A recent survey of 514 project, site, and construction managers in the U.S. and the United Kingdom, conducted by OnePoll for XYZ Reality, a leading provider of augmented reality applications, found that 94 percent had project backlogs and 63 percent admitted to delivering projects off schedule either “somewhat” to “very frequently.”

“Poor project performance, low productivity, and costly major project failures—and high-profile industry bankruptcies—continue to dog the sector,” wrote KPMG International in its recently released 2023 Global Construction Survey, based on responses from 257 engineering and construction firms and project owners around the world (29 percent of which were based in North America).

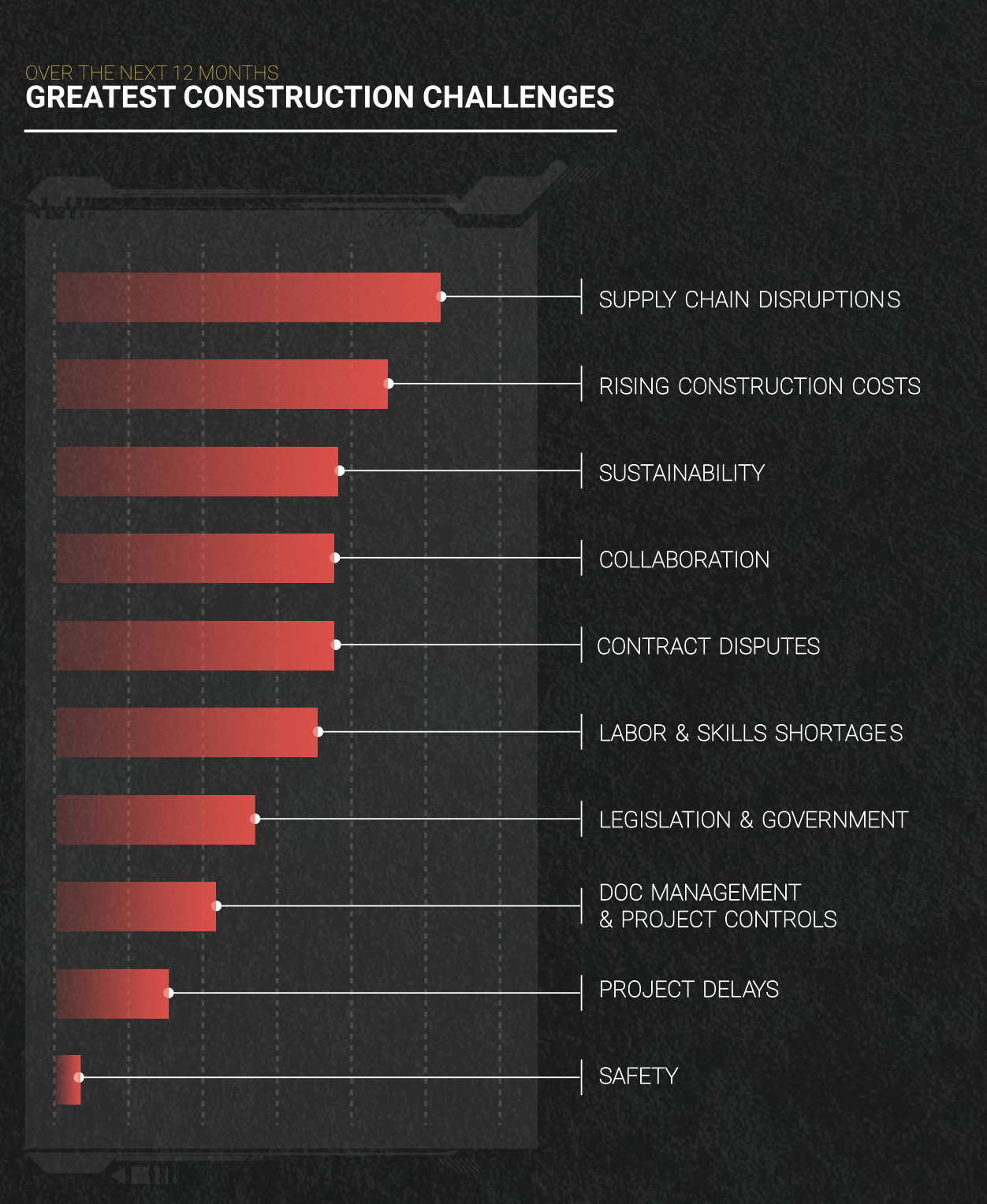

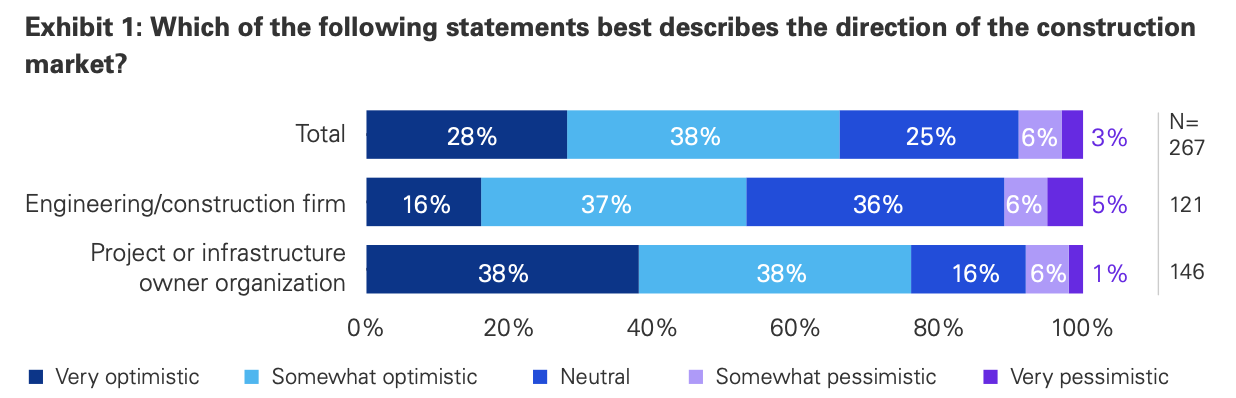

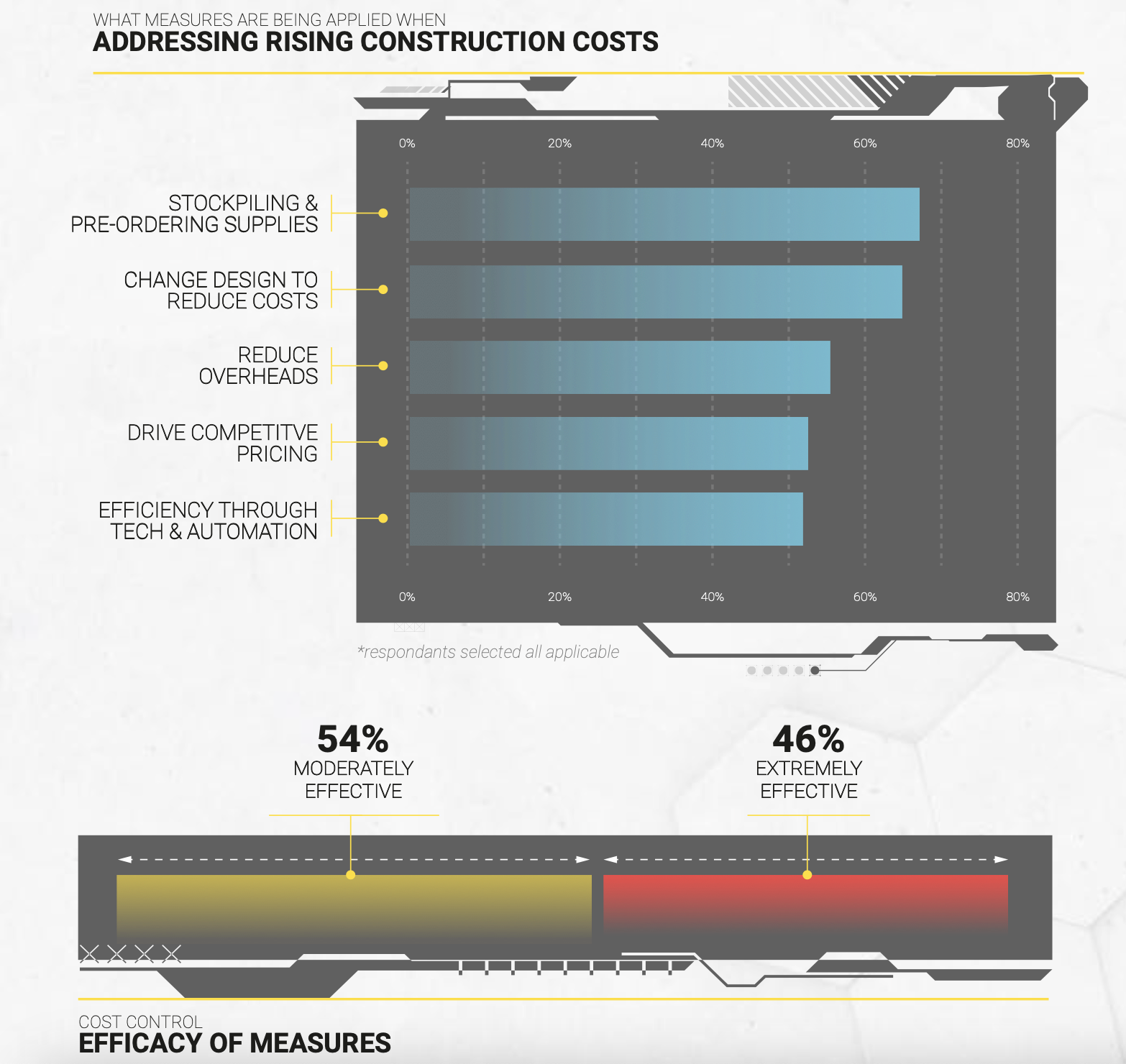

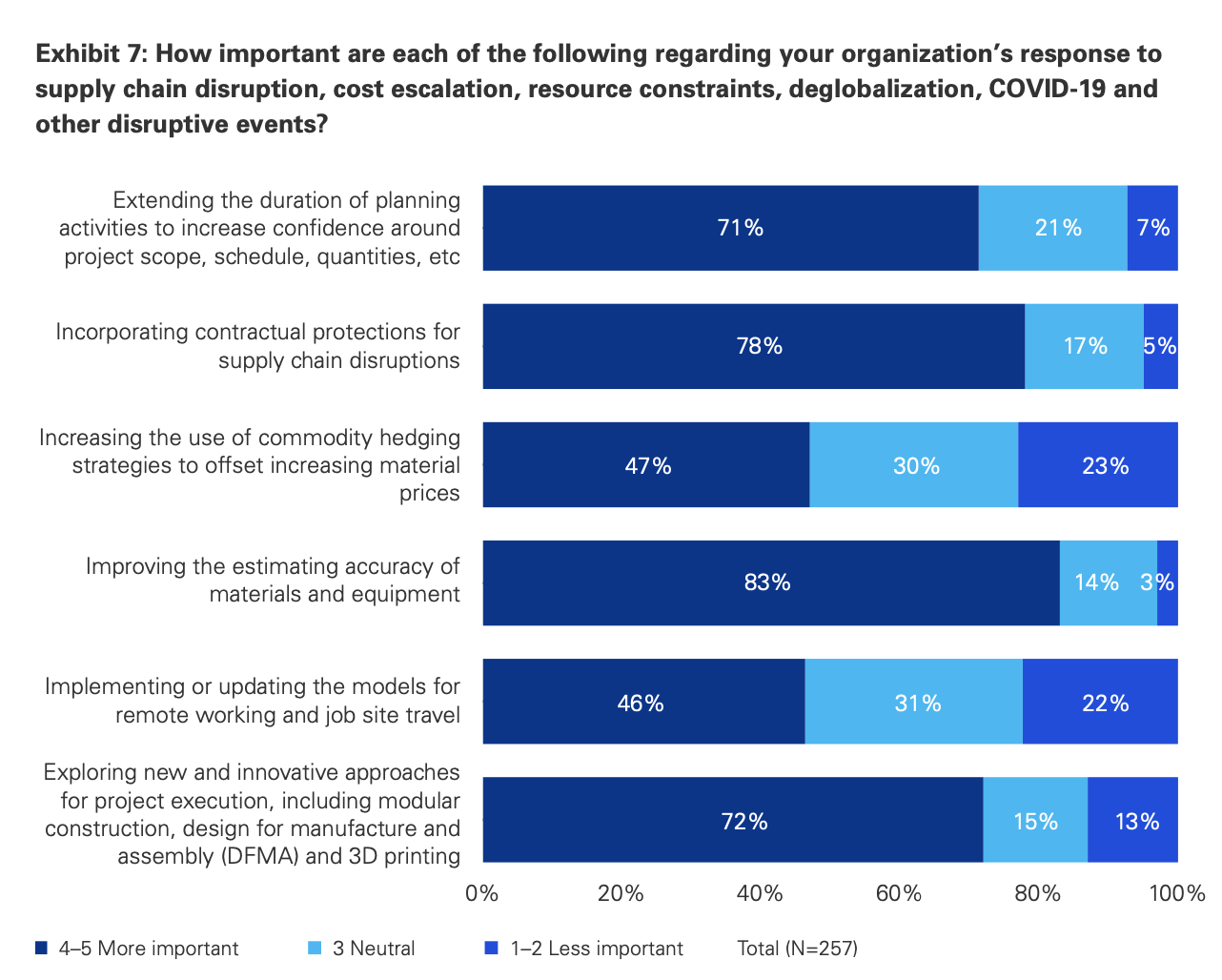

Respondents to KPMG’s survey, while mostly “cautiously optimistic” about their industry’s future, still lamented that less than half of their projects are being completed on time. Both surveys cite similar reasons why projects stall, starting with nagging supply-chain delays, labor shortages, and rising construction costs. KPMG is also seeing a “dramatic shift” by contractors away from fixed-price and guaranteed maximum-price contractors for major projects. Colin Cagney, the firm’s director of infrastructure, capital projects, and climate advisory in the U.S., surmises that contractors are attempting to mitigate their primary responsibility for performance risk.

