All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

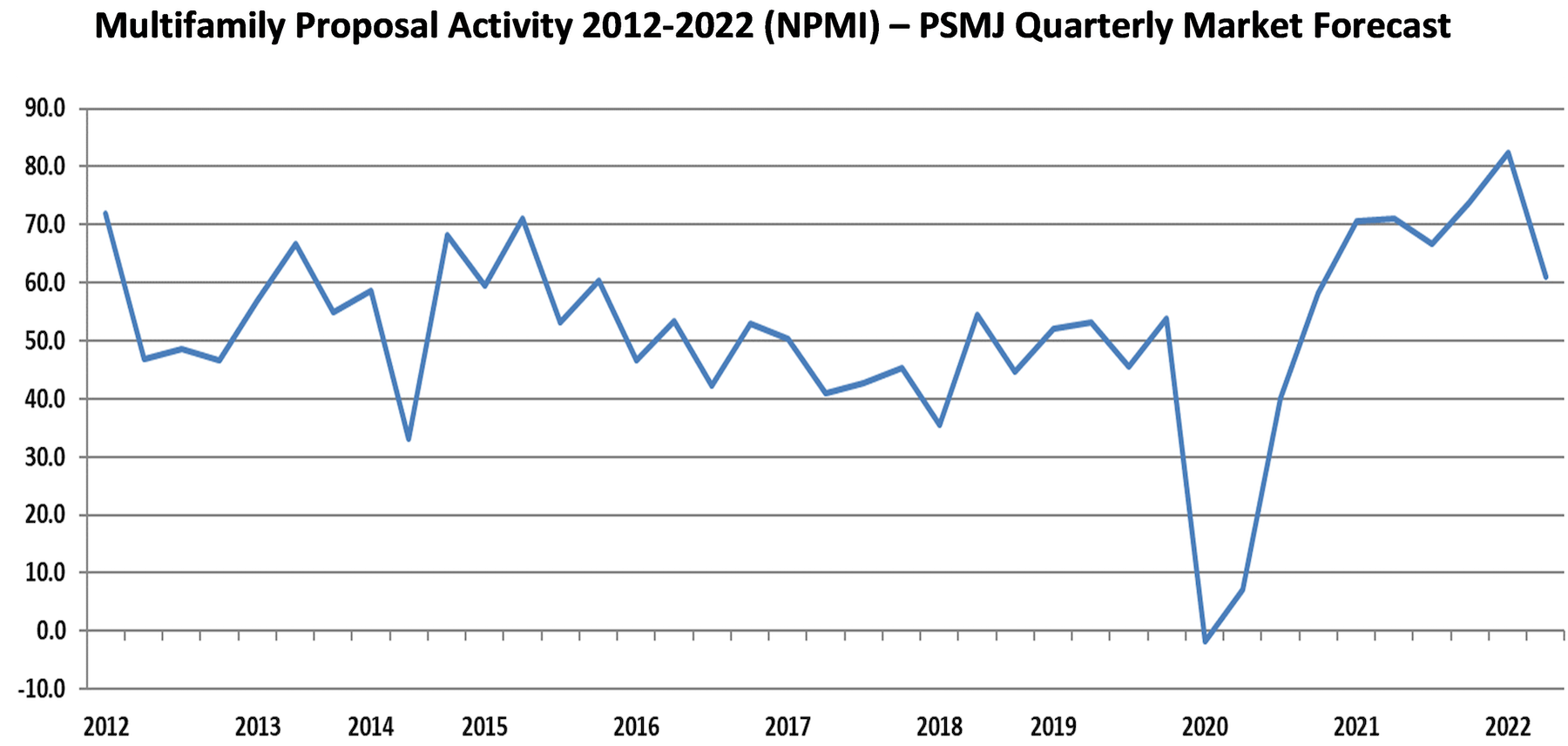

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| May 27, 2014

America's oldest federal public housing development gets a facelift

First opened in 1940, South Boston's Old Colony housing project had become a symbol of poor housing conditions. Now the revamped neighborhood serves as a national model for sustainable, affordable multifamily design.

| May 23, 2014

Big design, small package: AIA Chicago names 2014 Small Project Awards winners

Winning projects include an events center for Mies van der Rohe's landmark Farnsworth House and a new boathouse along the Chicago river.

| May 22, 2014

No time for a trip to Dubai? Team BlackSheep's drone flyover gives a bird's eye view [video]

Team BlackSheep—devotees of filmmaking with drones—has posted a fun video that takes viewers high over the city for spectacular vistas of a modern architectural showcase.

| May 22, 2014

NYC's High Line connects string of high-profile condo projects

The High Line, New York City's elevated park created from a conversion of rail lines, is the organizing principle for a series of luxury condo buildings designed by big names in architecture.

| May 20, 2014

Kinetic Architecture: New book explores innovations in active façades

The book, co-authored by Arup's Russell Fortmeyer, illustrates the various ways architects, consultants, and engineers approach energy and comfort by manipulating air, water, and light through the layers of passive and active building envelope systems.

| May 20, 2014

World's best new skyscrapers: Renzo Piano's The Shard, China's 'doughnut hotel' voted to Emporis list

Eight other high-rise projects were named Emporis Skyscraper Award winners, including DC Tower 1 by Dominique Perrault Architecture and Tour Carpe Diem by Robert A.M. Stern.

| May 16, 2014

BoA, USGBC to offer $25,000 grants for green affordable housing projects

The Affordable Green Neighborhoods Grant Program will offer 14 grants to developers of affordable housing in North America who are committed to building sustainable communities through the LEED for Neighborhood Development program.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 12, 2014

The best of affordable housing: 4 projects honored with 2014 AIA/HUD Secretary Awards [slideshow]

The winners include two dramatic conversions of historic YMCA buildings into modern, affordable multifamily complexes.

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.