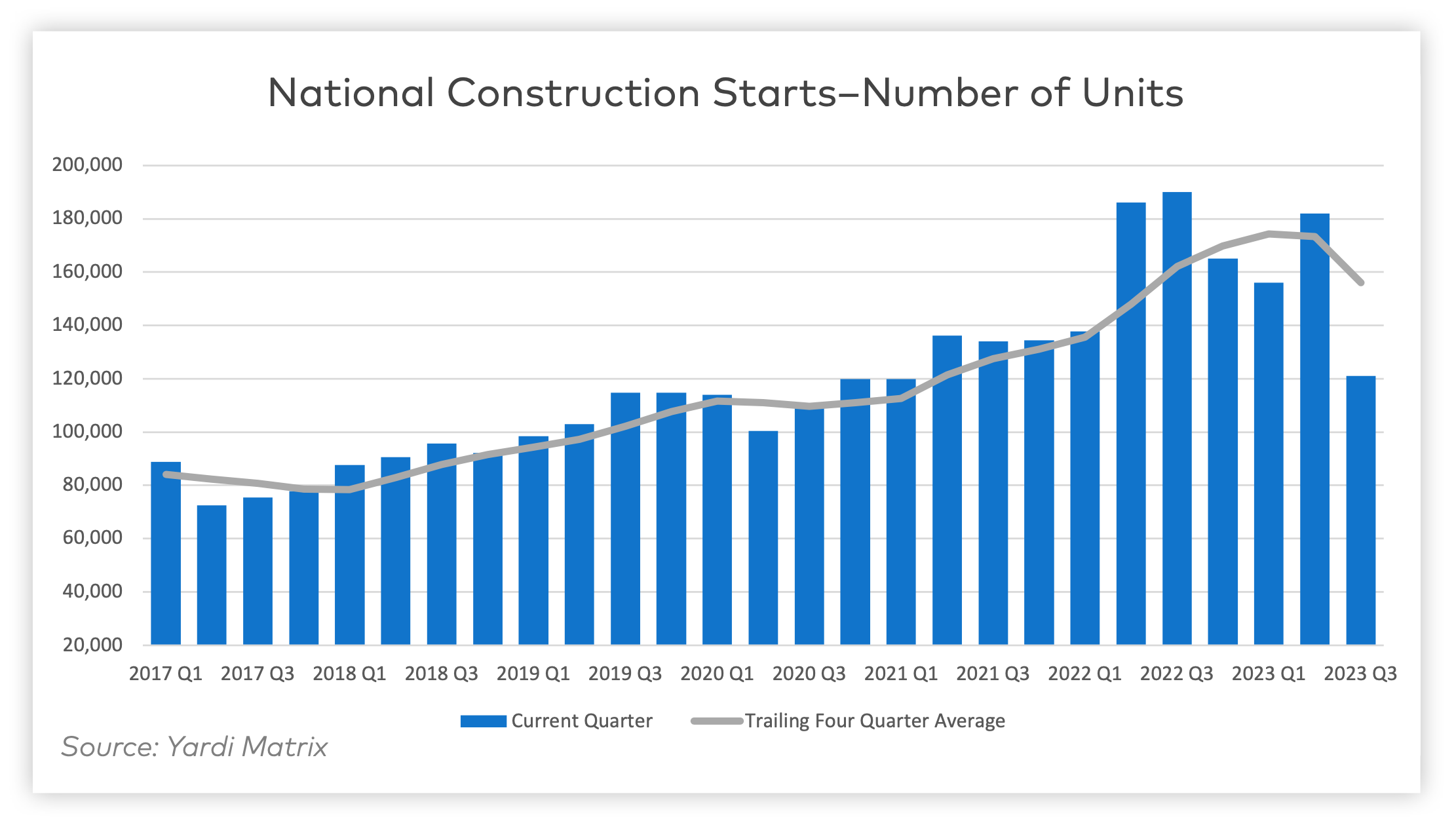

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report. The data from 2023—albeit incomplete—shows that 506,742 units began construction. This figure ranks third for new construction starts even without the complete full year's data.

Yardi’s biggest takeaway is that multifamily development in 2023 exceeded initial expectations. This was driven in part by a “stronger-than-expected” Q1 and Q2, as well as an influx of affordable and single-family rental housing.

