BD+C research: The AEC industry braces for tough sledding in the coming months amid COVID-19 outbreak

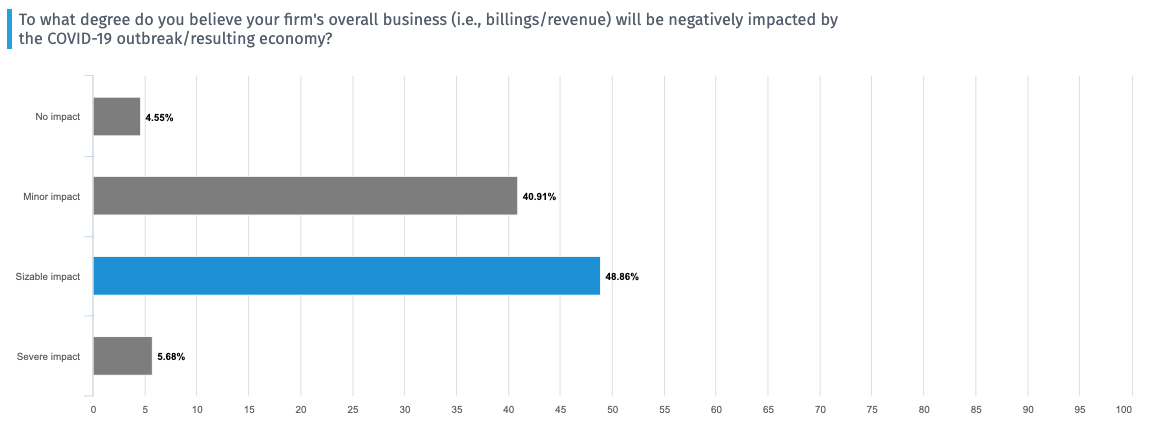

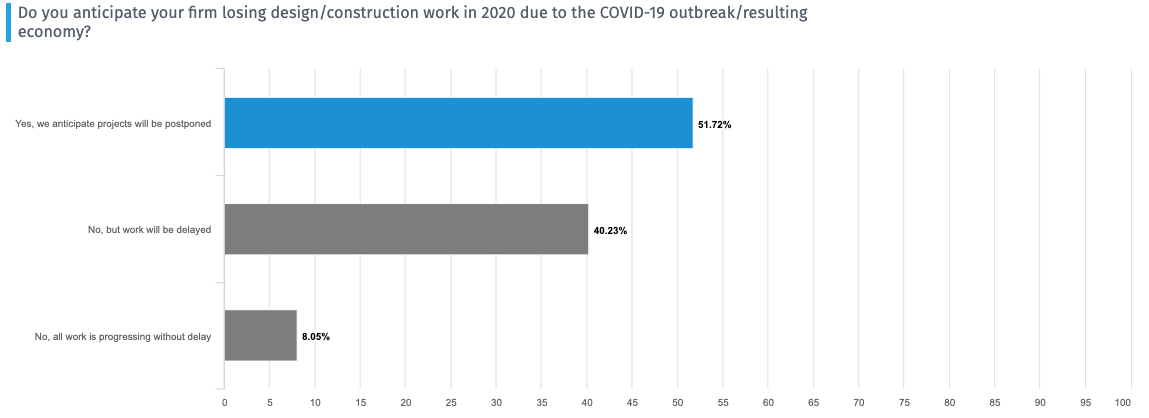

Nearly one-half of AEC firms expect the outbreak of COVID-19 to have a sizable impact on their businesses. The same percentage anticipates that projects they have been working on would be postponed in the wake of the pandemic.

Those are key findings in a poll that BD+C has been conducting for the past several days to gauge the effect of the virus on the U.S. construction industry. During the polling period, the virus has wreaked havoc on the global economy, and has led President Trump to declare a national emergency.

Source: BD+C Business Impacts from COVID-19 Survey

Source: BD+C Business Impacts from COVID-19 Survey

The Mayor of Boston, Martin Walsh, on March 17 imposed a moratorium on all construction projects in that city. That fiat prompted the Associated General Contractors of America to issue a statement insisting that jobsite closures are unnecessary. This afternoon, AGC released its own survey—conducted between March 17 and 19, and drawing 909 responses—that shows that the pandemic has caused 28% of contractors to halt or delay work on current projects.

