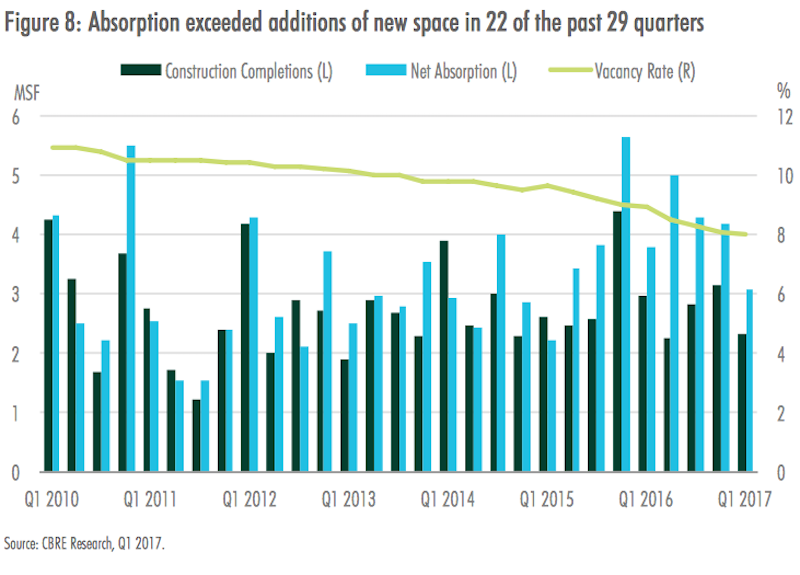

National construction of medical office buildings (MOBs) stood at 12.5 million sf in the first quarter of 2017, down slightly from a few years ago but still well above recession-era levels. However, construction continues to be outpaced by net absorptions, which between 2015 and Q1 2017 totaled 35.4 million sf, or 38% higher than completions over that same period.

In its first-ever report on U.S. Medical Office Buildings, CBRE notes that the vacancy rate for MOBs has “tightened steadily” since 2010, to its current level of 8%, a record low for this sector and well below the 13% vacancy rate for the U.S. office market.

To assess what’s driving MOB demand and development, CBRE took looked at Class A and B buildings with at least 10,000 sf of rentable area specifically designated as medical office space in 30 metros, with detailed investment and demographic profiles of each city.

It found a “resilient” MOB market that continues to benefit from several factors, not the least of which being the population growth of senior citizens. The U.S. Census Bureau estimates that the 65-plus population will nearly double between 2015 and 2055 to more than 92 million, and comprise nearly 23% of the country’s total population.

“The steep increase in both the 65+ population and anticipated greater need for in-office physician services by this group signal a continued increase in demand for health care services and medical office space in the decades ahead,” CBRE states.

Markets where the 65+ population is expected to grow strongest over the next five years include Las Vegas, Phoenix, Atlanta, Dallas-Fort Worth, Houston, and South Florida, according to Moody’s Analytics.

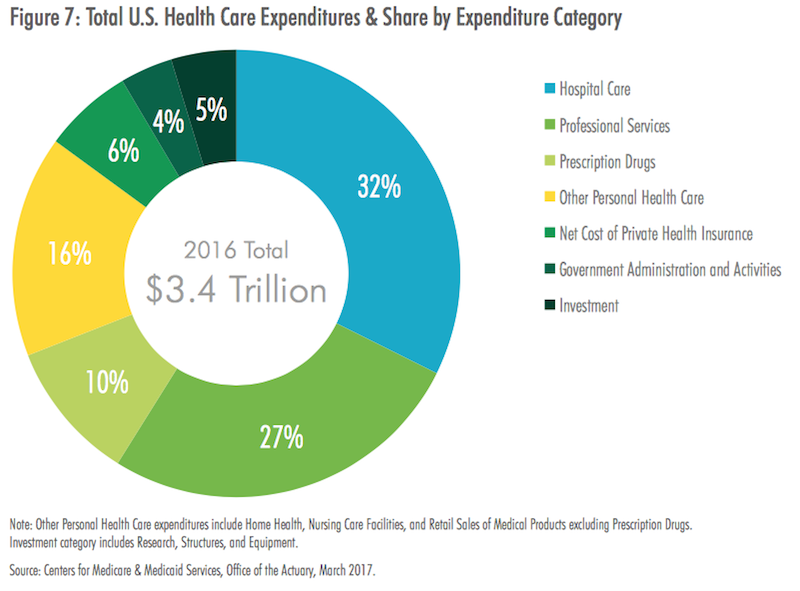

CBRE observes that providers are attempting to stem perennially increasing healthcare expenditures by moving more patient volume away from hospitals and toward more cost-effective outpatient facilities, such as MOBs and urgent-care centers.

