Entering the second quarter of 2022, FMI expects construction spending to end 2022 up 7% compared to up 8% in 2021. But that growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays and economic turmoil caused by international events such as the Russia-Ukraine war, according to FMI's 2022 North American Engineering and Construction Outlook Second Quarter Edition.

Key highlights of the report include:

- Strong investment in residential and manufacturing will drive industry spending through 2022.

- Due to expected increases in infrastructure funding later this year, several nonbuilding segments, including highway and street, sewage and waste disposal and water supply, are all anticipated to realize growth rates of more than 5% in 2022.

- Year-end 2022 growth will be tempered by ongoing spending declines across various nonresidential building segments, including lodging, office, educational, religious, public safety and amusement and recreation.

- Commercial, health care, communication, power and conservation and development are all expected to end the year with low growth, roughly in line with the historical rate of inflation, between 0% and 4%, and are therefore considered stable.

Download the free PDF report (short registration required).

Related Stories

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

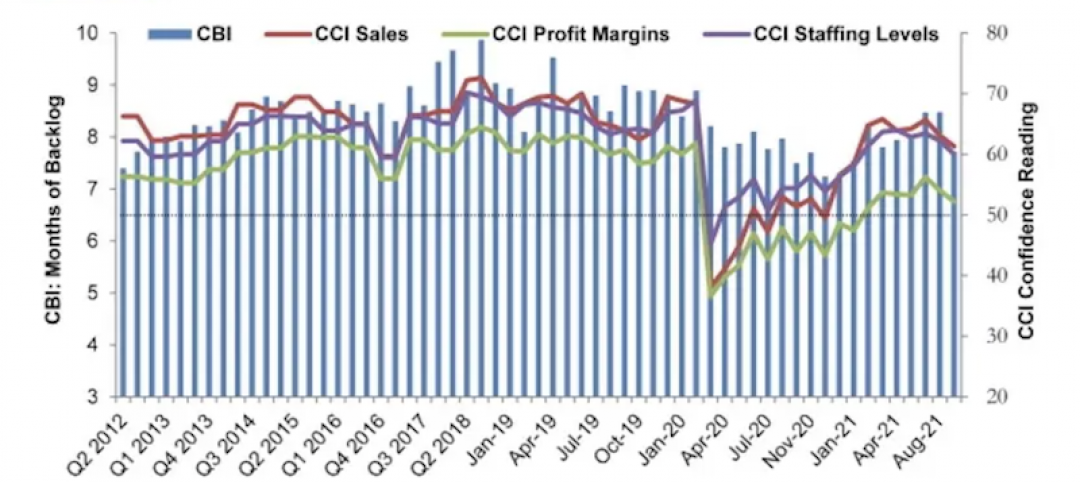

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

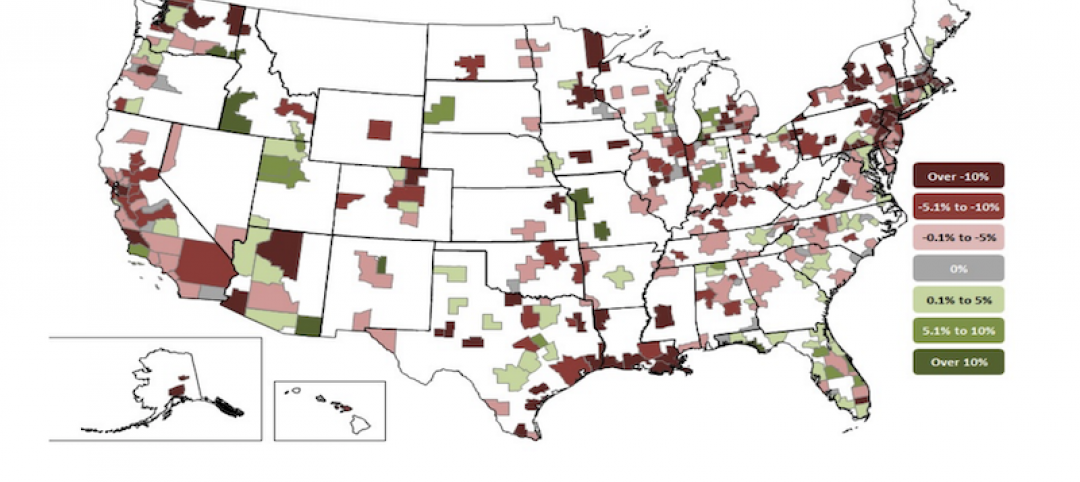

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.