Entering the second quarter of 2022, FMI expects construction spending to end 2022 up 7% compared to up 8% in 2021. But that growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays and economic turmoil caused by international events such as the Russia-Ukraine war, according to FMI's 2022 North American Engineering and Construction Outlook Second Quarter Edition.

Key highlights of the report include:

- Strong investment in residential and manufacturing will drive industry spending through 2022.

- Due to expected increases in infrastructure funding later this year, several nonbuilding segments, including highway and street, sewage and waste disposal and water supply, are all anticipated to realize growth rates of more than 5% in 2022.

- Year-end 2022 growth will be tempered by ongoing spending declines across various nonresidential building segments, including lodging, office, educational, religious, public safety and amusement and recreation.

- Commercial, health care, communication, power and conservation and development are all expected to end the year with low growth, roughly in line with the historical rate of inflation, between 0% and 4%, and are therefore considered stable.

Download the free PDF report (short registration required).

Related Stories

Market Data | Nov 10, 2021

Construction input prices see largest monthly increase since June

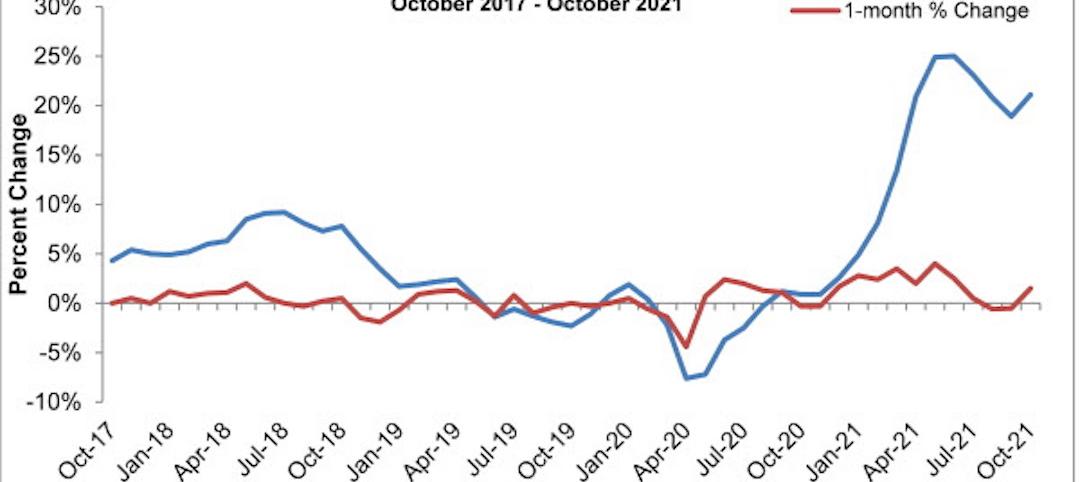

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

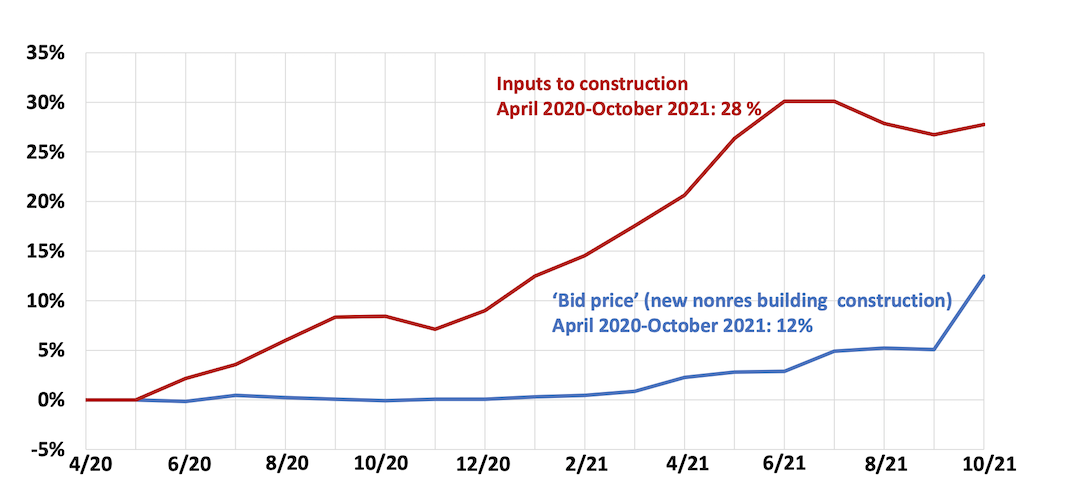

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.