A nationwide survey of more than 300 end users, operators, landlords, and developers found that an agile workplace has a positive impact on user engagement.

The survey—conducted by The Instant Group, a workplace innovation company, and the architectural firm HLW—also exposed a blurring of the lines separating “flex” and “conventional” approaches to office design and operations.

“Agile working practice has been widely adopted and is now viewed as a strategy to mitigate uncertainty and risk,” observed the authors of the research report based on the survey titled The Marketplace for Flexible Work. “Furthermore, many companies now see agile solutions as offering value to their business planning.”

Peter Bacevice, HLW’s Director of Research, adds, “Today’s workplace calls people to action and to do great things. Great workplaces inspire people and provide the essential staging for the cultivation of community from which fresh ideas emerge, evolve, and underpin sustained business growth.”

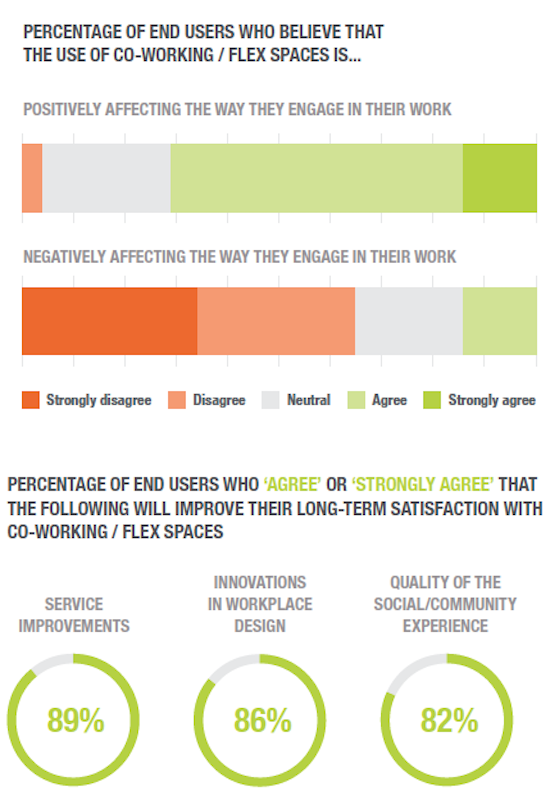

End users of co-working and flex office spaces spend an average of 54% of their total work weeks in these spaces, the survey revealed. Among its respondents, 83% of the survey’s end users of co-working and flex space claim they’ve benefited from these new work environments over the last five to 10 years. And 71% stated that these workspaces positively affect the ways that they engage their work.

The survey found a high level of satisfaction with flex and co-working spaces among end users. Image: The Instant Group/HLW

End users say they are thriving in flex office spaces because these environments expand their professional networks and business opportunities, engender innovation, and give them a higher feeling of energy. The experience in these kinds of office spaces is akin to what users might encounter in hotel operations, observed John Williams, Instant’s head of marketing.

It’s not surprising, then, that while the majority of end users expect they will be working in a range of work environments in the future, more than two-fifths (42%) expect to be using flex office spaces more going forward in their work lives.

Three-fifths of corporate respondents to the survey agreed that the rise of co-working and flexible approaches to office design and operations has benefited their businesses, particularly in the area of being able to add or reduce the amount of space needed to seat employees at any given time.

Corporate tenants are looking for maximum flexibility from the workspaces they lease. Image: The Instant Group/HLW

For landlords, flex and co-working space creates value for their portfolios, the survey found. And office operators see the growth of these approaches as a way to gain more market share from corporate tenants.

While corporate tenants remain divided on co-working and flex space as a short or long-term solution for their companies, more than two-fifths of landlords agreed that flex space is a long-term solution, and 72% agreed that working with co-working operators that have a strong brand has “significant benefits” for their development.

“There is still much work to be done by the landlord market to assess who these potential clients [for flexible spaces] are and their specific demands, but the desire is there to adapt their offer to the market,” wrote John Vaughan, Instant’s Director.

Overwhelmingly, all respondents agree that wireless connectivity and wireless security are the most important technology-related features of flex and co-working spaces. Printing compatibility and printing security were also very important to almost two-thirds of respondents.

And with leases, on average, down to as low as 5.2 years, and with the average tenure or stay around 36 months for operators, the choice among tenants between a “flex” or “conventional” approach is now based more on cash-flow and strategic considerations than the length of stay.

Related Stories

Green Renovation | Mar 5, 2023

Dept. of Energy offers $22 million for energy efficiency and building electrification upgrades

The Buildings Upgrade Prize (Buildings UP) sponsored by the U.S. Department of Energy is offering more than $22 million in cash prizes and technical assistance to teams across America. Prize recipients will be selected based on their ideas to accelerate widespread, equitable energy efficiency and building electrification upgrades.

Sustainability | Mar 2, 2023

The next steps for a sustainable, decarbonized future

For building owners and developers, the push to net zero energy and carbon neutrality is no longer an academic discussion.

Industry Research | Mar 2, 2023

Watch: Findings from Gensler's latest workplace survey of 2,000 office workers

Gensler's Janet Pogue McLaurin discusses the findings in the firm's 2022 Workplace Survey, based on responses from more than 2,000 workers in 10 industry sectors.

Seismic Design | Feb 27, 2023

Turkey earthquakes provide lessons for California

Two recent deadly earthquakes in Turkey and Syria offer lessons regarding construction practices and codes for California. Lax building standards were blamed for much of the devastation, including well over 35,000 dead and countless building collapses.

Sports and Recreational Facilities | Feb 27, 2023

New 20,000-seat soccer stadium will anchor neighborhood development in Indianapolis

A new 20,000-seat soccer stadium for United Soccer League’s Indy Eleven will be the centerpiece of a major neighborhood development in Indianapolis. The development will transform the southwest quadrant of downtown Indianapolis by adding more than 600 apartments, 205,000 sf of office space, 197,000 sf for retail space and restaurants, parking garages, a hotel, and public plazas with green space.

Retail Centers | Feb 24, 2023

Santiago Calatrava unveils plans for a luxury retail and office complex in Düsseldorf, Germany

Renowned architect and engineer Santiago Calatrava, along with the CENTRUM Group, has unveiled plans for Calatrava Boulevard, a luxury retail and office complex in Düsseldorf, Germany. Running parallel to Königsallee and connecting with the Steinstrasse station, Calatrava Boulevard will incorporate and connect to the boulevard’s existing buildings.

Reconstruction & Renovation | Feb 16, 2023

Insights from over 300 potential office-to-residential conversions

Research from Gensler finds that, surprisingly, the features that result in an unpleasant office often make for a superlative multifamily product.

High-rise Construction | Feb 15, 2023

Bjarke Ingels' 'leaning towers' concept wins Qianhai Prisma Towers design competition

A pair of sloped high-rises—a 300-meter residential tower and a 250-meter office tower—highlight the Qianhai Prisma Towers development in Qianhai, Shenzhen, China. BIG recently won the design competition for the project.

Office Buildings | Feb 12, 2023

Smyrna Ready Mix’s new office HQ mimics the patterns in the company’s onsite stone quarry

Designed by EOA Architects to showcase various concrete processes and applications, Smyrna Ready Mix's new office headquarters features vertical layering that mimics the patterns in the company’s stone quarry, located on the opposite end of the campus site. The building’s glass and concrete bands are meant to mirror the quarry’s natural contours and striations.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.