Walsh’s mandate forced Suffolk Construction to suspend its onsite work on its projects in Beantown.

“As always, our main priority is the safety of our people, teams and partners,” said Suffolk in a prepared statement to BD+C. “We will be prepared to safely mobilize our teams and resume onsite work on our projects once our teams are allowed to return to the jobsites. The spread of COVID-19 remains unpredictable so we will continue to monitor and assess the situation on an ongoing basis.”

Kathleen MacNeil, a Principal with MP Boston, an affiliate of Millennium Partners, stated confidently that the development of the 691-foot-tall Winthrop Center in Boston would continue once the moratorium is lifted.

“Our main concern is the health and wellbeing of our construction teams,” asserted MacNeil in a statement. “We are monitoring the situation very closely and following the direction given by the local, state, and federal government and will be taking all necessary steps to ensure the safety of our workers. Meanwhile, our team will continue to work on all the project details, including shop drawings, fabrication plans and logistics. As soon as we are given clearance, we will immediately resume the construction of Winthrop Center with speed and efficiency.”

When that clearance might be forthcoming, however, is anyone’s guess. It is just as likely that more restrictions imposed by municipalities and states on personal and business activities are imminent. Yesterday, Pennsylvania Gov. Tom Wolf ordered all non-life-sustaining businesses in his state to close their physical locations. California Gov. Gavin Newsome issued a statewide “stay at home” order starting today. (The virus is blamed for 19 deaths in California, where at least 1,000 people had tested positive through March 19.) This morning, New York Gov. Andrew Cuomo ordered nonessential workers to stay home. (New York has designated construction workers as “essential.”)

Mark Humphreys, AIA, Chairman and CEO of Humphreys & Partners Architects, said Newsome’s order allows his company’s offices in Costa Mesa and Los Angeles to remain open, at least for the moment. “Humphreys and its affiliates are prepared to continue operating from remote work locations when it becomes necessary or mandated,” he stated. “You will still be able to contact us through our normal phone numbers and email addresses, and we are making every effort to maintain normal business operations. If operations are further impacted, we will let you know.”

Dire 2020 forecasts for the AEC industry

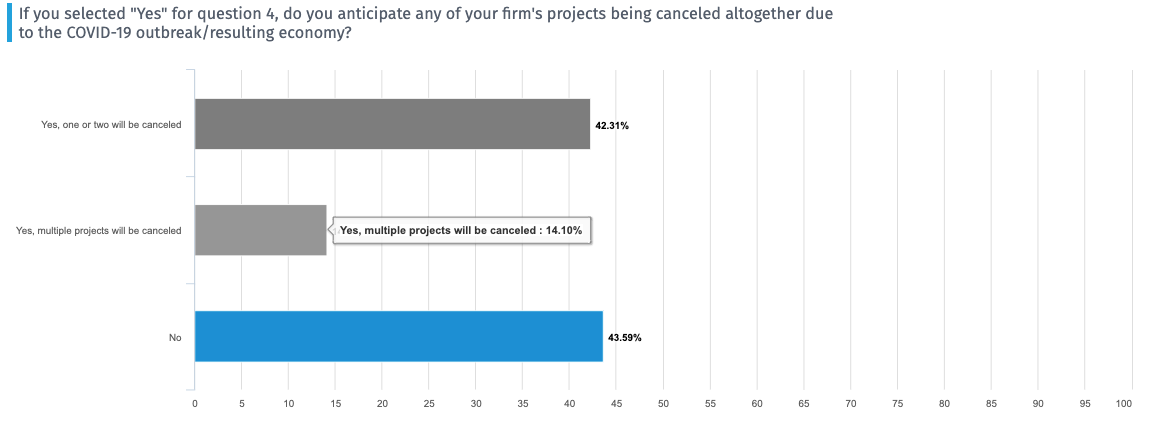

BD+C’s survey drew 86 AEC respondents, more than two-fifths of whom (42.11%) expected that one or two of their current projects might be cancelled altogether, either because of deteriorating economic conditions or as part of the measures being taken to minimize the virus’s spread.