New Multifamily Development Insights

These are three insights from the Yardi Matrix Multifamily Construction Starts – January 2024 report:

1. Single-family rentals and affordable housing have become increasingly popular

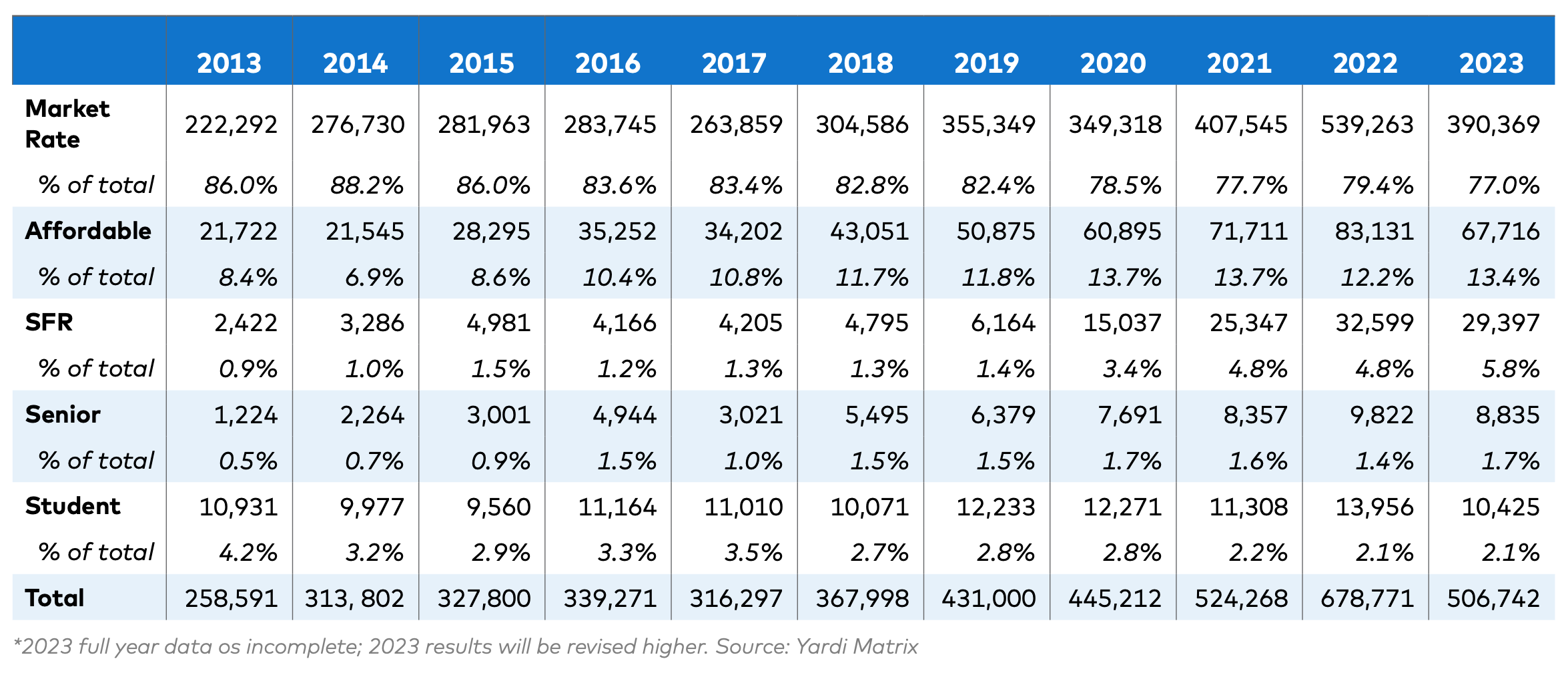

For the last decade, the percentage of market rate multifamily units has declined in favor of other product types. While market rate units comprised 86% of all new multifamily construction starts in 2013, they now make up only 77% of the sector as of last year.

Conversely, affordable housing starts jumped from 8.4% to 13.4% of the total in ten years. Single-family rental increased from 0.9% to 5.8% in the same timeframe.

Senior housing has remained largely unchanged since 2013, increasing from 0.5% to 1.7%; student housing has been declining slowly, comprising 4.2% of multifamily construction starts in 2013 to 2.1% in 2023.

