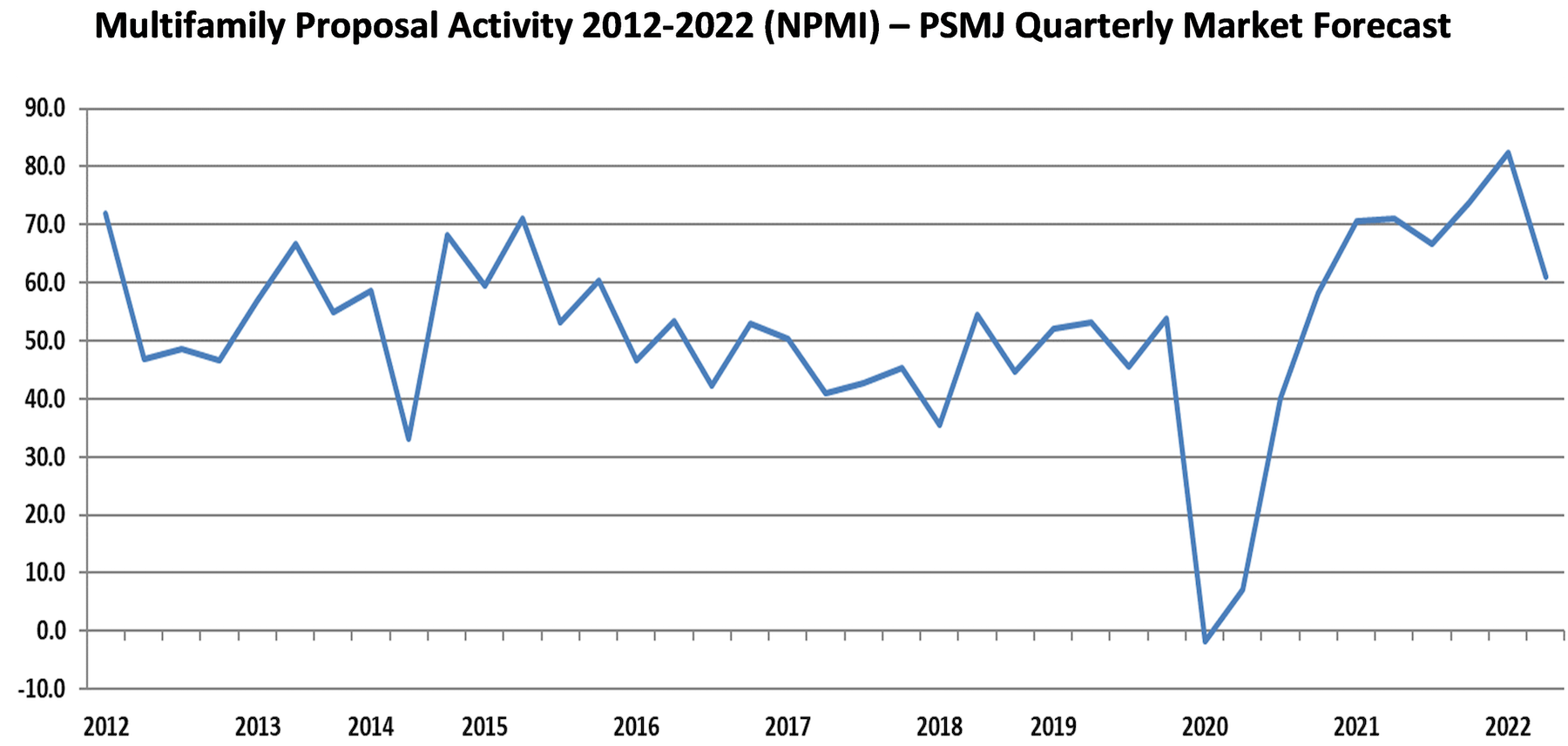

All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

CBRE reported that Multifamily remained the most preferred commercial real estate sector for investment in the 2nd Quarter, with a 32% year-over-year increase in volume to $78 billion, and the Federal Reserve reported strong multifamily results across all districts in its 2022 July Beige Book. At the same time, Rent.com reported that year-over-year rents grew 25.3% and 26.5% for one- and two-bedroom apartments, respectively, and the U.S. Census Department announced that apartment vacancy rates remained near record lows (5.6% in the 2nd Quarter of 2022).

The PSMJ Resources Quarterly Market Forecast (QMF) survey of architects, engineers and contractors reinforces this view. While more than two-thirds (67.2%) of the firm leaders surveyed said that proposal activity in the multifamily market increased from the 1st Quarter of 2022, only 6.3% reported a decline. The resulting net plus/minus index (NPMI) of 60.9 – which is the delta between the percentage of respondents seeing a rise and fall in proposal activity – is down from the record-setting 1st Quarter NPMI of 82.4, but is still among the best quarters since PSMJ began measuring proposal opportunities in submarkets in 2006.

