Construction employment increased in nearly two out of three U.S. metro areas between November 2020 and November 2021, according to an analysis by the Associated General Contractors of America of new government employment data. Association officials said the job gains were welcome news for the industry but cautioned that it will be difficult for construction levels to return to pre-pandemic levels amid tight labor market conditions.

“It isn’t surprising that construction employment has picked up in most metros over the past year, given the strong economic rebound most of the country has experienced,” said Ken Simonson, the association’s chief economist. “But with record job openings in construction, it’s clear that even more metros should be in the plus column if contractors could find the workers they need and get materials delivered on schedule.”

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months. Sacramento--Roseville--Arden-

Construction employment declined from a year earlier in 74 metros and was flat in 47. Nassau County-Suffolk County, N.Y. lost the most jobs (-6,300 or -8%), followed by Orange-Rockland-Westchester counties, N.Y. (-3,900 jobs, -9%); Calvert-Charles-Prince George’s counties, Md. (-2,700 jobs, -8%); Houston-The Woodlands-Sugar Land, Texas (-2,600 jobs, -1%) and Nashville-Davidson-

Association officials said most construction firms report they are struggling to find enough qualified workers to hire. The officials called on the Biden administration to boost funding for career and technical education to expose more students to construction career opportunities. They noted that federal officials put six dollars into collegiate education and preparation for every dollar they currently invest in career and technical education.

“The gap in federal funding for career and technical education is making it hard for sectors like construction, manufacturing and shipping to find workers interested in those career tracks,” said Stephen E. Sandherr, the association’s chief executive officer. “We are doing everything we can to recruit people into high-paying construction careers but exposing more students to construction skills will certainly help.”

View the metro employment data, rankings, top 10, and new highs and lows.

Related Stories

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

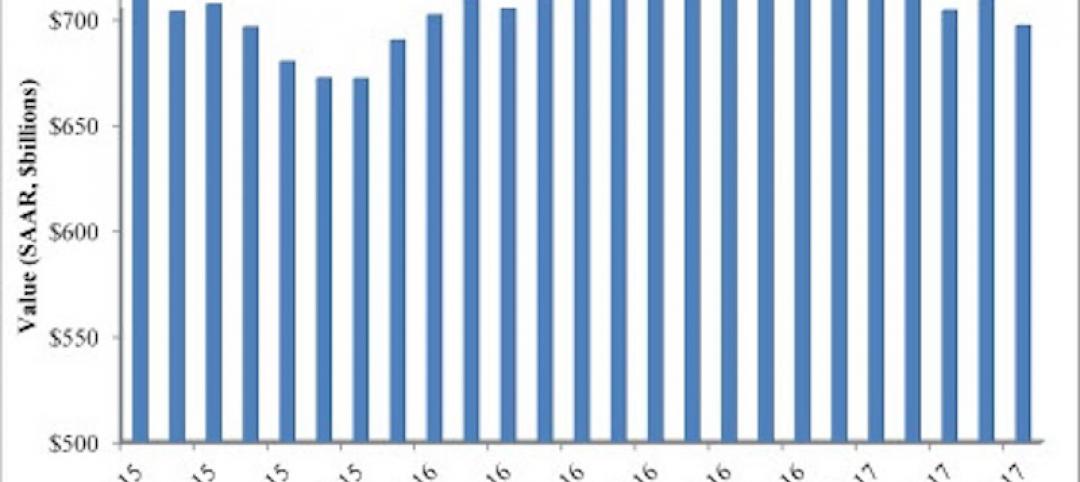

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

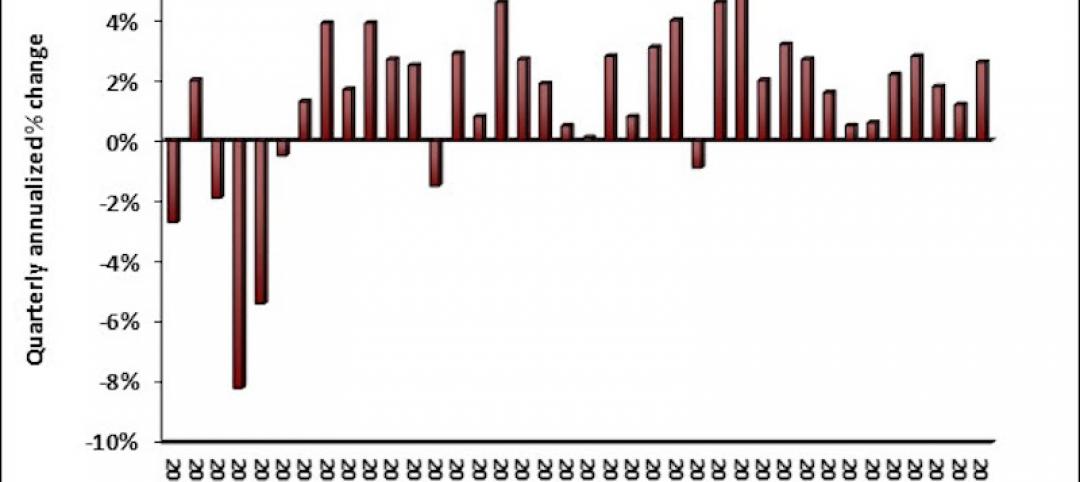

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

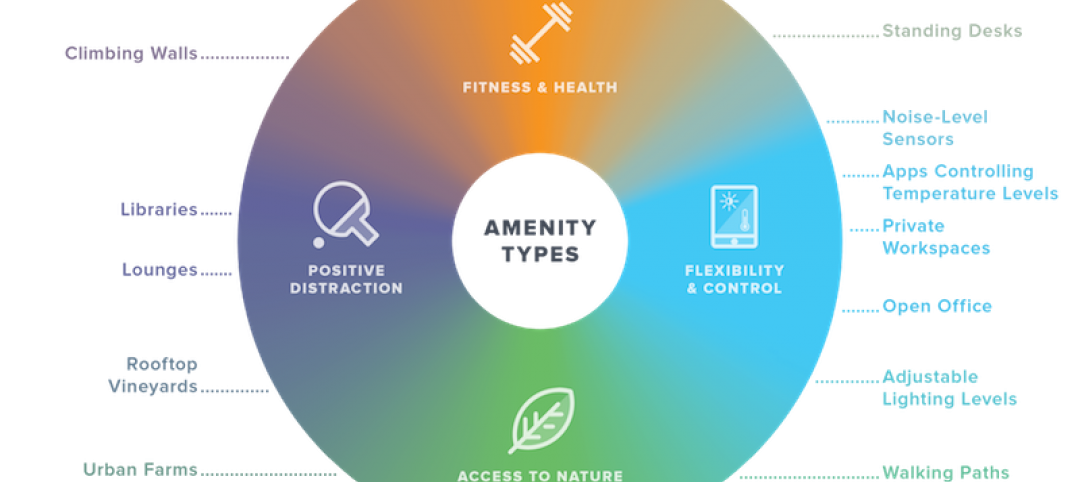

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.