Julian Anderson, President of Rider Levett Bucknall (RLB), the international project cost and management consultants, says that some of his firm’s projects are being delayed, although he couldn’t give a precise number yet. The types of projects being put on hold are aviation-related, gaming, hospitality multifamily (especially upmarket projects), and some education.

Projects that are being canceled outright, he says, “were likely at the edge of penciling out financially anyway, and the fall in the stock market was probably too much for them to withstand.”

Anderson notes, too, that some owners are using the virus’s spread to attempt to speed up their projects, a maneuver that he predicts subcontractors would resist if it requires more working hours.

Source: BD+C Business Impacts from COVID-19 Survey

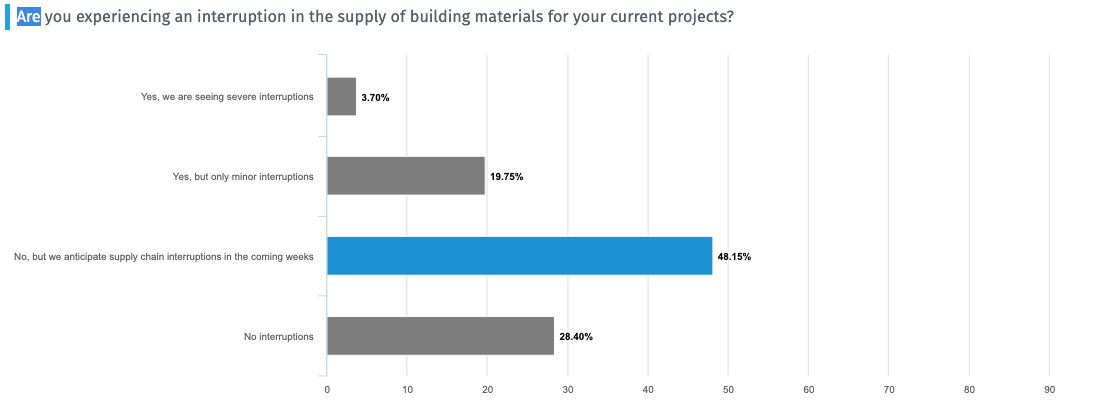

Source: BD+C Business Impacts from COVID-19 Survey

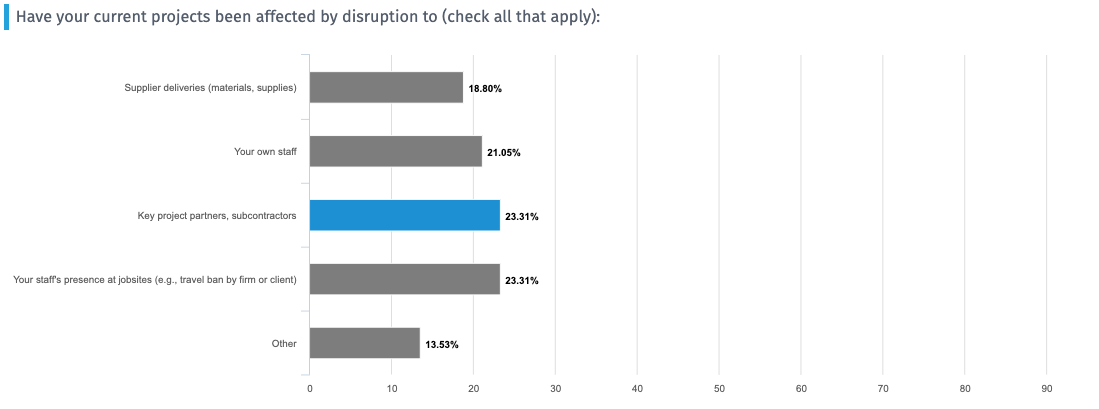

The pandemic has already been felt on the industry’s supply chain and workforce. More than 23% of respondents to BD+C’s poll said their projects had been affected by disruptions to partners such as subcontractors and the ability of project managers and superintendents to be on jobsites. Another 18.75% said materials deliveries have also been affected by prohibitions and plant closings as a result of the virus. Anderson of RLB says that so far, “we are seeing delays in items coming from China, specifically light fittings, granite, electrical equipment, and HVAC equipment.”

Nearly half (46.84%) of respondents anticipate supply chain disruptions in the coming weeks.