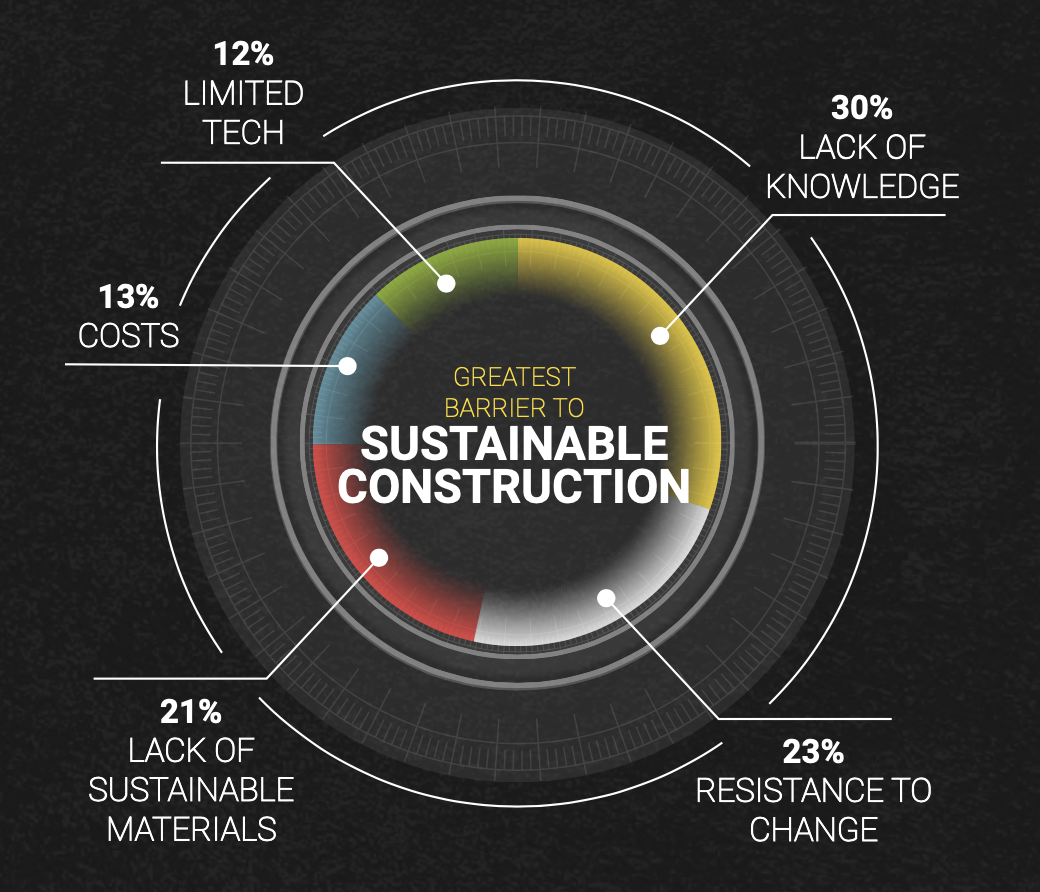

XYZ Reality’s survey notes, too, that construction firms struggle for a variety of reasons to meet their clients’ sustainability goals, and their projects get delayed as well by unexpected design changes, labor shortages, and poor jobsite communication.

