A few years ago, the term Internet of Things (IoT) was ubiquitous in smart home technology lexicon. It represented the abundance of connectable devices that residents would potentially be bringing into their apartment homes for generations. Wide-eyed projections seemed unlimited. The industry just needed to find a way to accommodate it all.

Apartment owners, managers, and developers are at once wowed by the exponential growth in connectivity, and also a bit intimidated. The sheer force of corporate marketing and fear of missing out has convinced them that connectivity must be an absolute necessity for any multifamily enterprise hoping to compete with the community down the block.

Henry Pye, Vice President, RealPage shared these facts for the hundreds of developments his team works on each year:

• Two years ago, 5% of new development – luxury properties – had a managed Wi-Fi system and offered smart home tech.

• One year ago, about 35% of development included a managed Wi-Fi system in the rent; 20% of those had smart home technology.

• Right now, about 70% of new development is installing a managed Wi-Fi system; 55% of those have smart rental units.

Apartment developers and technology companies that literally are unlocking these smartphone-based resident-user interfaces for security, utility, and onsite operations continue to innovate. Bulk-managed Wi-Fi systems are leading the way to high-rising trajectory for smart connectivity nstallation.

In this report, we explore some of the considerations for multifamily designer, builders, and developers when choosing the system to install or to add to their properties.

NOTE: Go to “9 smart connectivity systems for multifamily housing communities” to learn about Boingo, Brilliant, Carson Living, CommunityConnect by RealPage, Dwelo, Latch, PointCentral, SmartRent, and Xfinity Communities.

CONNECTIVITY – THE BACKBONE OF THE SMART RENTAL UNIT SYSTEM

The backbone of any smart home technology system is a community-wide high-speed internet access network with ubiquitous Wi-Fi connectivity. New development is embracing bulk-managed Wi-Fi network installations. Historically, market-rate and luxury multifamily communities executed communications service agreements with traditional phone and cable television service providers to deliver and market video and high-speed internet access (HSIA) directly to multifamily residents, says Pye.

Those service providers then executed subscriber agreements directly with residents. Under such arrangements, a community’s principal obligations were to: 1) supply space for service providers' equipment, 2) install a portion of the low-voltage infrastructure, and 3) assist the service providers’ marketing efforts.

“For the most part, the multifamily industry spent the past 20 years not providing HSIA on a bulk basis,” Pye says. “During the past two years, however, the adoption of bulk HSIA by multifamily communities has grown dramatically, and today, bulk HSIA is a topic of discussion for most multifamily communities.”

Several factors are contributing to the growth of bulk HSIA.

The main reason: It’s good for residents – even more so today, as the work-from-home situation brought on by COVID-19 has shown. Residents living in a community with a managed Wi-Fi system get superior service while paying about 50% of retail, Pye says.

For owners, a managed Wi-Fi system can save money by addressing multiple needs. “Technology has evolved to the point that now a single network can support various technology providers, and solutions, presenting a markedly better investment,” Pye says. “A managed HSIA solution with managed Wi-Fi provides the ability to support almost every on-site technology solution available today,” such as access control, cameras, electric vehicle charging ports, package solutions, metering, and fitness systems.

Cellular-assist services via a managed HSIA solution can also be a viable and less costly solution for 4G/5G mobile support. “No one knows precisely how the migration to 5G will affect multifamily,” Pye says. “However, there are many reasons to believe it will be unpleasant. 5G promises revolutionary mobile communications approaching Wi-Fi speeds. It achieves these service levels and speeds via higher-frequency transmissions. Unfortunately, the amplitude of a radio transmission is inversely proportional to how far the signal can reliably travel and how well the signal penetrates objects.

Pye says that energy code requirements like low-energy windows and radiant barriers, as well as building with light-gauge steel, increases the impediments to outside radio frequency. “Mobile communications providers are moving toward a new mobile communications standard that presents even greater challenges for penetrating multifamily buildings,” he says.

Pye says that the first solution many communities consider for cellular augmentation is a Distributed Antenna System (DAS). But 5G DAS doesn’t exists today, and the promise of CBRS (Citizens Broadband Radio Service) is still a couple of years away, Pye says. “Moreover, DAS systems are increasingly expensive to operate because they tie to incoming broadband connections instead of rooftop antennas. Faced with paying for a 4G system with no clear upgrade path, Wi-Fi cellular assist often is a less costly solution.”

