Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

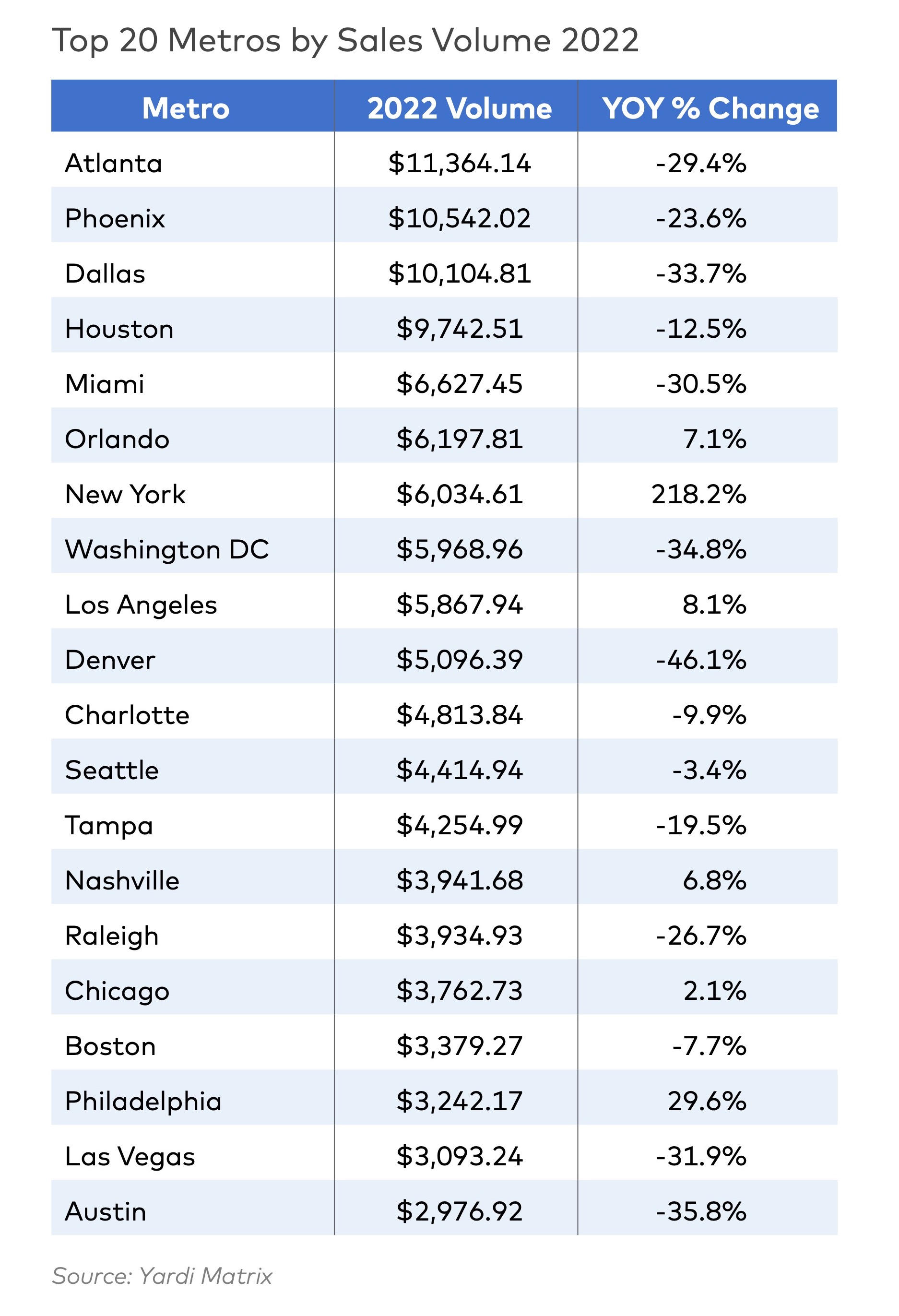

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

| Jul 22, 2011

Five award-winning modular innovations

The Modular Building Institute's 2011 Awards of Distinction highlight fresh ideas in manufactured construction projects.

| May 16, 2011

Autodesk and the USGBC announce multifamily design competition

Autodesk is partnering with the U.S. Green Building Council to sponsor the organization’s multifamily midrise design competition, which will give design professionals and students an opportunity to present their solutions to sustainable, multifamily midrise design.

| May 3, 2011

Would apartment shells help the housing market?

One reason the U.S. government pushed for homeownership is because it’s thought to reduce turnover and build strong communities. Owners have a vested interest in their properties whereas renters don’t—but what if were to change?

| Apr 12, 2011

Luxury New York high rise adjacent to the High Line

Located adjacent to New York City’s High Line Park, 500 West 23rd Street will offer 111 luxury rental apartments when it opens later this year.