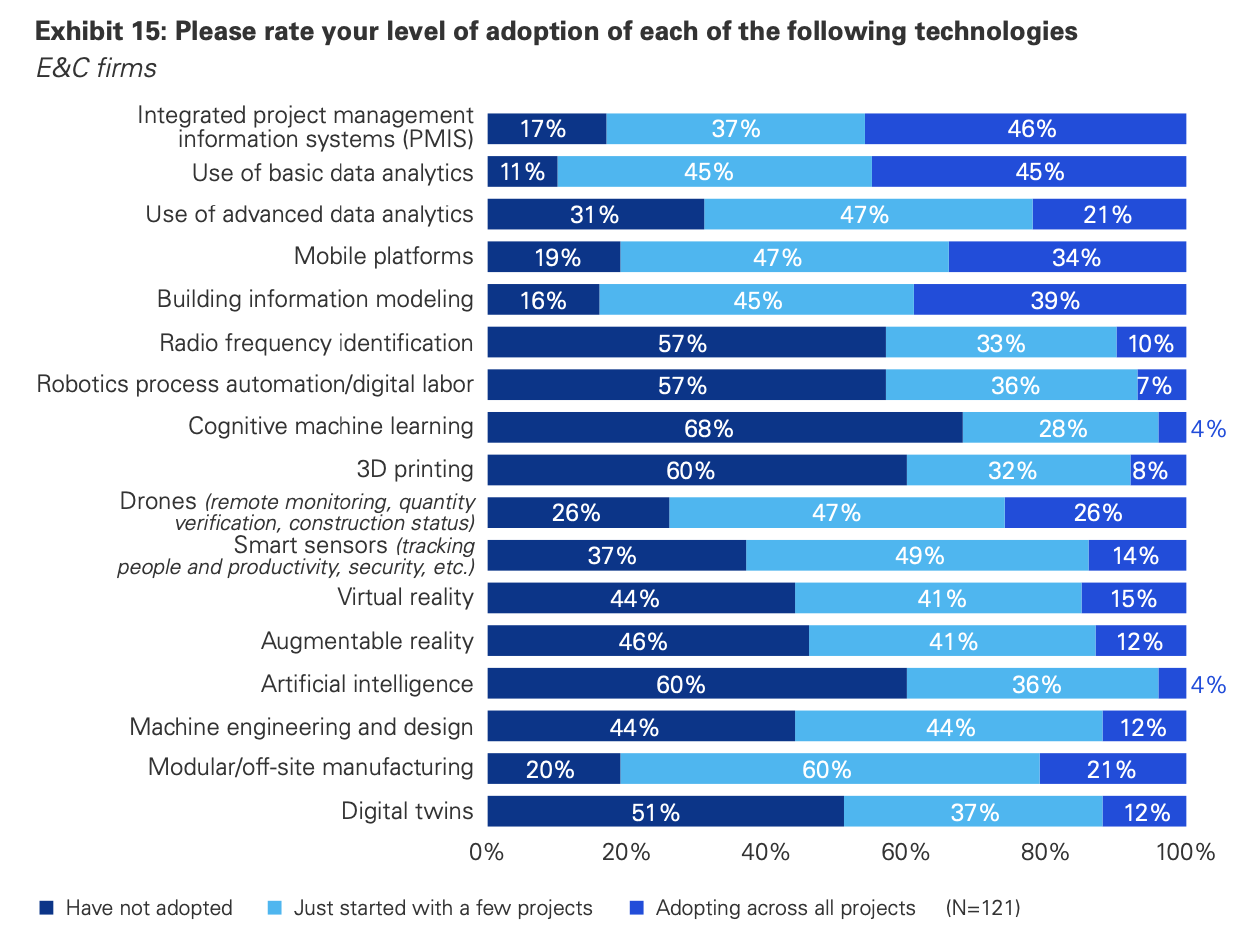

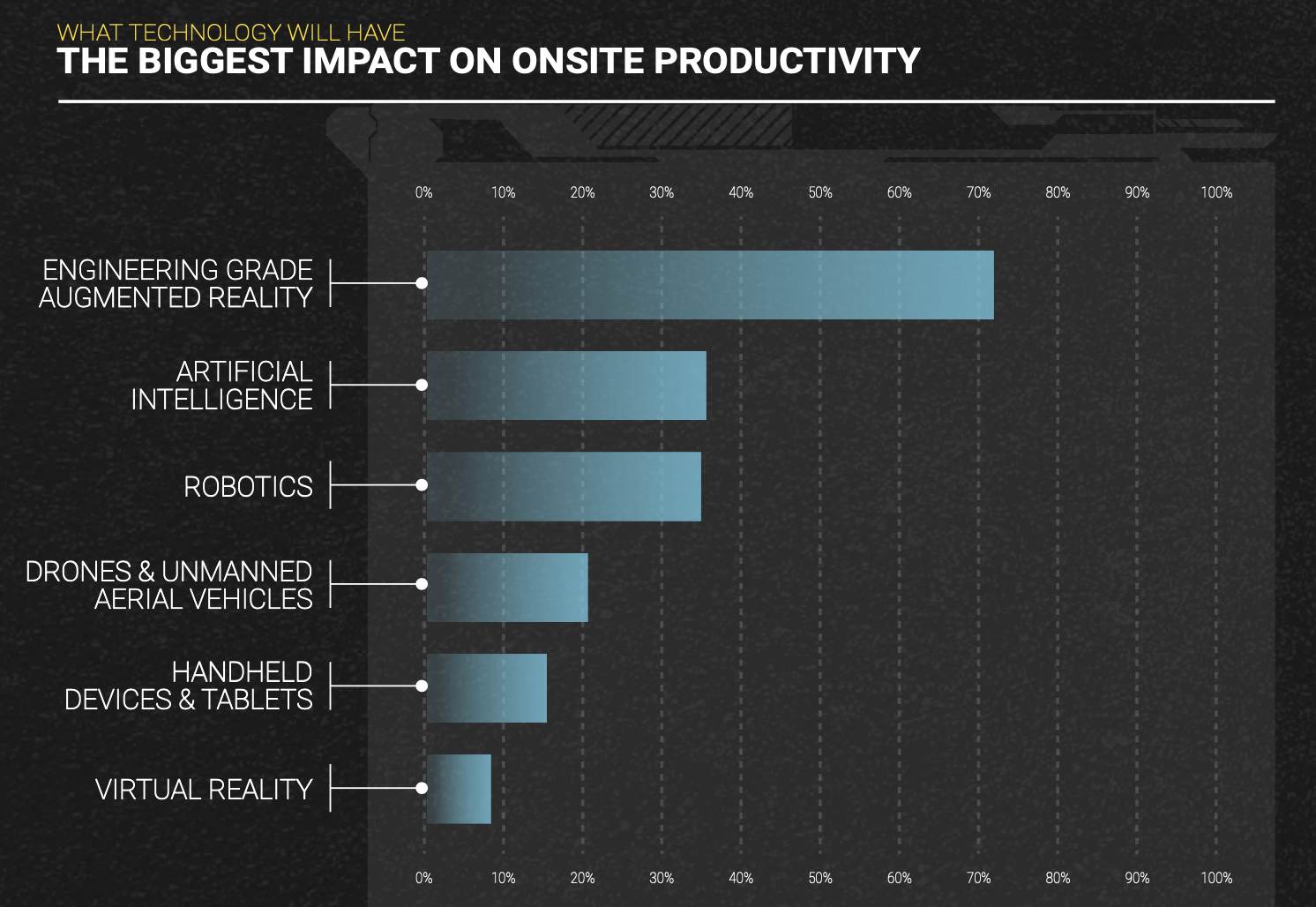

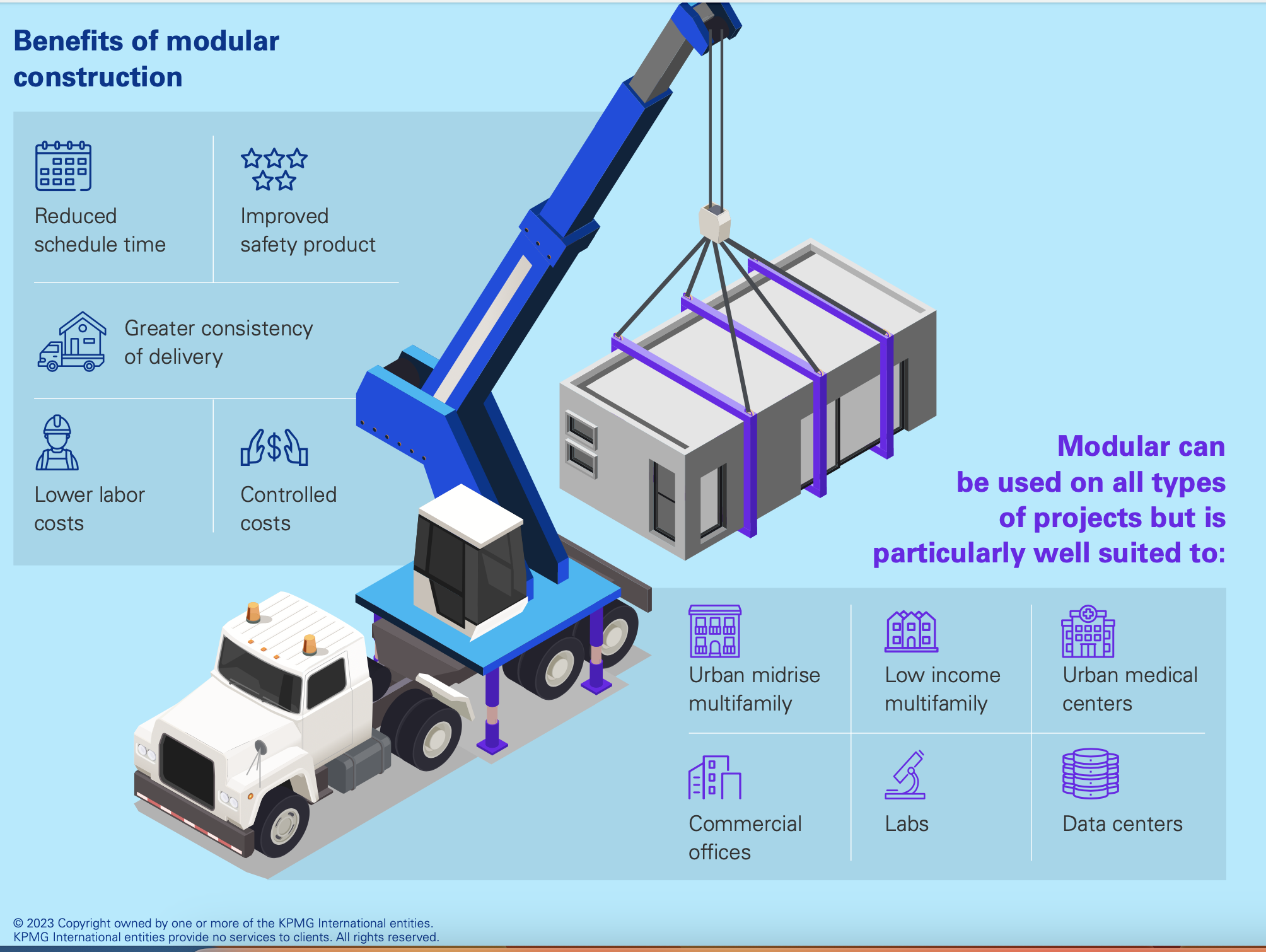

The biggest priority for respondents to KPMG’s survey is improving estimating accuracy, transferring risk, and increasing innovation. Both surveys depict an industry turning more toward technology for answers. Engineering-grade AR, AI, robotics, and drones are among the technological solutions preferred by respondents to XYZ Reality’s survey. More than eight in 10 respondents to KPMG’s survey have adopted mobile platforms, 43 percent are using robotics, and 40 percent are in early stages of using artificial intelligence. KPMG’s respondents also believe emerging technologies that include 3D printing have greater potential for delivering better returns on investment.

More than one-fifth of KPMG respondents have adopted modular and offsite manufacturing on all projects, and 60 percent on at least some projects.

“As our business grows, we want to be evolutionary rather than revolutionary,” stated John Murphy, CEO of J. Murphy & Sons Ltd., a London-based infrastructure construction firm, whose comments were among several respondents quoted in KPMG’s report. “We are continuously investing to keep up with the pace of technological change—constantly progressing.”

ESG and DEI are now priorities

This is KPMG’s 14th Global Construction Survey, which allows the firm the benefit of hindsight. One of the trends it has tracked is a stronger commitment among E+C firms to incorporate Environmental, Social, and Governance (ESG) precepts into their project practices. Nearly 54 percent of respondent firms “fully envision” the benefits of ESG and are aggressively pursuing maturity and improvement by embedding ESG into capital projects. (Admittedly, some of these pursuits are being mandated by stricter legislation.)