A managed HSIA network provides a superior and less risky smart community experience. “It is wise for communities to protect their investment by avoiding proprietary equipment and pursuing solutions with multiple exit strategies,” Pye says. “A managed HSIA solution combined with Wi-Fi-enabled edge devices, such as thermostats, sensors, and lighting systems, reduces the potential impact of proprietary equipment while offering increased options to adjust or change.”

Managed HSIA solutions can provide a Wi-Fi solution far superior to anything residents can obtain on their own. “Resident-provided Wi-Fi in multifamily buildings operates very poorly,” Pye says. “The primary challenge for wireless HSIA is not the quality of the resident's Wi-Fi equipment, but rather the lack of a system to manage the wireless access point within a resident unit relative to those that surround the unit in three dimensions.”

Residents’ wireless access points continuously interferes with each other. In Pye’s view, the most important reason to use wireless equipment from a quality vendor is the ability of a managed solution to mitigate the adverse effects of placing dozens of wireless access points in proximity. That results in better Internet access for residents while giving the property management team opportunities to reduce expenses and add revenue streams, he says.

“A large percentage of managed HSIA solutions previously deployed to market-rate or luxury multifamily communities proved unsuccessful,” says Pye, largely due to the high costs for backbone bandwidth. “Communities settled for a speed/price combination that was not as competitive as the best offers from traditional phone and cable television service providers,” he says.

That has changed in the last 24 to 36 months, he says. The lower cost of bringing significant backbone bandwidth to individual communities has greatly improved the managed HSIA financial model. In major metropolitan areas, most communities with 200 or more units that pay for network equipment up front can offer a gigabit HSIA solution to each unit for $20/unit/month or less. By comparison, the retail options from traditional phone and cable television service providers routinely command $70-100/month for “up to” 1 gigabit HSIA. “The economics have flipped, allowing communities to offer HSIA services that meet or exceed the combination of speed and pricing available in the consumer marketplace,” says Pye.

“Bulk-managed HSIA now represents a viable option to consider for many multifamily communities and should be considered before moving forward with any DAS system or IoT deployment,” Pye says.

3 COMMON SMART HOME MISTAKES TO AVOID

Adrian Adriano, Vice President of Strategic Initiatives, Xfinity Communities, points to three common mistakes that multifamily designers and developers can make when strategizing for smart home technology:

1) Not conducting market research to determine their target audience and what this market cares about when it comes to smart home tech.

2) Neglecting the training that will be required for property managers and maintenance staff. They will be the ones managing these devices and the residents’ needs day-to-day, so they will need to know how to use this technology to solve any problems that come up.

3) Forgetting how these smart technologies will put an increased strain on the network. Properties will need to partner with a service provider to develop solutions that best handle the bandwidth and connectivity challenges of a smart facility.

Herb Sharpe, Vice President Sales, Business Development Multifamily at Boingo Wireless, says, “Owners should plan for property-wide wireless coverage with technologies that meet 5G specifications. Unlike the traditional approach to wireless, which places residents and owners/managers at the mercy of cable companies or Internet service providers, bulk networks serve as a property’s central operational hub.”

Residents benefit from instant-on, wall-to-wall coverage, and owners/managers have access to real-time usage insights, leading to greater operational efficiency and resident satisfaction, he says.

Sharpe says he believes that bulk-managed Wi-Fi is the future for multifamily connectivity.

“This Wi-Fi approach integrates the necessary infrastructure to power both the resident connectivity experience and IoT devices seamlessly,” he says. “When you have a property with 300+ units blasting Wi-Fi on the same channel, it gets complicated. You need one centralized network that designs the experience for everyone — the resident, the owner, and the property staff.

“By having a managed Wi-Fi network, owners can design the experience they want, while tracking it in real-time with powerful analytic tools, while also enabling them to adapt to a fast-moving world and tech industry.”

PROTOCOLS – THE RUBRIC OF SMART CONNECTIVITY TECHNOLOGY

For smart connectivity technology to work, it must use the most optimal protocols. The National Multifamily Housing Council cites four IoT protocols – Z-Wave, Zigbee, Bluetooth and Insteon – from among the more than a dozen now available, including Wi-Fi, LoRa, and cellular.

