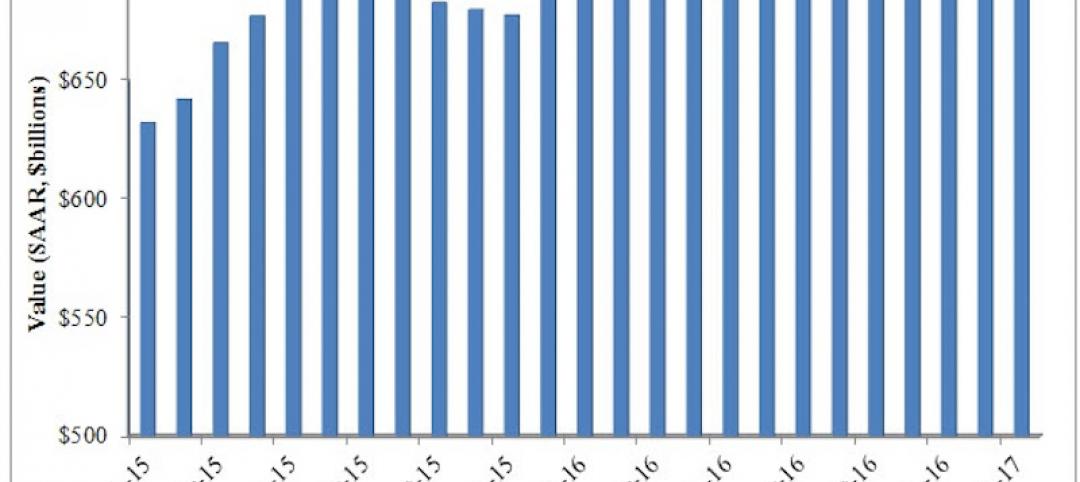

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.