Anecdotally, many AEC firms seem to be in limbo, trying to stay reasonably functional—and keep their clients—with their employees working from home and with travel being severely limited. Due to the guidelines, restrictions, and directives issued by the CDC, state and local public health officials, and governmental agencies, “our firm’s ability to perform certain contractual duties regarding the project are or may be restricted,” write DKN Architects’ CEO Rob Donhoff, President Patrick Nall, and VP Tom Kargi.

Source: BD+C Business Impacts from COVID-19 Survey

Source: BD+C Business Impacts from COVID-19 Survey

DPR Construction has in place a set of advanced protocols to address situations ranging from enhanced office and jobsite cleaning/distancing practices to a full temporary pause of work. “Business-critical staff will ensure sites are secure throughout [any] work stoppage. In some areas, we are also working to educate local authorities about what it takes to wind down projects safely.”

DPR is providing its teams with the technology and tools to collaborate remotely for operational continuity.

Three principals in CO Architects’ Los Angeles office offered their perspective. Tom Chessum, FAIA, NCARB, a healthcare expert, said he hadn’t seen any projects delayed yet. However, some work inside hospitals is being deferred.

Scott Kelsey, FAIA, who has been with the firm 33 years, says that while none of his projects have been delayed, “we are hearing that some will begin to shut down.” CO Architects has contingency plans in place to keep its teams busy for eight weeks of shutdowns.

Source: BD+C Business Impacts from COVID-19 Survey

Source: BD+C Business Impacts from COVID-19 Survey

Andrew Labov, FAIA, LEED AP, Principal, Science and Technology Director, says that as the L.A. office adjusts to working remotely, “we are experiencing some small reductions in productivity.” Working through local plan-check agencies has become more cumbersome. And “many clients” have told CO “explicitly” that they planned to shut down projects at some point. As there are no more third-party inspections and commissioning, “we have seen some supply-chain disruptions” that CO is trying to ameliorate by preordering materials and equipment.

All three executives agree the pandemic’s impact could linger beyond the virus’s eventual dissipation. “We have already seen a major school-construction bond fail in California’s February primary,” observes Labov. Chessum thinks that any resounding impact will depend on how well the firm overcomes inefficiencies related to shifting employees to working remotely. “It could potentially influence how we interact internally as a business and externally with our clients,” adds Kelsey.

BD+C’s poll responses jibe with a recent survey of 131 AEC firms by the management consultant Zweig Group. While nearly 80% said that economic conditions were either the same or somewhat better than a year ago, almost half (47%) thought the economy would be worse in the next 12 months. Half of those surveyed by Zweig also expect the AEC industry to perform in line with the economy.

Source: BD+C Business Impacts from COVID-19 Survey

Source: BD+C Business Impacts from COVID-19 Survey

Zweig Group’s survey also found that:

• 41% of respondents’ clients have canceled or delayed a project, and another one-quarter (24%) is considering postponements;

• About half of respondents say their firms support decisions of their employees to refrain from public networking, 34% have liberalized their telecommute policies, and 61% of the companies have halted nonessential travel;

• 56% of the firms are considering changes to their 2020 budget;

• 66% foresee a decrease in revenue this year; and

• 78% said the virus’s spread would affect overall business development in next 12 months.

Anderson of RLB believes that an economic recession, if it occurs, could spur any number of scenarios:

- Companies will try to diversify the locales of manufacturing—specifically, away from China—to provide more options in case of future events like COVID-19.

- The reliance on communication and technology to facilitate working remotely will push capital into those sectors and drive innovation.

- The use of factory-built, preassembled components (for example, framed and finished wall sections, and plumbing and mechanical systems) and robotic installation will increase, as these methodologies allow construction to continue during pandemics and other extreme events.

- Hospitality will take some time to come back, as customers will want to be sure that the pandemic is definitely over before making big travel plans.

- Aviation will be negatively affected for the same reason.

- Healthcare will be the beneficiary of increased funding, especially if there is a change in Administration arising from this year’s Presidential election.

- Office space may become a “who needs it” product, including shared office space.

He also believes that, if the recession is sustained, and shrinks the construction industry, “a recovery will be difficult due to lack of qualified personnel.”