PSMJ Director and Senior Consultant David Burstein, PE, acknowledges the current strength of the entire housing market, but expects a turnaround in the not-too-distant future, albeit a minor to moderate one. “The housing market, including multifamily housing, has been red hot. But it may be on the verge of cooling off a bit,” he says. “A recent analysis by CNBC indicated that the average mortgage payments for a house purchased in 2019 was $1,192 per month. With the increase in home prices and interest rates, the mortgage on that same house is now $1,991 – an increase of almost $800 per month. Wages have gone up since 2019, but they haven’t gone up enough to account for that difference in mortgage costs. The net result will be fewer families able to afford a new home.”

This will have an impact on multifamily as well, adds Burstein. “The increase in interest rates also affects developers’ ability to finance new multifamily rental buildings. And the Fed has indicated that they aren’t close to topping out on their rate increases. So I expect the pace of new multifamily to slow significantly in the next few months. And those projects that do move forward will probably be for lower-cost properties.”

To Burstein’s point, the National Association of Home Builders (NAHB) Multifamily Market Survey weakened in the 1st Quarter of 2022 (the latest figures available), with confidence in market-rate rentals and for-sale apartments sliding. Only lower-rent properties supported by government programs showed a small increase in confidence among the builders responding to the survey.

Despite this caution, the forward-looking QMF survey also anticipates relatively healthy futures for two other multifamily submarkets it measures – condominiums and senior/assisted living.

Condominiums recorded an NPMI of 47.9 in the 2nd Quarter of 2022, its second-highest reading ever. Only the 2nd Quarter of 2021, when condos scored an NPMI of 59.2, was better. More than 54% of respondents working in the condo market saw higher proposal activity in the 1st Quarter, compared with about 6% that saw a decrease.

Proposal opportunities in senior/assisted living facilities also impressed, recording an NPMI of 58.8 – 62.7% saw an increase in activity, while only 3.9% reported a decline.

PSMJ has been conducting the Quarterly Market Forecast survey of its members since 2003. The A/E/C consulting and publishing company chose proposal activity as the basis for its QMF because it represents the earliest stage of the project lifecycle. For more information, go to https://www.psmj.com.

Related Stories

| Jan 29, 2014

Historic church will be part of new condo building in D.C.

Sorg Architects unveiled a design scheme for 40 condos in a six-story building, which will wrap around an existing historic church, and will itself contain four residential units.

| Jan 28, 2014

First Look: BIG's Honeycomb building for Bahamas resort [slideshow]

BIG + HKS + MDA have unveiled the design for the new Honeycomb building and adjacent plaza in The Bahamas – a 175,000-sf residential facility with a private pool on each balcony.

| Jan 28, 2014

2014 predictions for skyscraper construction: More twisting towers, mega-tall projects, and 'superslim' designs

Experts from the Council on Tall Buildings and Urban Habitat release their 2014 construction forecast for the worldwide high-rise industry.

| Jan 28, 2014

16 awe-inspiring interior designs from around the world [slideshow]

The International Interior Design Association released the winners of its 4th Annual Global Excellence Awards. Here's a recap of the winning projects.

| Jan 24, 2014

Urban Land Institute, Enterprise outline issues in rental housing shortage: Report

Bending the Cost Curve: Solutions to Expand the Supply of Affordable Rentals outlines factors that impede the development of affordable rental housing – causing the supply in many markets to fall far short of the demand.

| Jan 22, 2014

SOM-designed University Center uses 'sky quads,' stacked staircases to promote chance encounters

The New School's vertical campus in Manhattan houses multiple functions, including labs, design studios, a library, and student residences, in a 16-story building.

| Jan 13, 2014

Custom exterior fabricator A. Zahner unveils free façade design software for architects

The web-based tool uses the company's factory floor like "a massive rapid prototype machine,” allowing designers to manipulate designs on the fly based on cost and other factors, according to CEO/President Bill Zahner.

| Jan 8, 2014

Strengthened sprinkler rules could aid push for mid-rise wood structures in Canada

Strengthened sprinkler regulations proposed for the 2015 National Building Code of Canada (NBCC) could help a movement to allow midrise wood structures.

Smart Buildings | Jan 7, 2014

9 mega redevelopments poised to transform the urban landscape

Slowed by the recession—and often by protracted negotiations—some big redevelopment plans are now moving ahead. Here’s a sampling of nine major mixed-use projects throughout the country.

| Jan 3, 2014

World’s tallest vegetated façade to sprout in Sri Lanka [slideshow]

Set to open in late 2015, the 46-story Clearpoint Residences condo tower will feature planted terraces circling the entire structure.