Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

Coronavirus | Mar 25, 2020

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Coronavirus | Mar 25, 2020

Plaza Construction and Central Consulting & Contracting strategic alliance expands to Florida in response to coronavirus pandemic

New York City-based partnership to aid Florida healthcare systems amid COVID-19 outbreak and will continue medical construction in the region following resolution.

| Mar 25, 2020

Designing public health laboratories to safeguard researchers during pandemics

As laboratory designers, we want to shed light on a subset of our population critical to protecting us from, and preventing the spread of, severe outbreaks: public health researchers.

Market Data | Mar 23, 2020

Coronavirus will reshape UAE construction

The impact of the virus has been felt in the UAE, where precautionary measures have been implemented to combat the spread of the virus through social distancing.

Coronavirus | Mar 21, 2020

Perkins and Will’s CEO sees a light at the end of COVID-19 tunnel

Phil Harrison says the virus outbreak could make more clients see the connection between design and wellbeing.

Coronavirus | Mar 21, 2020

Construction business and union leaders call on government officials to include construction as an 'essential service' during shutdowns

The chief executive officer of the Associated General Contractors of America, Stephen E. Sandherr, and the President of North America’s Building Trades Unions, Sean McGarvey, issued the following joint statement urging Government Officials to Exempt Construction Work from Regional, State and Local Work Shutdowns.

Coronavirus | Mar 21, 2020

Associated General Contractors launches eight-part webinar series around COVID-19

The programming, which begins Monday, will offer advice on how businesses might need to adjust during the virus.

Coronavirus | Mar 20, 2020

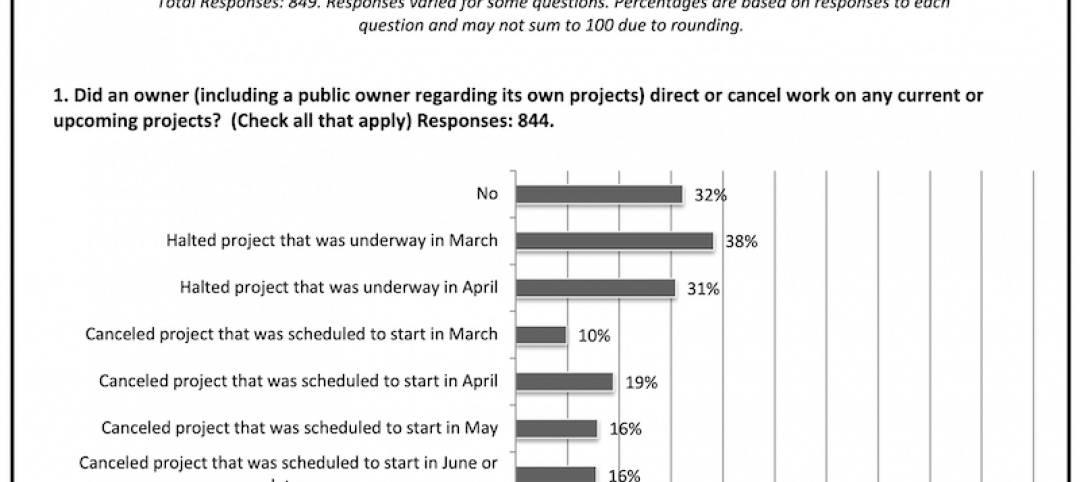

BD+C research: The AEC industry braces for tough sledding in the coming months amid COVID-19 outbreak

A new BD+C poll of U.S. architecture, engineering, and construction firms finds that companies are anticipating project postponements and delays.

Coronavirus | Mar 20, 2020

Pandemic has halted or delayed projects for 28% of contractors

Coronavirus-caused slowdown contrasts with January figures showing a majority of metro areas added construction jobs; Officials note New infrastructure funding and paid family leave fixes are needed.

Coronavirus | Mar 20, 2020

AIA implores Congress to provide relief to business owners and employees

The American Institute of Architects (AIA) 2020 President Jane Frederick, FAIA, and EVP/Chief Executive Officer Robert Ivy, FAIA, are urging Congress to address the critical needs of business owners and employees during the COVID-19 pandemic.