Extreme price increases continued in July for a wide range of goods and services used in construction, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged President Biden to immediately end tariffs and quotas on steel, aluminum, lumber and other essential construction items to help stave off inflationary pressure in the construction industry.

“July was the sixth-straight month of double-digit price increases for construction inputs,” said Ken Simonson, the association’s chief economist. “In addition, lead times to produce or deliver many items keep lengthening. Many reports since the government collected this price data in mid-July show the trend will continue, at a minimum into the autumn and likely beyond, unless tariffs and quotas are removed.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 4.4% over the past 12 months. That was a small fraction of the 25.6% increase in the prices that producers and service providers such as distributors and transportation firms charged for construction inputs, Simonson noted.

There were double-digit percentage increases in the selling prices of materials used in every type of construction. The producer price index for steel mill products more than doubled from July 2020 to last month, leaping 108.6%. The index for lumber and plywood jumped 56.8% despite a large drop in mill prices from May to July. The index for copper and brass mill shapes rose 49.0% and the index for aluminum mill shapes increased 33.2%. The index for plastic construction products rose 26.7%. The index for gypsum products such as wallboard climbed 21.6%. The index for insulation materials rose 11.8%, while the index for prepared asphalt and tar roofing and siding products rose 10.9%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 13.8%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials urged the president to remove tariffs on key construction materials, including steel and aluminum. They noted that some countries have opted for quotas on steel and aluminum in place of tariffs, making supplies even tighter. They said these government limitations on key materials, if left in place, would undermine some of the benefits of the new infrastructure measure that passed in the Senate

“These tariffs and quotas are artificially inflating the cost of many key materials and doing more damage to the economy than help,” said Stephen E. Sandherr, the association’s chief executive officer. “Leaving these measures in place will undermine the broader benefits of the bipartisan new infrastructure measure the House should be passing.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Hotel Facilities | Sep 6, 2017

Marriott has the largest construction pipeline of any franchise company in the U.S.

Marriott has the most rooms currently under construction with 482 Projects/67,434 Rooms.

Market Data | Sep 5, 2017

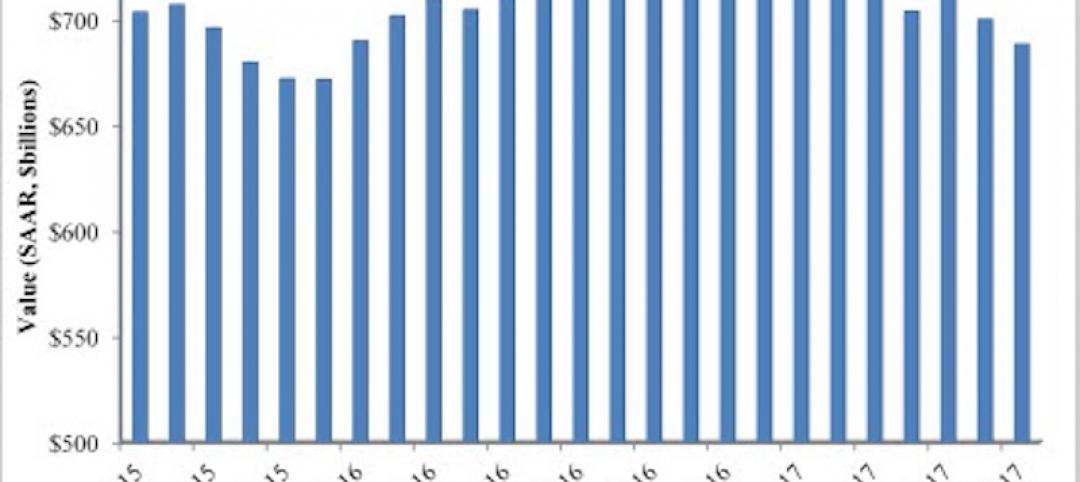

Nonresidential construction declines again, public and private sector down in July

Weakness in spending was widespread.

Market Data | Aug 29, 2017

Hidden opportunities emerge from construction industry challenges

JLL’s latest construction report shows stability ahead with tech and innovation leading the way.

Market Data | Aug 28, 2017

U.S. hotel construction pipeline is up 7% year-over-year

For the economy, the rate of growth may be low but it’s running on all cylinders.

Market Data | Aug 23, 2017

Architecture Billings Index growth moderates

“The July figures show the continuation of healthy trends in the construction sector of our economy,” said AIA Chief Economist, Kermit Baker.

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 20, 2017

Some suburban office markets are holding their own against corporate exodus to cities

An analysis of mortgage-backed loans suggests that demand remains relatively steady.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.