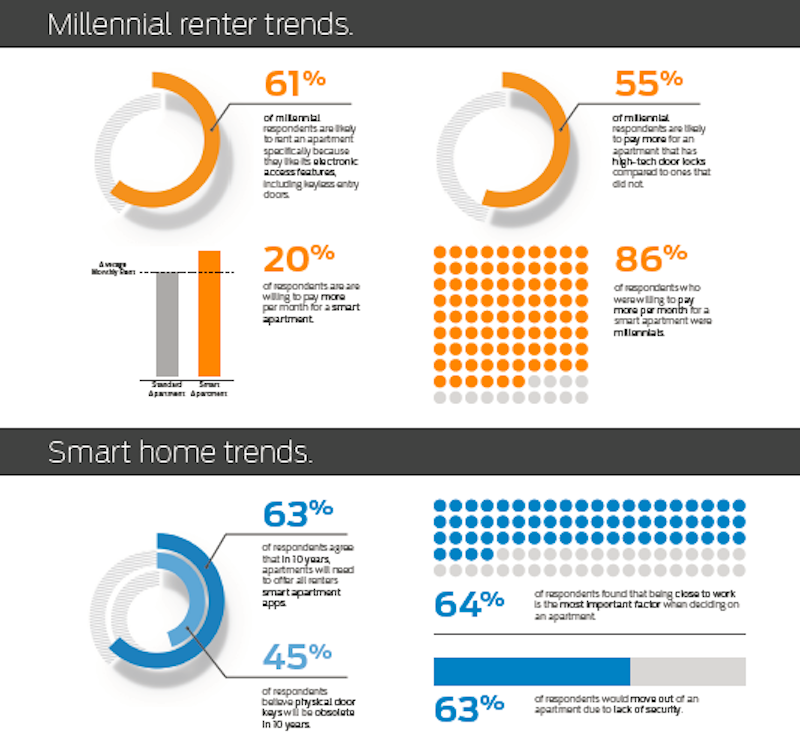

Recently, millennials have supplanted Baby Boomers as the largest generation on the planet. With such a huge number of people, many of who are 20-somethings beginning to get a little spending power, you better believe companies are doing everything they can to try and crack the enigma that is the millennial buyer and figure out what they value most (beyond ironic t-shirts, protesting, and coffee shops).

Perhaps unsurprisingly, when it comes to a place to live, what millennials value most is technology. A recent survey from Wakefield Research and Schlage of 1,000 U.S. renters in multifamily dwellings revealed that 86% of millennial renters who live in multifamily dwellings would pay higher rent for a “smart” apartment. For comparison, only 65% of Baby Boomers would pay more for an apartment packed with automated or remote-controlled devices.

The survey also found that over 61% of millennial renters would rent an apartment specifically for electronic access features, such as keyless entry doors, and 55% would pay more for an apartment with high-tech door locks compared to traditional door locks. Another 44% of Millennials said they would sacrifice having a parking spot if it meant they could live in a high-tech apartment. Overall, millennials would pay about one-fifth more for smart home features than other generations.

It isn’t just technology millennial renters are after, however. Convenience and security are also important. 63% of millennial respondents said they would move out of an apartment because of poor security. Additionally, 64% of millennials feel it is more important for an apartment to be closer to work than friends and family.

At least according to this survey, the average millennial renter is more concerned with technology and convenience than anything else in an apartment, and are willing to pay for the things they desire.

The Schlage survey was conducted in October 2016 via email and an online survey.

Related Stories

Industry Research | Apr 25, 2023

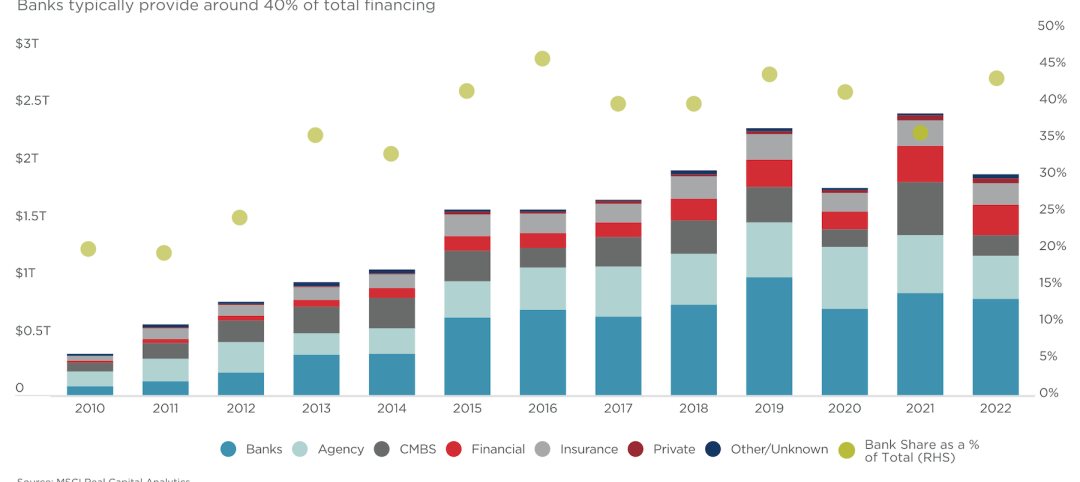

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Self-Storage Facilities | Apr 25, 2023