Firuzan Speroni, KPMG’s U.S. director of infrastructure, capital projects, and climate advisory, sees “a huge opportunity” for E+C firms and owners to commit to decarbonization of their buildings by measuring potential embodied carbon and choosing building materials with help to reduce it.

Respondents to the 2023 global survey ranked Diversity, Equity, and Inclusion as the third-most-important factor determining their success. Half of those respondents cited the importance of diversified workplace demographics to help address disruption. And 46 percent agreed that updating models for remote working and jobsite travel can contribute to construction projects’ resilience. However, the survey also found that the industry needs to do a better job of attracting and retaining talent. (For example, owners were only “relatively” concerned about reducing greenhouse gas emissions from their projects.)

Finding answers in tech

Both surveys highlight the centrality of innovation to the success of projects and businesses. For example, in 2017 E+C firms were only starting to deploy project management information systems, sensors, drones, or other robotics. This year’s survey, on the other hand, found that 81 percent of respondents from E+C firms say their organizations have adopted, or are starting to adopt, mobile platforms. The use of virtual reality tool has almost doubled (to 56 percent of respondents from 28 percent in 2017). Nearly half of E+C firms responding to the survey have adopted digital twin on at least some of their projects.

“The successful adopters are championing innovation from the very top, and investing in educating their teams,” observed Suneal Vora, a Partner in Business Consulting-Capital Projects and Industry 4.0 for KPMG in India. E+C firms must advocate for innovation, though, as owners seem somewhat less willing to adopt new technologies for their projects.

Keep up with a changing landscape

In summary, the key takeaways from the KPMG Global Construction Survey are:

•Address productivity as a matter of urgency, by taking an outside-in approach

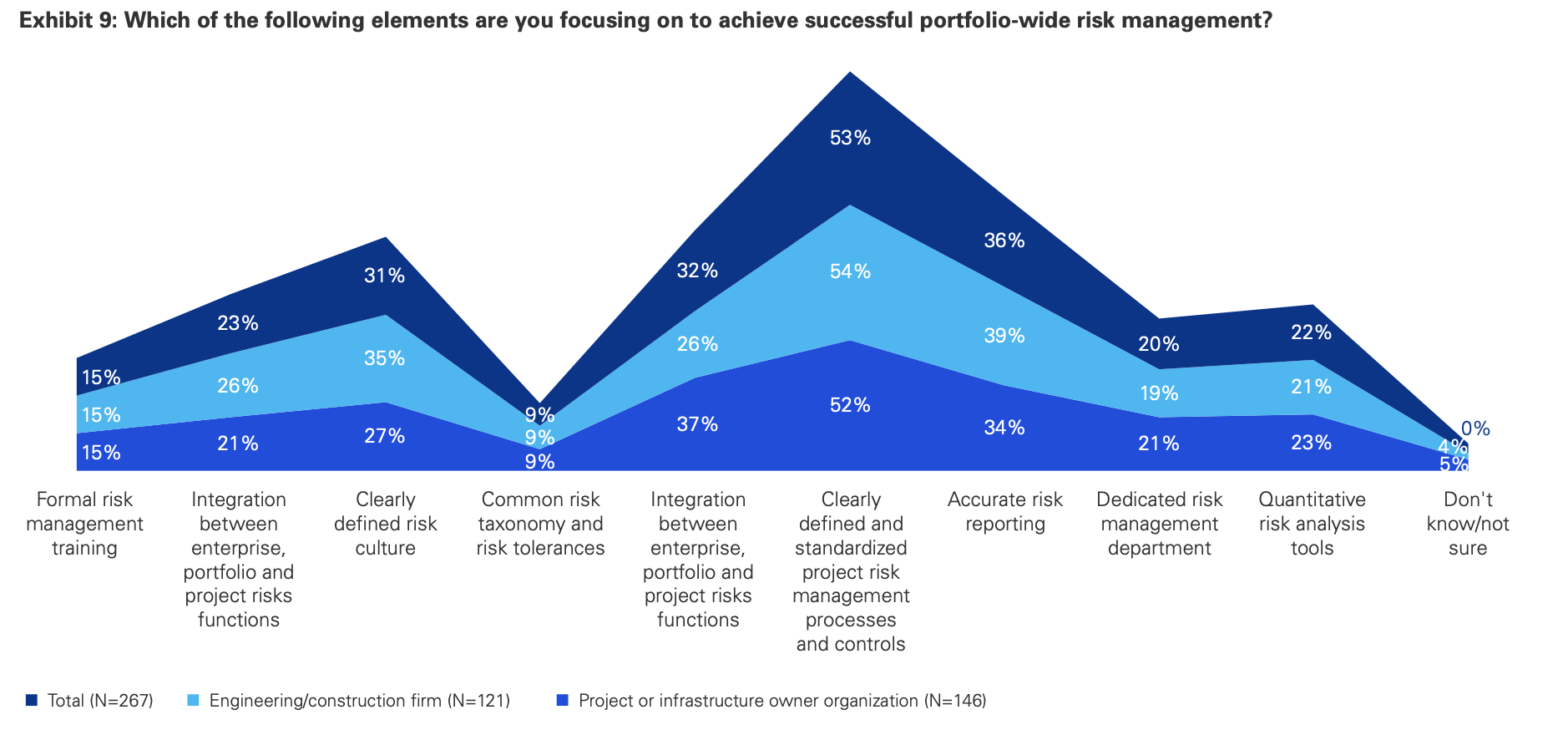

•Master enterprise risk management, and have the confidence to resist a race to the bottom in choosing and financing projects

•Truly embed ESG as a component of a company’s sustainability profile and access to capital and talent

•Become data masters, which can help make jobsites safer and attract a new breed of digital worker.