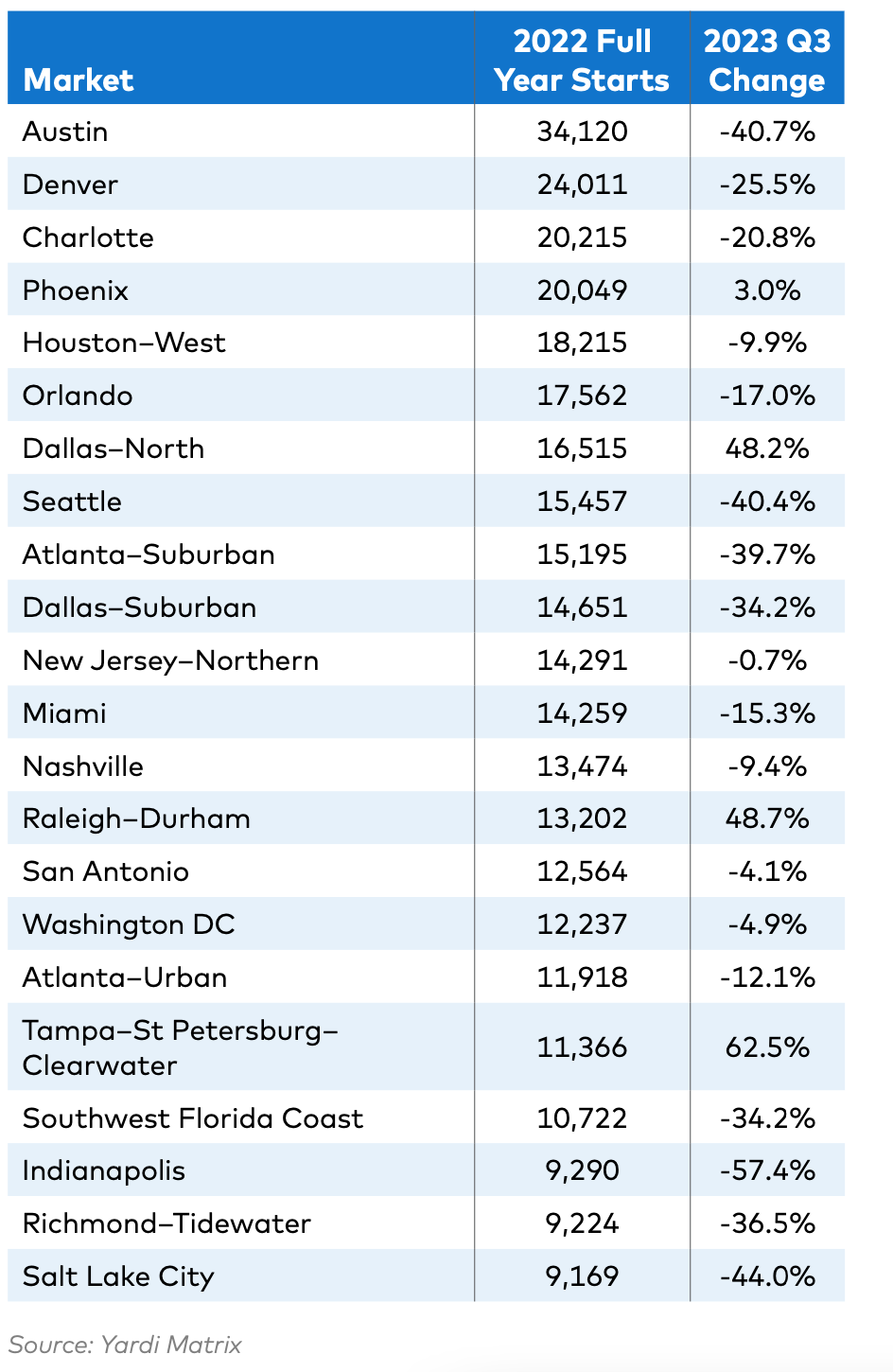

2. Markets with high levels of development in 2022 saw substantial declines in new construction starts in 2023

2022 saw 678,771 units start construction, a 29.4% increase over 2021 levels. Half of those were contained in just 22 markets. For the first three quarters of 2023, 18 of those markets saw starts decline compared to the same period in 2022.

Some of the more sizable declines in major metropolitan areas include:

- Salt Lake City, Utah, had a –44% change in multifamily starts from 2022

- Austin, Texas, had a –40.7% change in multifamily starts from 2022

- Seattle, Wash., had a –40.4% change in multifamily starts from 2022

Other markets like Southwest Florida Coast and suburban Atlanta, Dallas, and Denver saw starts decline by 25% or more.

