The Q3 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index (Index) released today indicates skilled labor shortages will have the greatest impact on commercial construction businesses over the next three years. The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years with over half (57%) expecting the impact to be high/very high.

The skilled labor shortage has been consistently identified as a major issue facing the industry, but it is now reported by 80% of contractors to be impacting worker and jobsite safety. In fact, the Q3 report found that a lack of skilled workers was the number one factor impacting increased jobsite safety risks (58%).

"The commercial construction industry is growing but the labor shortage remains unresolved," said Jennifer Scanlon, president and CEO of USG Corporation. "As contractors are forced to do more with less, a renewed emphasis on safety is imperative to the strength and health of the industry. It continues to be important for organizations to build strong and comprehensive safety programs."

As contractors grapple with a scarcity of skilled workers, findings show a majority are working to improve the overall safety culture on the jobsite (63%) and at their firm's offices (58%). However, the indicators that were reported to have the highest impact on improving safety culture and outcomes are those that engage employees throughout the organization. This includes developing training programs for all levels of workers (67%), ensuring accountability across the organization (53%), empowering and involving employees (48%). Other indicators reported include improving communication (46%), demonstrating management's commitment to safety (46%), improving supervisory leadership (43%) and aligning and integrating safety as a value (42%).

In addition to the skilled labor shortage, the report found addiction and substance abuse issues are a factor in worker and jobsite safety. Nearly 40% of contractors are highly concerned over the safety impacts of worker use/addiction to opioids, followed by alcohol (27%) and marijuana (22%). Notably, the report showed that while nearly two-thirds of contractors have strategies in place to reduce the safety risks presented by alcohol (62%) and marijuana (61%), only half have strategies to address their top substance of concern: opioids, which is a newer growing concern. The opioid epidemic cost our economy $95 billion in 2016, and could account for approximately 20% of the observed decline in men's labor force participation.

"The opioid crisis has both human and economic costs," said Neil Bradley, chief policy officer of the U.S. Chamber. "The U.S. Chamber of Commerce remains committed to helping combat the opioid epidemic, which continues to devastate too many families, communities, and industries every day. While there is no one-size-fits-all answer, a multipronged legislative approach is a critical first step."

Overall contractor sentiment saw a slight boost in optimism with an Index score of 75 in the third quarter – up two points from Q2 2018. The Index looks at the results of three leading indicators to gauge confidence in the commercial construction industry - backlog levels, new business opportunities and revenue forecasts – generating a composite index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis.

The Q3 2018 results from the three key drivers were:

— Backlog: Optimal backlog rose from 73 to 81, the largest change in any of the three components of the CCI in the last six quarters. The average current backlog was 10.3 months, up from 9.3 last quarter.

— New Business: The level of overall confidence was 74, relatively steady quarter-over-quarter (75 in Q2 2018) but down two points since Q1 (76).

— Revenues: Expectations slipped from 72 to 69, the most notable change coming in a decrease in the percentage of contractors who now expect an increase in revenues, which dropped from 83% to 72%.

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Related Stories

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 20, 2017

Some suburban office markets are holding their own against corporate exodus to cities

An analysis of mortgage-backed loans suggests that demand remains relatively steady.

Market Data | Aug 17, 2017

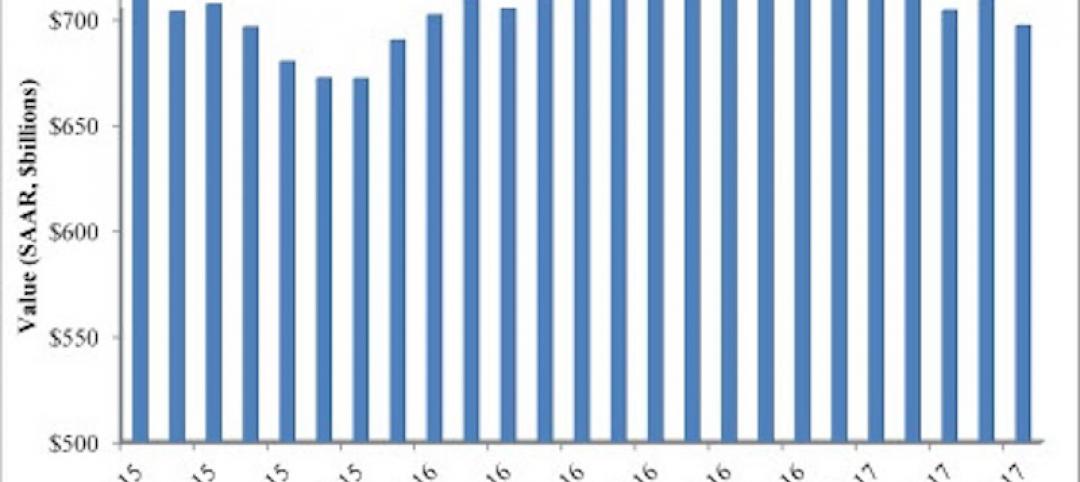

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

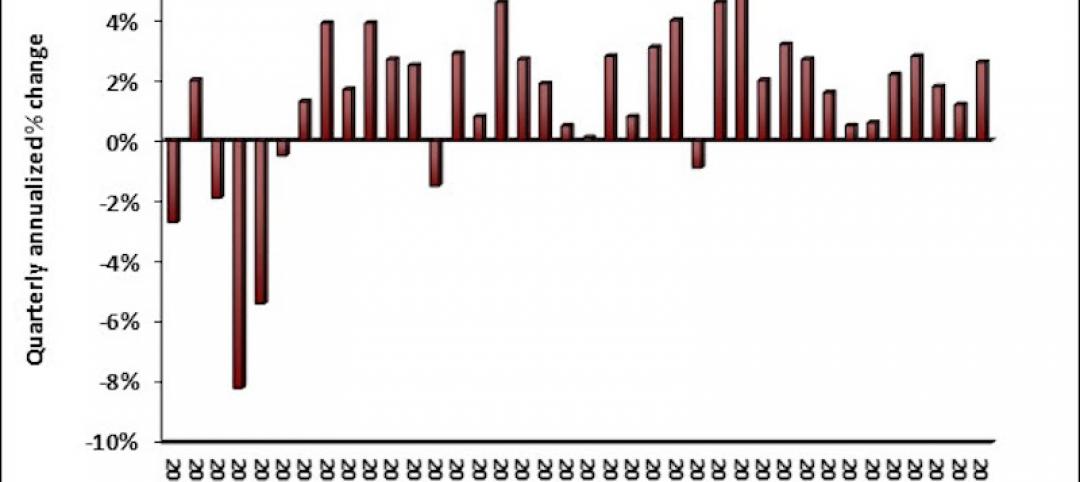

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.