Related Stories

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

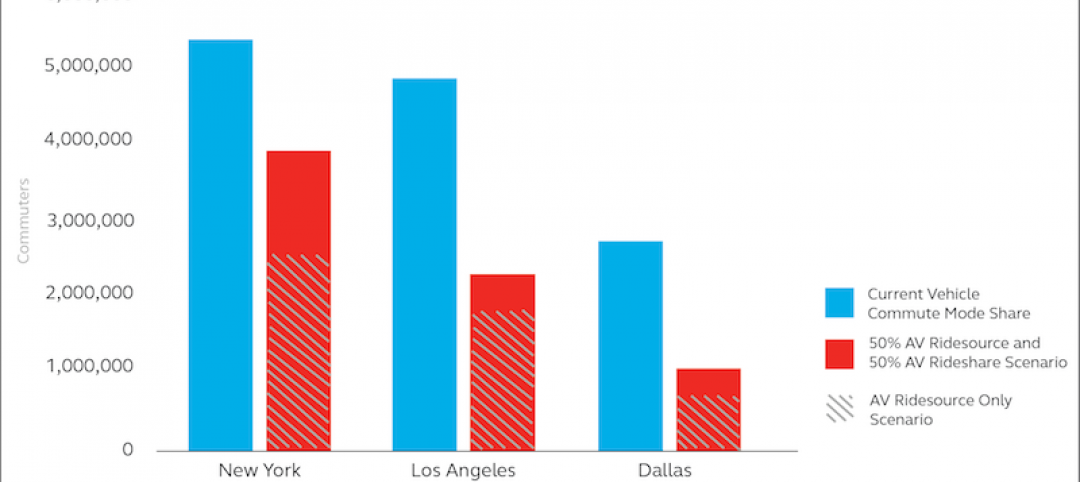

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.

Office Buildings | Mar 7, 2017

Large creative office projects generate staggering returns for property investors

A new Transwestern report examines the adaptive reuse trend across the U.S.

Industry Research | Mar 7, 2017

These are the 10 most expensive cities in the world to build in

Paris, Frankfurt, and Macau are all on the list, but none of them are more expensive than the city in the number one spot.

Office Buildings | Mar 2, 2017

White paper from Perkins Eastman and Three H examines how design can inform employee productivity and wellbeing

This paper is the first in a planned three-part series of studies on the evolution of diverse office environments and how the contemporary activity-based workplace (ABW) can be uniquely tailored to support a range of employee personalities, tasks and work modes.

Industry Research | Feb 15, 2017

Putting workers first should be every employer’s priority

The latest Sodexo report on workplace trends explores 10 factors that are impacting the global work environment.

Industry Research | Feb 13, 2017

How thought leadership marketing can generate referrals for your firm

The most effective way to boost your reputation is through thought leadership marketing.

Market Data | Feb 1, 2017

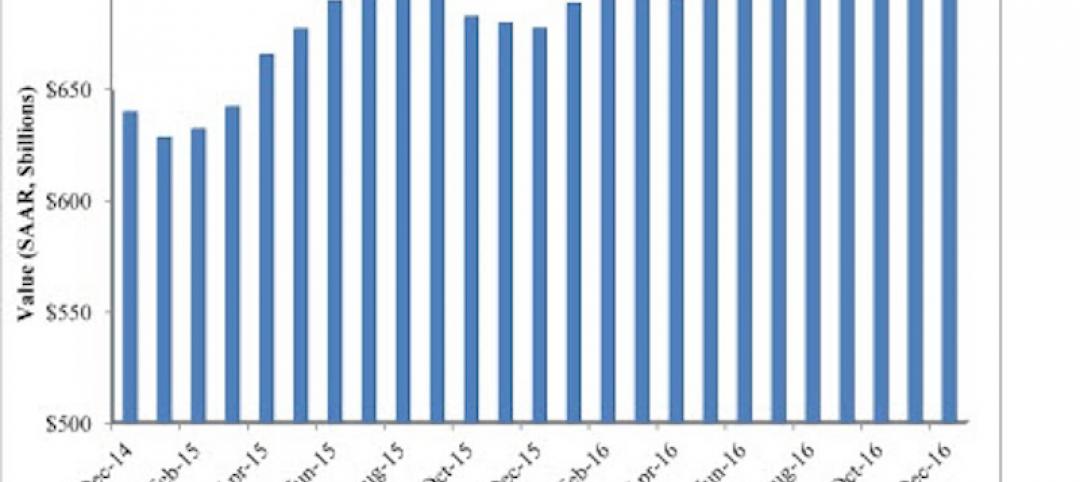

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.