The AEC industry is heading into 2010 in better shape than was the case a year ago, according to the 2010 AEC Industry Outlook: Strategy and Insight for Design & Construction Firms, a new forecast released by ZweigWhite this month.

A significant turnaround for the commercial market isn't anticipated until 2011, but a modest pickup is expected in late 2010. Some sectors are faring better than others—and will continue to do so. Markets to watch for 2010: healthcare, education, and mixed-use.

Following is an overview of the major commercial AEC markets, based on the ZweigWhite report.

Three sectors showing growth

Healthcare. This sector's growth over the past few years is expected to continue for 2010 and beyond. Although some slowing is expected, healthcare is still considered the hottest market for AEC firms. Behind the market's growth: rising numbers of outpatient procedures, aging population, declining hospital infrastructure, consolidation of healthcare systems, BIM and other technologies, sustainable design, and security and disaster preparedness.

The value of healthcare construction to be put in place for 2010 will reach $48.5 billion, an increase of 1.2% from 2009 levels.

Education. Education is one of the largest sectors for AEC firms, and it's growing, making K-12 and higher education markets two of the industry's best prospects. The markets aren't expected to slow significantly, but they took big hits in 2008 and 2009 and are not immune to the downturn.

For 2010, the education sector outlook is mixed, with high school construction looking strong and college and university construction to continue apace to meet projected enrollment increases through 2017. Project work is also expected to be mixed—some new construction and some expansions and renovations to existing facilities.

Overall, the value of all school construction to be put in place for 2010 will top $99.5 billion.

Mixed-use. Another bright spot in the industry. Mixed-use projects are gaining in popularity because the building type ties into New Urbanist principals, creates more livable communities, and is being used as a catalyst for city redevelopment.

Construction spending on mixed-use projects is not tracked, so predictions for 2010 are unavailable. Mixed-use projects, however, aren't immune to a slow economy because many incorporate components from markets that are down, such as lodging and retail.

The rest of the story

Lodging. One of the hardest-hit commercial sectors, lodging is expected to continue its sluggish pace in 2010. The decline, however, is viewed as cyclical, and a recovery is anticipated for 2011.

The value of lodging construction to be put in place for 2010 will reach $20.1 billion, a decrease of 12.8% from 2009 levels.

Manufacturing. Construction of manufacturing and industrial facilities also slowed significantly because of the recession, and 2010 is expected to be another down year. Rents are expected to decline through 2010. Market recovery isn't expected until 2011, and then is expected to be slow.

The value of manufacturing construction to be put in place for 2010 will reach $59.6 billion, a decrease of 19% from 2009 levels.

Multifamily. This sector was hit hard by the recession, and a slow 2010 is expected, with some growth anticipated in 2011. Multifamily starts are notoriously volatile, but they are expected to reach 126,000 for 2010, down from 130,000 in 2009. Looking ahead to 2011, multifamily starts are expected to average 150,000.

Office buildings. With so many layoffs, the nation's reduced workforce is the biggest drag on the office sector. An improving economy signals a turnaround—although the rebound will happen slowly and cautiously. Vacancy rates are expected to remain high during 2010 and then start to decrease in 2011.

The value of office construction to be put in place for 2010 will reach $46.6 billion, a decrease of 13.5% from 2009 levels.

The ZweigWhite 2010 AEC Industry Outlook (214-page PDF, $295; free Executive Summary) may be ordered at: http://www.zweigwhite.com/p-858-2010-aec-industry-outlook-strategy-and-insight-for-design-construction-firms.php?mtn=F3658E

Related Stories

AEC Innovators | Feb 28, 2023

Meet the 'urban miner' who is rethinking how we deconstruct and reuse buildings

New Horizon Urban Mining, a demolition firm in the Netherlands, has hitched its business model to construction materials recycling. It's plan: deconstruct buildings and infrastructure and sell the building products for reuse in new construction. New Horizon and its Founder Michel Baars have been named 2023 AEC Innovators by Building Design+Construction editors.