1 in 5 Americans rent self-storage units, study finds

StorageCafe’s survey of nearly 18,000 people reveals that 21% of Americans are currently using self-storage. The self-storage sector, though not the most glamorous, is essential for those with practical needs for extra space.

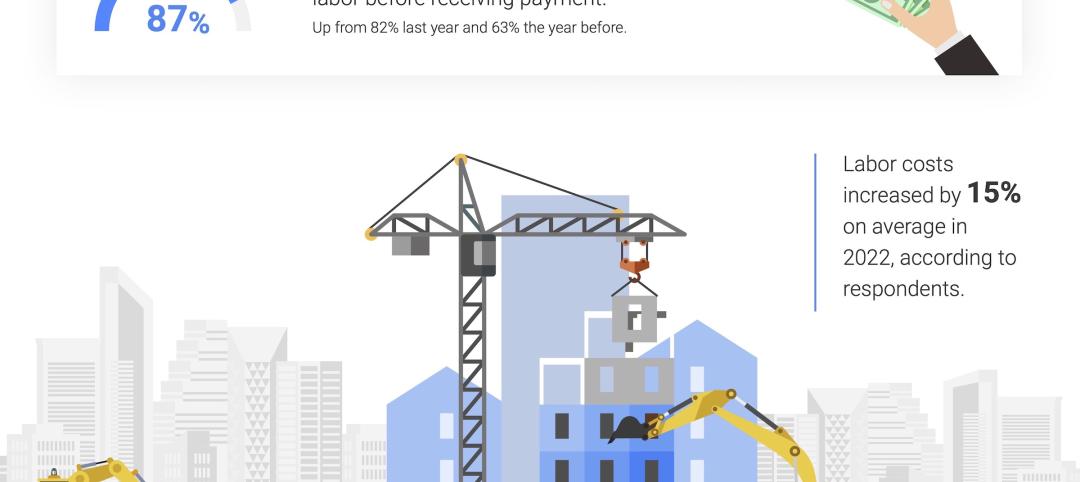

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

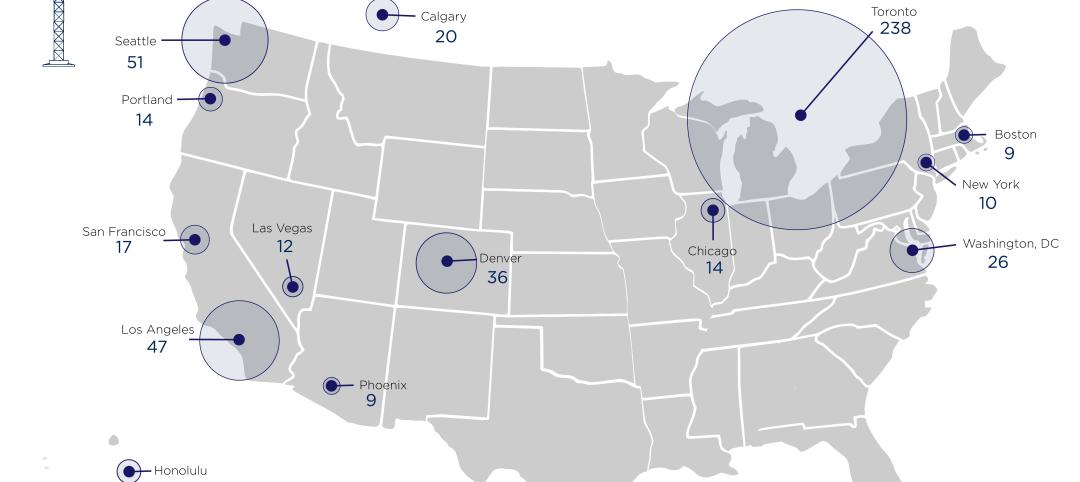

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.

Sustainability | Apr 4, 2023

NIBS report: Decarbonizing the U.S. building sector will require massive, coordinated effort

Decarbonizing the building sector will require a massive, strategic, and coordinated effort by the public and private sectors, according to a report by the National Institute of Building Sciences (NIBS).

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Office Buildings | Mar 20, 2023

Untraditional ‘Back To Work’ survey results for designers' insights

SMMA shares the results of its "Back To Work" survey, with respondents from multiple industries weighing in on return-to-office pros and cons.