Lodging Econometrics (LE) has released its year-end Global Construction Pipeline Trend Report, which compiles the construction pipeline counts for every country and market around the world. At the close of 2018, LE analysts state that the total global construction pipeline hit record highs with 13,573 projects/2,265,792 rooms, a 7% increase in projects and a 6% increase in rooms year-over-year (YOY).

The global pipeline has been ascending for eight consecutive years after reaching its cyclical low in 2010. All regional pipelines, with the exception of South America, continued their upward trend YOY. It is notable considering economic growth rates started to decline in 2018 and are forecast to slow further in 2019 and 2020. Four of the seven global regions reached all-time highs in 2018: Europe, Africa, Middle East, and Asia Pacific.

There are a record high 6,352 projects/1,172,591 rooms currently under construction worldwide. Projects scheduled to start construction in the next 12 months are at 3,860 projects/572,483 rooms. Projects in the early planning stage stand at 3,361rooms/520,718 projects, also at an all-time high.

The top countries by project count are the United States with 5,530 projects/669,456 rooms, still short of its all-time high of 5,883 projects/785,547 rooms set in the second quarter of 2008, and China with 2,761 projects/580,635 rooms whose pipeline reached a new all-time high. The U.S. accounts for 41% of projects in the total global construction pipeline while China accounts for 20%, resulting in 61% of all global projects being focused in just these two countries. Distantly following are Indonesia with 387 projects/65,405 rooms, Germany with 283 projects/52,569 rooms, and the United Kingdom with 266 projects/38,590 rooms.

Around the world, the cities with the largest pipeline counts are New York City with 171 projects/29,457 rooms, Dubai with 168 projects/49,943 rooms, and Dallas with 163 projects/19,476 rooms. Los Angeles follows with 147 projects/23,404 rooms, and Guangzhou, China with 132 projects/28,694 rooms.

The leading franchise companies in the global construction pipeline by project count are Marriott International with 2,544 projects/420,405 rooms, Hilton Worldwide with 2,252 projects/333,209 rooms, InterContinental Hotels Group (IHG) with 1,716 projects/249,379 rooms, and AccorHotels with 966 projects/177,052 rooms. These four companies account for 55% of all projects in the global pipeline.

Brands leading in the pipeline for each of these companies are Marriott’s Fairfield Inn with 397 projects/43,089 rooms, Hampton by Hilton with 619 projects/79,591 rooms, IHG’s Holiday Inn Express with 731 projects/91,691 rooms, and AccorHotel’s Ibis Brands with 321 projects/48,368 rooms.

