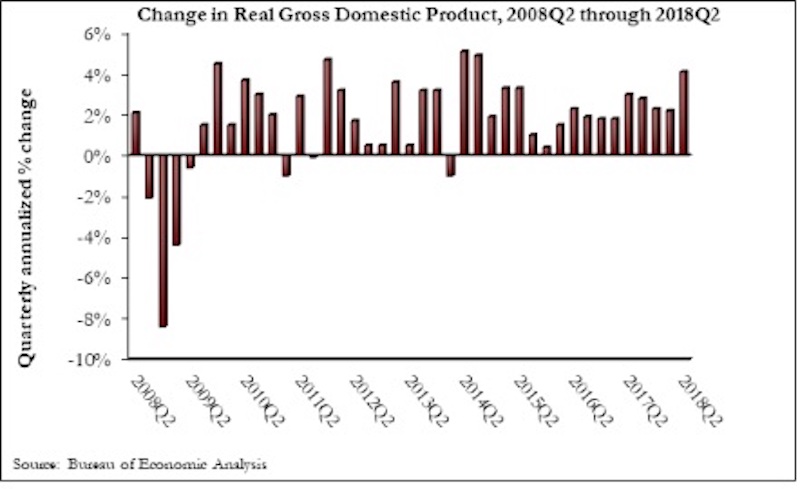

The U.S. economy expanded at an annualized 4.1% rate during the second quarter of 2018—the fastest rate of quarterly growth since the second quarter of 2014, according to an Associated Builders and Contractors analysis of U.S. Bureau of Economic Analysis data released today.

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate. While overall fixed investment expanded at a 5.4% annualized pace, nonresidential fixed investment grew 7.3%. The nonresidential sub-component exhibiting the most upward force was structures, which grew at a 13.3% annualized pace and by 13.9% during the year’s initial quarter.

Today’s data release helps explain why nonresidential contractors continue to report hefty backlog and scramble for human capital. By contrast, the residential segment, which continues to be impacted by rising mortgage rates and the lowest level of housing affordability in a decade, contracted at a 1.1% annualized rate and has now shrunk during three of the previous four quarters.

“It is quite remarkable that an economy now in its 10th year of economic expansion is actually gaining steam,” said ABC Chief Economist Anirban Basu. “A host of forces are at work, including elevated levels of confidence among business owners, developers and others who drive investment in America. Meanwhile, the consumer, supported by the strongest labor market in about two decades, continues to reliably contribute to economic growth. The result is an economy that is now on its way to a potential 3% growth year.

“As always, there are reasons to temper optimism,” said Basu. “Some of second quarter growth was driven by aggressive purchases of American output (e.g. soybeans) in advance of the imposition of retaliatory tariffs. That helped bulk up exports, but that pattern may not continue during the third quarter. The rapidly expanding economy is also serving to exacerbate inflationary pressures, which in turn are likely to drive borrowing costs higher. In other words, today’s strong economic growth may translate into weaker economic growth at some point in the future, and there is plenty of precedent for such a dynamic.

“Contractors can rest assured that the economy will retain its momentum through the balance of the year,” said Basu. “While financial markets may remain volatile and the global news cycle will undoubtedly continue to swirl, leading indicators, including those related to the level of observable activity among engineers, architects and other design professionals, suggest that another wave of building construction is on the way. The tax cuts passed late last year are just now beginning to have an impact. The hope is that tax reform will trigger a structural shift in the U.S. economy by helping to expand productivity and the economy’s long-term growth potential.The other possibility is that the tax reform’s primary effects will be to lift short-term growth, expand federal budget deficits, and ultimately give way to a countervailing reform at some point in the future.”

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

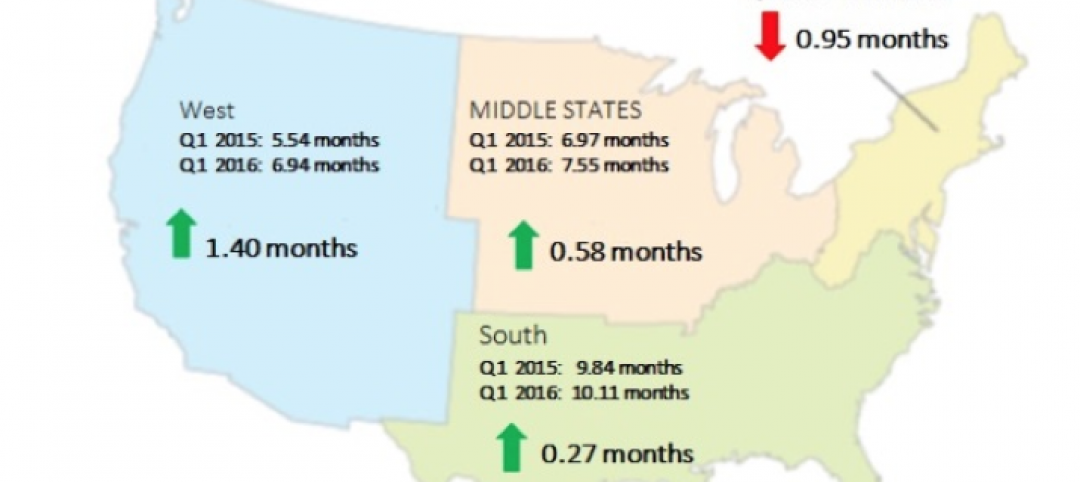

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.