Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

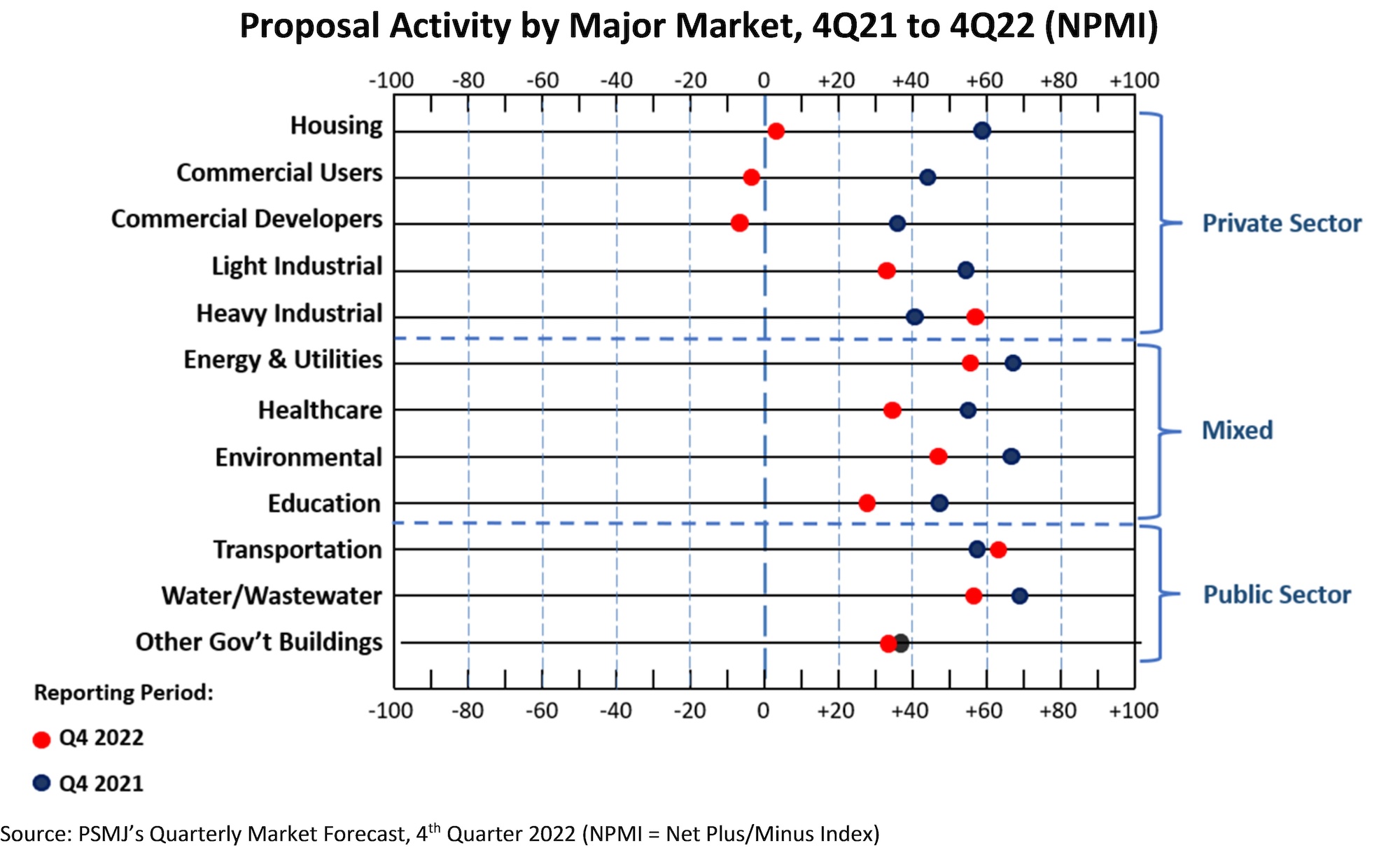

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| May 9, 2012

Construction Defect Symposium will examine strategies for reducing litigation costs

July event in Key West will target decision makers in the insurance and construction industries.

| May 8, 2012

WDMA and AAMA release window, door & skylight market studies

Historic data for 2006 through 2011 and forecast data for 2012 through 2015 are included in the report.

| May 8, 2012

Study presents snapshot of domestic violence shelter services

Unique partnership of architects and domestic violence advocates brings new strategies for emergency housing.

| May 8, 2012

Gensler & J.C. Anderson team for pro bono high school project in Chicago

City Year representatives came to Gensler for their assistance in the transformation of the organization’s offices within Orr Academy High School, which also serve as an academic and social gathering space for students and corps members.

| May 8, 2012

Skanska USA hires Zamrowski as senior project manager

In his new role at Skanska, Zamrowski will serve as the day-to-day on-site contact for select Pennsylvania-based projects during all phases of construction.

| May 8, 2012

Morgan/Harbour completes three projects at Columbia Centre

Projects completed on behalf of property owner, White Oak Realty Partners, LLC, Pearlmark Realty Partners, LLC and Angelo Gordon & Co.

| May 7, 2012

4 more trends in higher-education facilities

Our series on college buildings continues with a look at new classroom designs, flexible space, collaboration areas, and the evolving role of the university library.

| May 7, 2012

Best AEC Firms: MHTN Architects nine decades of dedication to Utah

This 65-person design firm has served Salt Lake City and the state of Utah for the better part of 90 years.

| May 7, 2012

2012 BUILDING TEAM AWARDS: TD Ameritrade Park

The new stadium for the College World Series in Omaha combines big-league amenities within a traditional minor league atmosphere.