Sustainability | Feb 8, 2023

A wind energy system—without the blades—can be placed on commercial building rooftops

Aeromine Technologies’ bladeless system captures and amplifies a building’s airflow like airfoils on a race car.

Mass Timber | Jan 27, 2023

How to set up your next mass timber construction project for success

XL Construction co-founder Dave Beck shares important preconstruction steps for designing and building mass timber buildings.

Concrete | Jan 24, 2023

Researchers investigate ancient Roman concrete to make durable, lower carbon mortar

Researchers have turned to an ancient Roman concrete recipe to develop more durable concrete that lasts for centuries and can potentially reduce the carbon impact of the built environment.

Standards | Jan 19, 2023

Fenestration Alliance updates liquid applied flashing standard

The Fenestration and Glazing Industry Alliance (FGIA) published an update to its Liquid Applied Flashing Standard. The document contains minimum performance requirements for liquid applied flashing used to provide water-resistive seals around exterior wall openings in buildings.

Products and Materials | Jan 18, 2023

6 innovative products for multifamily developments

Here are six innovative products for various multifamily developments, including a condominium-wide smart electrical system, heavy-duty aluminum doors, and prefabricated panels.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

ProConnect Events | Jan 17, 2023

3 ProConnect Single Family events for Home Builders and Product Manufacturers set for 2023

SGC Horizon, parent company of ProBuilder, will present 3 ProConnect Single Family Events this year. At ProConnect Single Family, Home Builders meet in confidential 20-minute sessions with Building Product Manufacturers to discuss upcoming projects, learn about new products, and discover practical solutions to technical problems.

75 Top Building Products | Nov 30, 2022

75 top building products for 2022

Each year, the Building Design+Construction editorial team evaluates the vast universe of new and updated products, materials, and systems for the U.S. building design and construction market. The best-of-the-best products make up our annual 75 Top Products report.

Building Materials | Nov 2, 2022

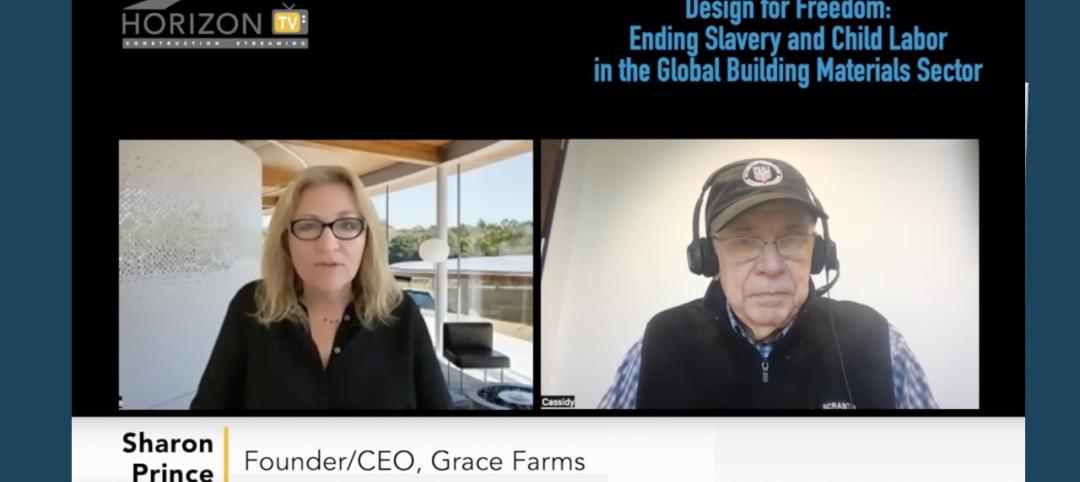

Design for Freedom: Ending slavery and child labor in the global building materials sector

Sharon Prince, Founder and CEO of Grace Farms and Design for Freedom, discusses DFF's report on slavery and enforced child labor in building products and materials.