Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

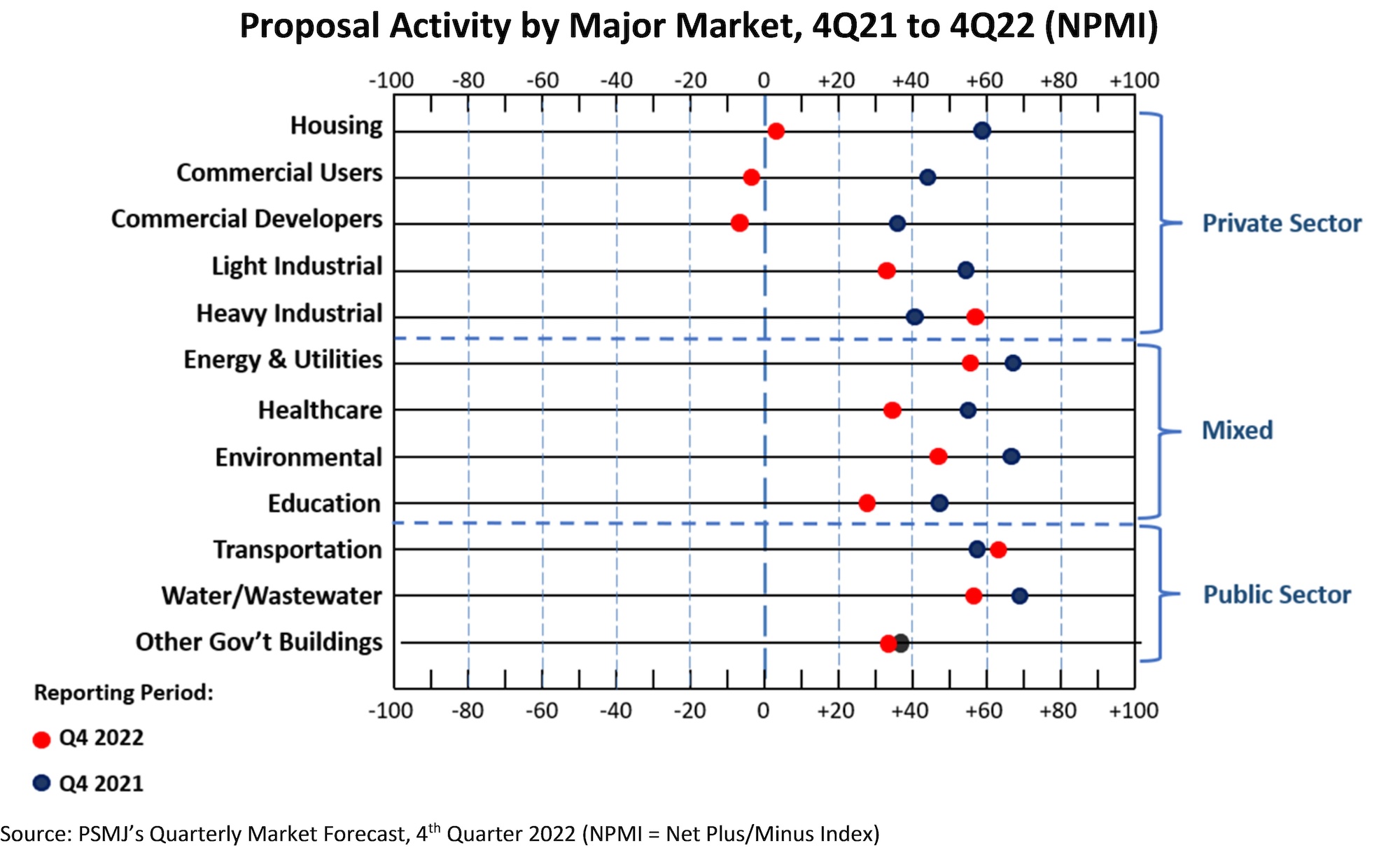

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| May 10, 2012

Chapter 6 Energy Codes + Reconstructed Buildings: 2012 and Beyond

Our experts analyze the next generation of energy and green building codes and how they impact reconstruction.

| May 10, 2012

Chapter 5 LEED-EB and Green Globes CIEB: Rating Sustainable Reconstruction

Certification for existing buildings under these two rating programs has overtaken that for new construction.

| May 10, 2012

Chapter 4 Business Case for High-Performance Reconstructed Buildings

Five reconstruction projects in one city make a bottom-line case for reconstruction across the country.

| May 10, 2012

Chapter 3 How Building Technologies Contribute to Reconstruction Advances

Building Teams are employing a wide variety of components and systems in their reconstruction projects.

| May 10, 2012

Chapter 2 Exemplary High-Performance Reconstruction Projects

Several case studies show how to successfully renovate existing structures into high-performance buildings.

| May 9, 2012

Chapter 1 Reconstruction: ‘The 99% Solution’ for Energy Savings in Buildings

As a share of total construction activity reconstruction has been on the rise in the U.S. and Canada in the last few years, which creates a golden opportunity for extensive energy savings.

| May 9, 2012

International green building speaker to keynote Australia’s largest building systems trade show

Green building, sustainability consultant, green building book author Jerry Yudelson will be the keynote speaker at the Air-Conditioning, Refrigeration and Building Systems (ARBS) conference in Melbourne, Australia.

| May 9, 2012

Tishman delivers Revel six weeks early

Revel stands more than 730 feet tall, consists of over 6.3 milliont--sf of space, and is enclosed by 836,762-sf of glass.

| May 9, 2012

Stoddert Elementary School in DC wins first US DOE Green Ribbon School Award

Sustainable materials, operational efficiency, and student engagement create high-performance, healthy environment for life-long learning.

| May 9, 2012

Shepley Bulfinch given IIDA Design award for Woodruff Library?

The design challenges included creating an entry sequence to orient patrons and highlight services; establishing a sense of identity visible from the exterior; and providing a flexible extended-hours access for part of the learning commons.