3. Much of 2023’s new-development activity was driven by smaller and midsize markets

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

According to the report, markets that did not participate in the post-pandemic development surge were better able to sustain new construction in 2023. These markets tended to be on the smaller size, averaging an increase of 2,161 units over the year.

Just four of the 22 strongest markets in 2022 continued to grow in 2023:

- Phoenix, Ariz., had a 3% growth in multifamily starts

- North Dallas, Texas, had a 48.2% growth in multifamily starts

- Raleigh–Durham, N.C., had a 48.7% growth in multifamily starts

- Tampa–St. Petersburg–Clearwater, Fla., had a 62.5% growth in multifamily starts

Other markets like Boston, Mass., (35%) and Kansas City, Mo., (41%) saw growth as well.

Bottom Line

Though slightly less than expected, new multifamily starts in 2023 are the 3rd highest year ever with 506,742 units. The growth primarily comes from affordable housing, single-family rentals, and smaller/midsize markets.

The decline this year is largely driven by tight financing conditions, and markets with high 2022 activity not being able to keep up. Despite the decline in starts, completions are expected to stay strong in 2024-2025.

Related Stories

Industry Research | Apr 4, 2022

Nonresidential Construction Spending Drops Slightly in February, Says ABC

National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Industry Research | Mar 17, 2022

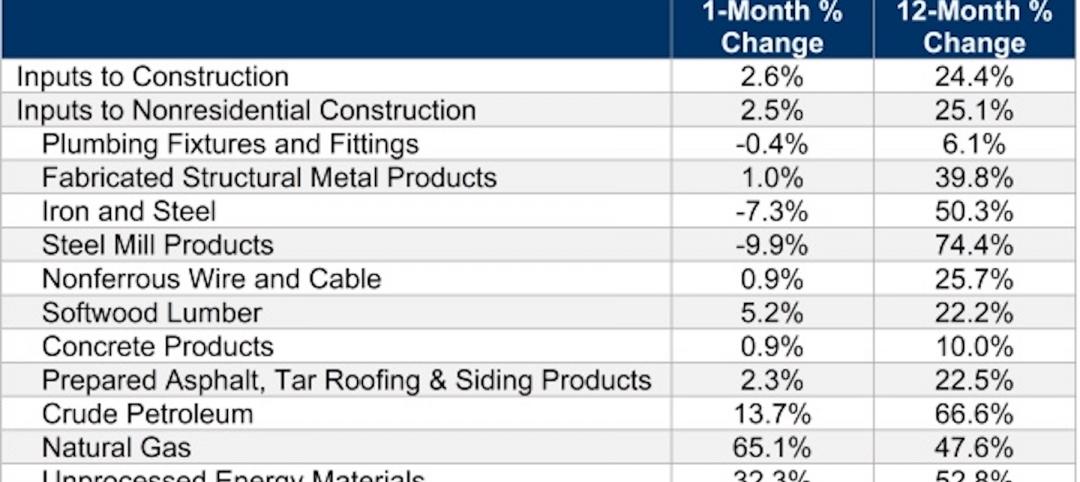

Construction input prices rise 2.6% in February, says ABC

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today

Museums | Mar 16, 2022

Unpacking the secrets to good museum storage

Museum leaders should focus as much design attention on the archives as the galleries themselves, according to a new white paper by Erin Flynn and Bruce Davis, architects and museum experts with the firm Cooper Robertson.

Codes and Standards | Mar 10, 2022

HOK offers guidance for reducing operational and embodied carbon in labs

Global design firm HOK has released research providing lab owners and developers guidance for reducing operational and embodied carbon to meet net zero goals.

Industry Research | Mar 9, 2022

Survey reveals five ways COVID-19 changed Americans’ impressions of public restrooms and facilities

Upon entering the third year of the pandemic, Americans are not only more sensitive to germs in public restrooms, they now hold higher standards for the cleanliness, condition and technology used in these shared spaces, according to the annual Healthy Handwashing Survey™ from Bradley Corporation conducted in January.

Codes and Standards | Mar 7, 2022

Late payments in the construction industry rose in 2021

Last year was a tough one for contractors when it comes to getting paid on time.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.