Donald Davidoff and Dom Beveridge of apartment industry consulting firm D2 Demand Solutions, have written that Z-Wave and Zigbee are standard protocols, with Z-Wave emerging as the de facto industry standard for smart home devices. Z-Wave helps to counter the growing problem of “app fatigue,” they note.

Operators do not want to tout smart home technology only to have it result in a poor user experience. For some residents, all this “convenience” can border on becoming a nuisance with so many apps, passwords, securities, and platforms/hubs to account for.

Z-Wave protocols help safeguard this problem by stipulating that residents can add as many devices as they want in their apartments, but they must all be controlled through a single app and the Z-Wave hub.

The efficiency of one app and hub controlling all the smart devices in a unit can be appealing. Imagine a single button that says “I’m home” and thus turns on the lights, changes the thermostat, opens the drapes and unlocks the door. This level of coordination would not be attainable with multiple different apps controlling the devices.

SECURITY ASPECTS OF SMART CONNECTIVITY ARCHITECTURE

Security is also an important consideration in the selection of smart community architecture. “The implementation of individual hubs restricts security access to individual units, as access to each apartment’s smart devices is through its own hub,” Beveridge says. “Alternative configurations aggregate multiple units into hubs, or worse, control access across an entire property network.” In the event of a breach, many apartments could be compromised.

The individual hub architecture reduces the problems inherent in aggregating control by establishing security at the lowest possible level – the individual unit. In this scenario, a hacker would need to hack two levels to exploit a vulnerability: first, the cellular or Wi-Fi network, to gain control of the individual unit’s hub; then, the Z-Wave protocol, to gain access to the hub itself. In this way, the individual hub architecture enables access, while adding a second layer of security to protect it.

Pye recommends a community-wide network with enterprise-grade and security-tested hubs for optimized cost savings and security. With such a system, individual residents cannot purposefully or accidentally disconnect or move their system and 24/7 monitoring means increased operating efficiencies for management.

Pye also recommends enterprise-grade technology with a hub that leverages the strengths of multiple protocols, including Z-Wave, Zigbee, Bluetooth Low Energy, and LoRa, to optimize the opportunity for owners to choose products for their asset class and goals. For example, some Class A operators may prefer the brand recognition available with Google Nest thermostats or Lutron and therefore need a multi-protocol solution to meet their demographic needs. On the other hand, asset classes focused on ROI by optimizing efficiencies may prefer a technology like LoRa, which enables smart devices to communicate for miles without any building-run wires.

Pye says with regards to security, an enterprise-grade system will minimally provide access to advanced security audits (SOC 2 Type II for Security, Confidentiality and Availability), static code reviews, and penetration testing results, as well as data strategy for privatization, anonymization, compartmentalization, and GDPR/CCPA compliance.

He adds that owners should ask how many tools are in the API (application programming interface) toolkit: Does the vendor have one thermostat or a choice of several, such as Honeywell Nest, ecobee, or Zen? The API’s depth also must be considered. For example, does the IoT partner’s API work with your Property Management System to connect not only to leasing, but also to maintenance, utility management, payments, and messaging solutions?

HOW ONE OWNER UPGRADED ITS SMART OPERATIONS HUB

For multifamily operators, smart home technology’s rise began with improved locks and entrance systems as well as the prospect of energy savings. Another plus was that managing such functions remotely through a community-wide hub can save time for their on-site teams, especially their maintenance staffs.

In 2019, apartment REIT UDR installed smart building technology at 15 properties in Los Angeles, Seattle, and metro Washington, D.C., with the goal of reducing common area HVAC expenses at these properties by 10–15%, a year. Its smart building technology provides real-time whole-building energy consumption and allowed it to implement energy protocols to operate its buildings more efficiently.

The technology – smart meters, sensors, thermostats, and other wireless equipment – enabled UDR to actively set heating/cooling schedules and temperature ranges from a centralized location. Alert notifications are easily monitored through secure authorized access via a mobile device or computer. The technology can also identify potential water leaks in its properties and alert property management staff. UDR has since expanded this technology to an additional 20 properties.

“When operators can manage vacant units and control access to both buildings and individual units, they can remove considerable friction from the day-today lives of maintenance and leasing teams,” Davidoff says. “There is no longer any need to travel around the property to retrieve keys.”

