Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

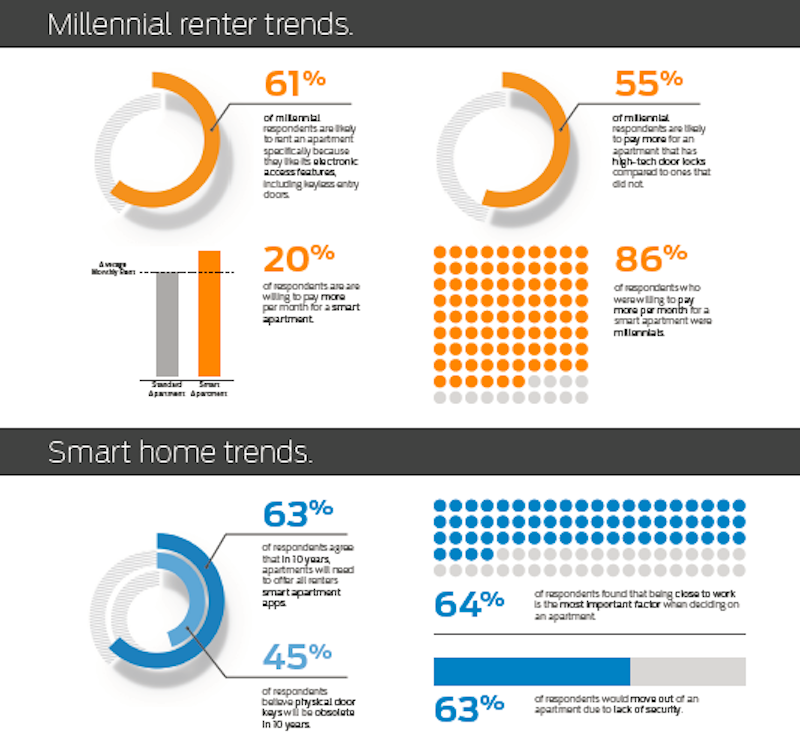

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Multifamily Housing | May 11, 2022

Kitchen+Bath AMENITIES – Take the survey for a chance at a $50 gift card

MULTIFAMILY DESIGN + CONSTRUCTION is conducting a research study on the use of kitchen and bath products in the $106 billion multifamily construction sector.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

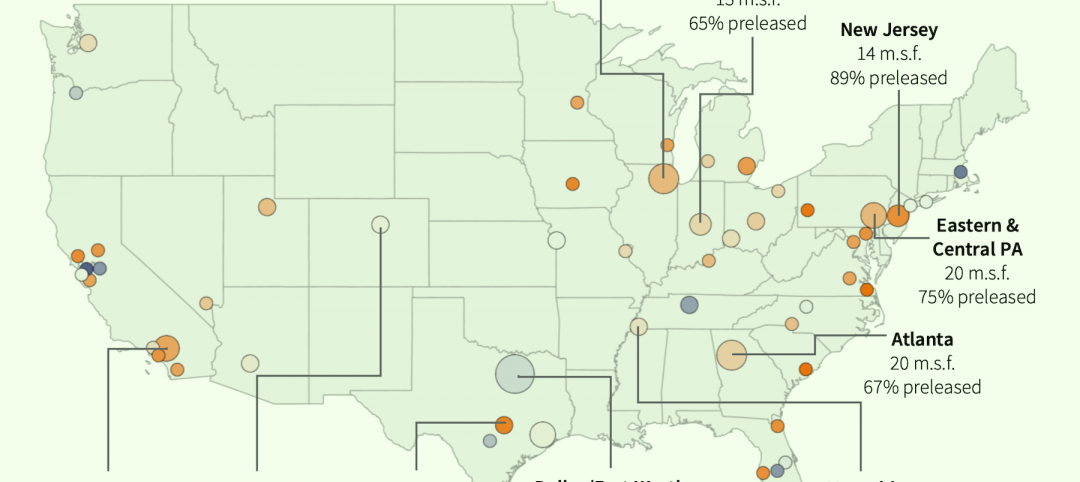

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Industry Research | Apr 4, 2022

Nonresidential Construction Spending Drops Slightly in February, Says ABC

National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Industry Research | Mar 17, 2022

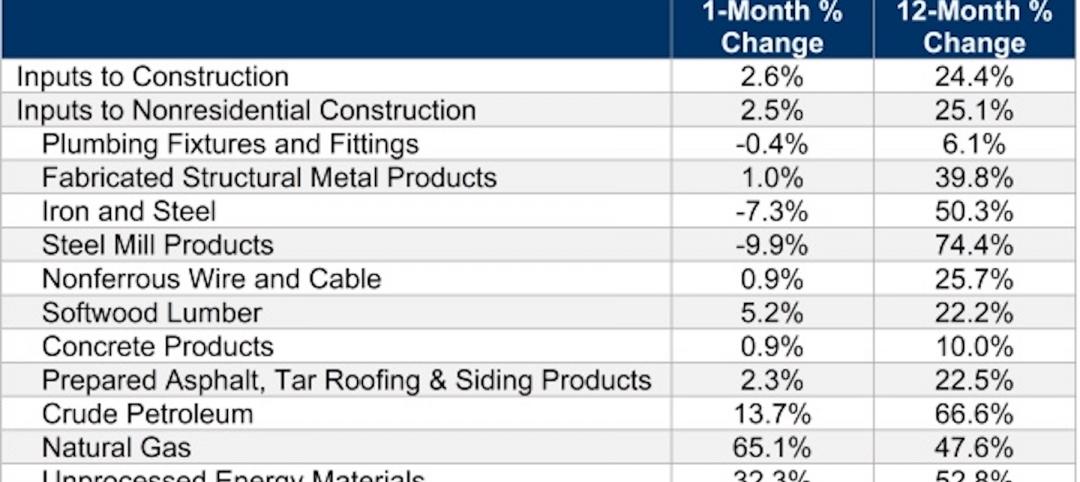

Construction input prices rise 2.6% in February, says ABC

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today