Related Stories

Market Data | Apr 11, 2023

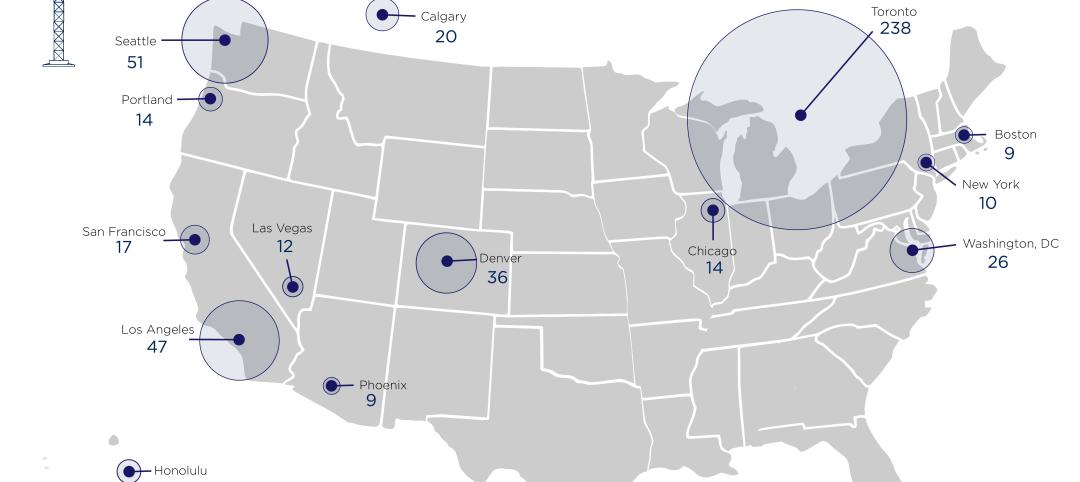

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

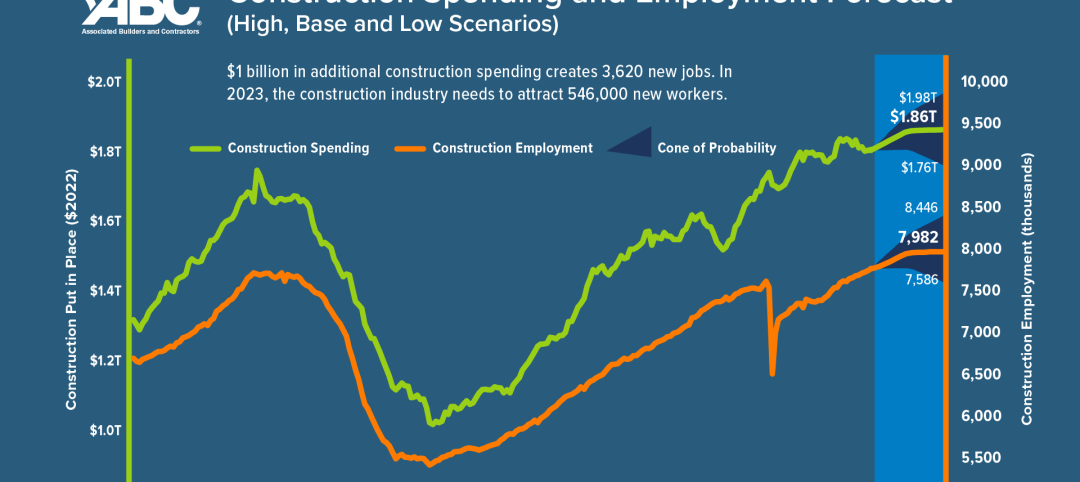

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

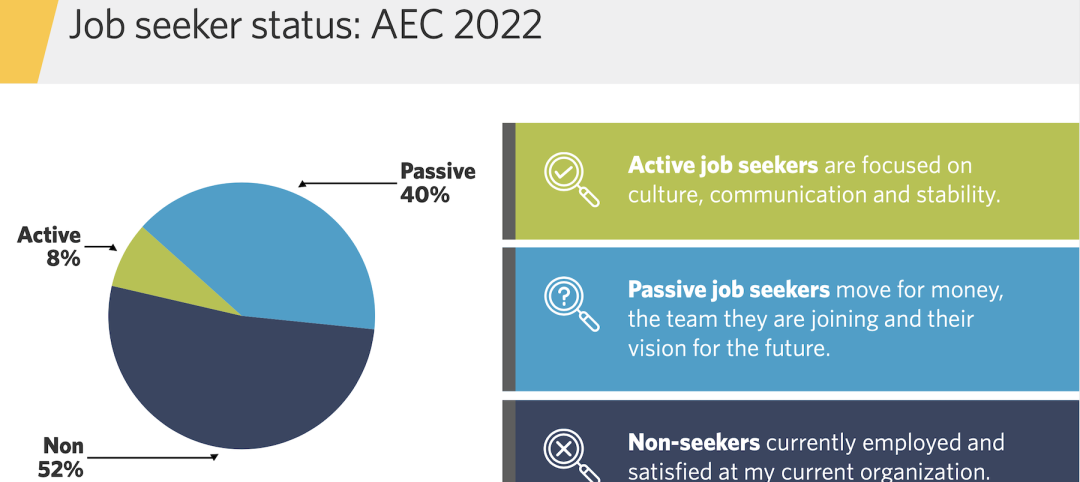

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.