For owners, investing in leak-detection technology and being able to monitor heat pumps for deficiencies may get them more years’ use of the heat pumps, thereby saving on replacement costs.

Related Stories

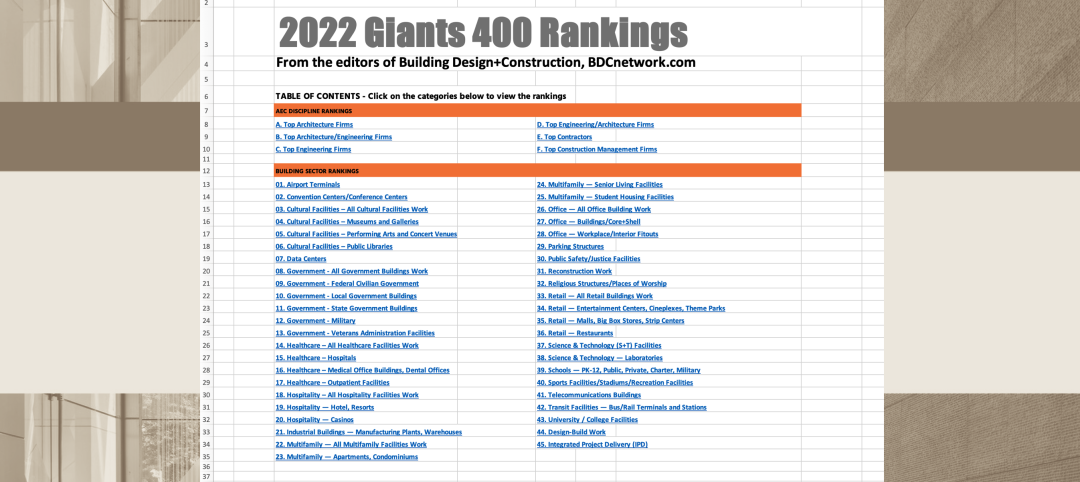

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Multifamily Housing | Feb 3, 2023

HUD unveils report to help multifamily housing developers overcome barriers to offsite construction

The U.S. Department of Housing and Urban Development, in partnership with the National Institute of Building Sciences and MOD X, has released the Offsite Construction for Housing: Research Roadmap, a strategic report that presents the key knowledge gaps and research needs to overcome the barriers and challenges to offsite construction.

Multifamily Housing | Feb 2, 2023

St. Louis’s first transit-oriented multifamily development opens in historic Skinker DeBaliviere neighborhood

St. Louis’s first major transit-oriented, multi-family development recently opened with 287 apartments available for rent. The $71 million Expo at Forest Park project includes a network of pathways to accommodate many modes of transportation including ride share, the region’s Metro Transit system, a trolley line, pedestrian traffic, automobiles, and bike traffic on the 7-mile St. Vincent Greenway Trail.

Multifamily Housing | Feb 1, 2023

Step(1) housing: A new approach to sheltering unhoused people in Redwood City, Calif.

A novel solution to homelessness will open soon in Redwood City, Calif. The compact residential campus employs modular units to create individual sleeping units, most with private bathrooms. The 240 units of housing will be accompanied by shared services and community spaces. Instead of the congregate dorm-style shelters found in many U.S. cities, this approach gives each resident a private, lockable, conditioned sleeping space.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Multifamily Housing | Jan 23, 2023

Long Beach, Calif., office tower converted to market rate multifamily housing

A project to convert an underperforming mid-century office tower in Long Beach, Calif., created badly needed market rate housing with a significantly lowered carbon footprint. The adaptive reuse project, composed of 203,177 sf including parking, created 106 apartment units out of a Class B office building that had been vacant for about 10 years.

Multifamily Housing | Jan 19, 2023

Chicago multifamily high-rise inspired by industrial infrastructure and L tracks

The recently unveiled design of The Row Fulton Market, a new Chicago high-rise residential building, draws inspiration from industrial infrastructure and L tracks in the historic Fulton Market District neighborhood. The 43-story, 300-unit rental property is in the city’s former meatpacking district, and its glass-and-steel façade reflects the arched support beams of the L tracks.

Multifamily Housing | Jan 19, 2023

Editorial call for Multifamily Affordable Housing project case studies - no cost to submit!

Building Design+Construction will feature a roundup of "Multifamily Affordable Housing" projects on BDCnetwork.com.