Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

Coronavirus | Apr 9, 2020

COVID-19 Design Innovation Grant: IDA offers $14,000 to spur design innovation for combating the coronavirus pandemic

The International Design Awards is looking for innovations in low-cost ventilators, in-home isolation pods, and reusable masks.

Coronavirus | Apr 9, 2020

COVID-19 alert: Robins & Morton to convert Miami Beach Convention Center into a 450-bed field hospital

COVID-19 alert: Robins & Morton to convert Miami Beach Convention Center into a 450-bed field hospital

Coronavirus | Apr 8, 2020

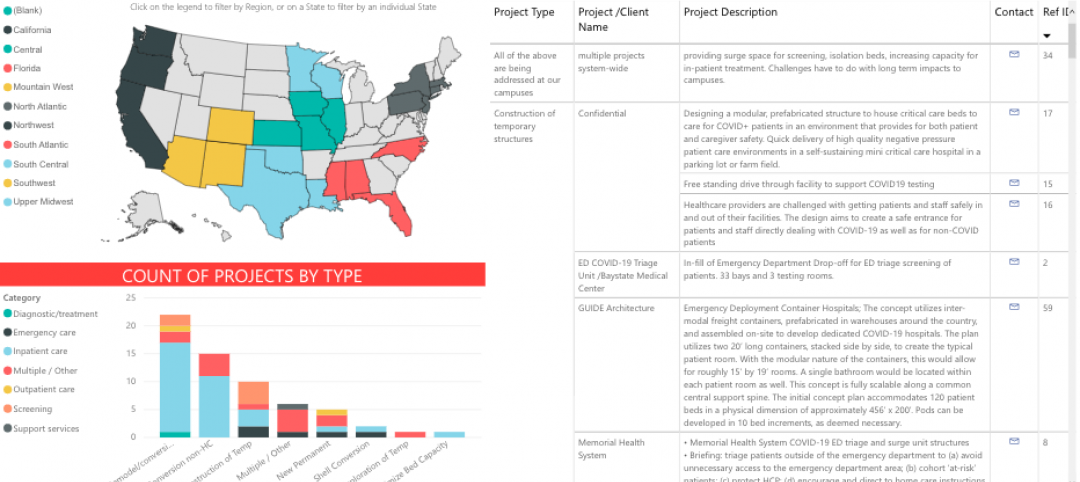

AIA task force launches tool for assessing COVID-19 alternative care sites

The tool is intended to assist non-healthcare design professionals with identifying alternative sites suitable for patient care.

Coronavirus | Apr 8, 2020

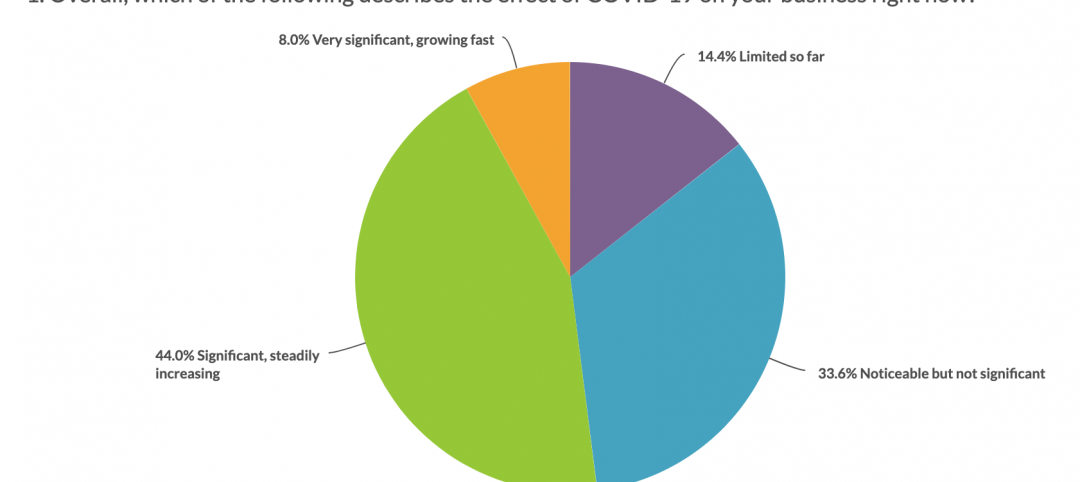

COVID-19 alert: Most U.S. roofing contractors hit by coronavirus, says NRCA

NRCA survey shows 52% of roofing contractor said COVID-19 pandemic was having a significant or very significant impact on their businesses.

Coronavirus | Apr 8, 2020

Navigate supply chain and manufacturing challenges during disruption

First, most important and most complex: Create an extensive safety plan for your facilities and job sites that protects both the personnel onsite and the end users of your product.

Coronavirus | Apr 7, 2020

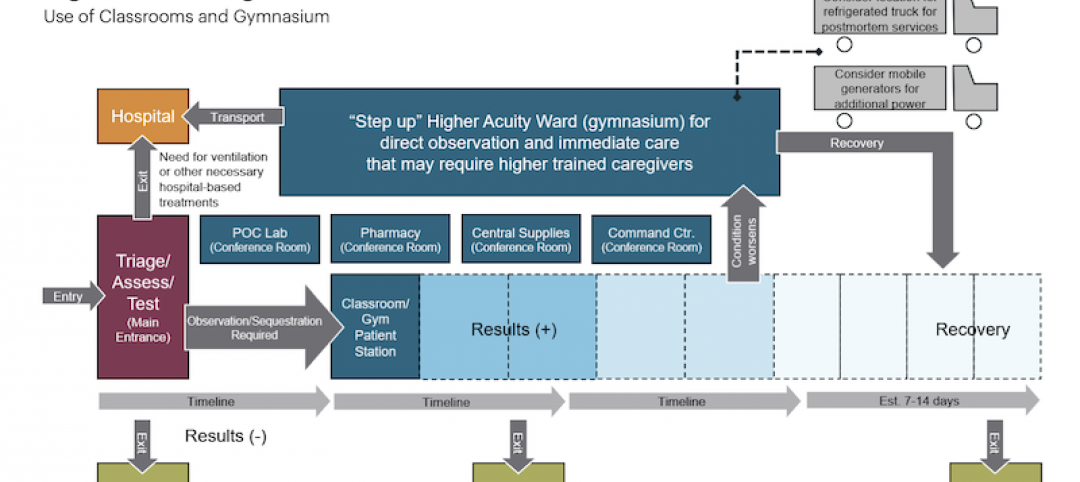

How to turn a high school into a patient care center in 15 days

HKS’s concept paper presents three scenarios.

Coronavirus | Apr 7, 2020

New Trump administration guidance now allows firms with 500 of fewer employees to qualify for paycheck protection program loans

Associated General Contractors of America secures fix to loan qualifications after alerting administration officials to small business administration language that excluded many firms.

Coronavirus | Apr 6, 2020

New small business administration loan guidance appears to exclude many construction firms that employ fewer than 500 people

Construction officials urge agency to make clear that firms that employ 500 or fewer people to qualify for paycheck protection program loans, regardless of revenue.

Coronavirus | Apr 6, 2020

Pandemic preparedness: How hospitals can adapt buildings to address worst-case scenarios

A Canadian healthcare architect looks at how hospital staff can act now to modify facilities and contain a pandemic.

Coronavirus | Apr 5, 2020

COVID-19: Most multifamily contractors experiencing delays in projects due to coronavirus pandemic

The NMHC Construction Survey is intended to gauge the magnitude of the disruption caused by the COVID-19 outbreak on multifamily construction.