HOK’s WorkPlace practice, in partnership with the UK Chapter of CoreNet Global, has released a new report that studies the impact of coworking from a corporate real estate (CRE) perspective.

Coworking is one of the fastest-growing sectors of the commercial real estate market. The new report, Coworking: A Corporate Real Estate Perspective, examines the drivers of coworking from the demand and supply sides, the industry risks and implications for corporate real estate, as well as information about the owners, coworkers and centers.

The HOK/CoreNet Global Coworking report highlights the ideas that changing business priorities and the need to attract talented people, reduce real estate costs, improve speed to innovation and increase productivity are driving corporations to consider different workplace models, including on- and off-site coworking.

Key findings from the Coworking report also include:

- The coworking concept is evolving to comprise accelerators, incubators and maker spaces. It reaches beyond office settings to include college campuses, retail locations, hotels and libraries.

- The impact of coworking spaces on CRE includes providing new uses for older properties and for underutilized spaces in existing facilities.

- The lowest engagement levels are found in employees who never work remotely. The highest employee engagement levels occur among those who work remotely less than 20% of the time.

- Many coworking centers emerged in a time of high unemployment and low rents. But 54% of the coworkers will leave a specific location in less than a year. The high turnover and tenant instability challenge coworking centers to maintain profitability. They are vulnerable to market conditions and new competitors.

“For corporate occupiers and other real estate professionals, the coworking trend is worth watching, exploring and testing,” said Curtis Knapp, director of consulting for HOK. “It is a way to add flexibility to the portfolio and help match the ebb and flow of supply and demand. It can be one solution to the many challenges posed by the changing nature of both work and worker.”

Related Stories

Industry Research | Apr 8, 2019

New research finds benefits to hiring architectural services based on qualifications

Government agencies gain by evaluating beyond price, according to a new Dodge survey of government officials.

Office Buildings | Jul 17, 2018

Transwestern report: Office buildings near transit earn 65% higher lease rates

Analysis of 15 major metros shows the average rent in central business districts was $43.48/sf for transit-accessible buildings versus $26.01/sf for car-dependent buildings.

Market Data | May 29, 2018

America’s fastest-growing cities: San Antonio, Phoenix lead population growth

San Antonio added 24,208 people between July 2016 and July 2017, according to U.S. Census Bureau data.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

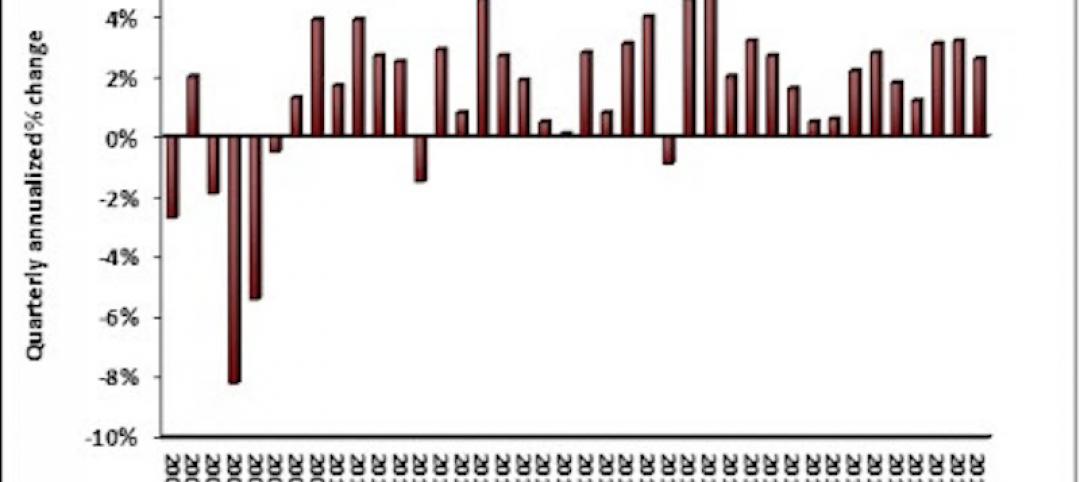

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 12, 2018

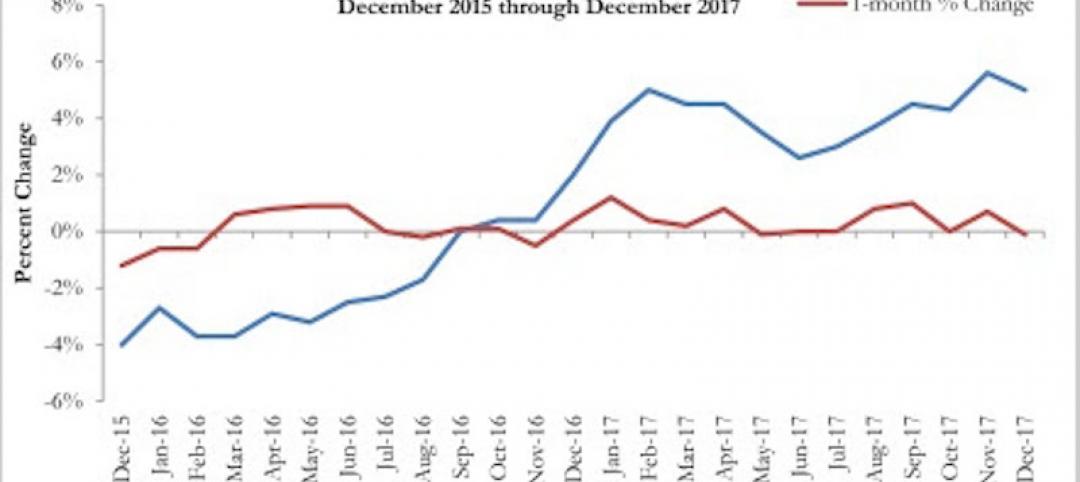

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

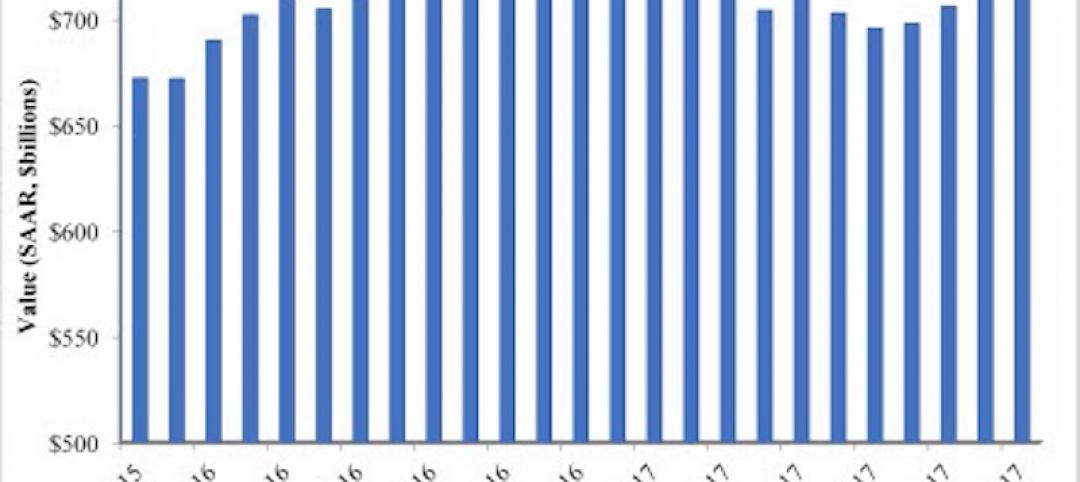

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.