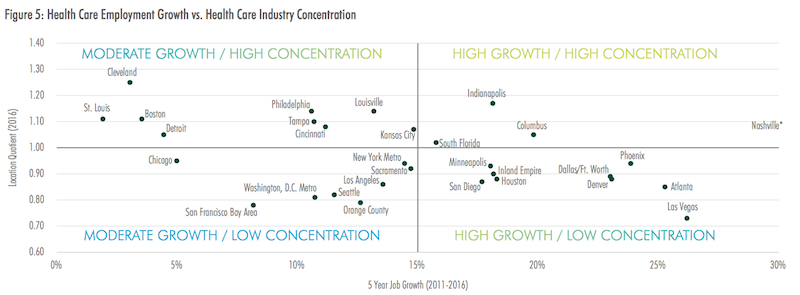

Health care jobs, particularly physicians, have been added at a much faster pace than jobs overall. Image: CBRE

Another cost-cutting trend that’s impacting healthcare real estate, says CBRE, has been the “significant uptick” in mergers and acquisitions. Consolidation among physician medical groups has been particularly strong, with deal volume surging by 19% in 2016 and 109% year-over-year in Q1 2017, according to PwC.

Outpatient professional services are not as expensive as hospital care, but they still accounted for nealry $900 billion in 2016. Image: CBRE.

Overall asking rents for medical office properties have remained relatively stable over the past seven years, ranging between $22 and $23 per sf per year. CBRE explains that the high cost of tenant build-outs, as well as the importance of proximity to a provider’s patient base and ancillary medical services, compel many tenants to remain in place for long periods of time.

But rent appreciation varies widely by market; average rents in New York, for example, grew by 83% since Q1 2010 to over $68 per sf in Q1 2017. Indeed, almost all of the 30 markets examined registered rent increases over the past year. And investors surveyed expect MOB rents to increase between 1% and 3% this year.

Low vacancy rates in this sector are attributed, in part, to the widening gap between completions and absorptions over the past three years.

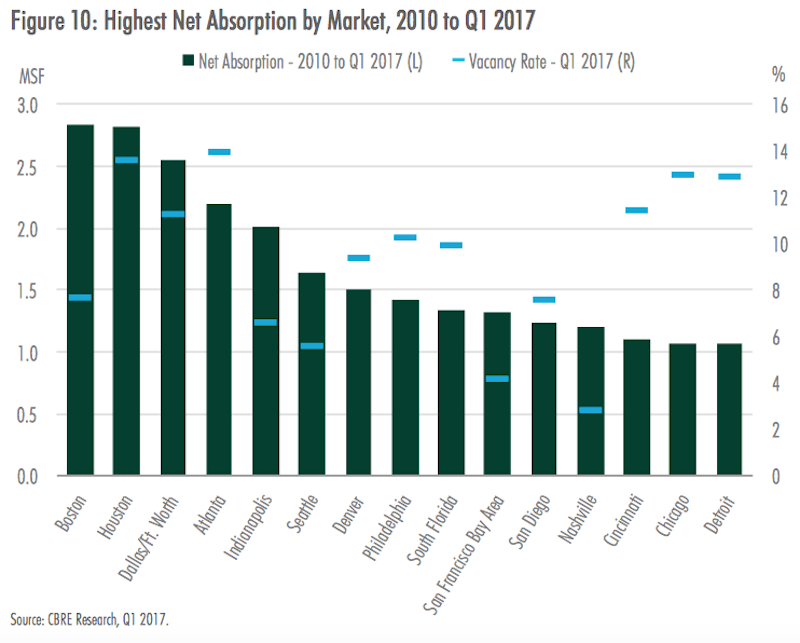

On a yearly basis, net absorption has been increasing since 2011 when it totaled 8.1 million sf. Since then, annual absorption grew by 114% to 17.2 million sf in 2016. Four of the five markets with the most positive net absorption in 2016 were located in the South or West: Houston (436,300 sf) Tampa (413,800 sf) Phoenix (314,400 sf) and South Florida (310,703 sf). Indianapolis was the lone top market not located in the Sun Belt, ranking third with 383,700 sf of positive absorption.

This chart compares cities' net absorptions of MOBs with their vacancy rates for that building type. Image: CBRE

New construction of MOBs is not keeping up with demand, based on net absorption rates for 30 large metros. Image: CBRE

CBRE found that as investors’ appetites for healthcare-related properties have increased, MOBs “have emerged as the most popular property type within the niche.” Ninety-seven percent of investors surveyed in 2017 were most interested in medical office properties among all health care-related real estate that met their investment criteria.

CBRE cites Real Capital Analytics research that estimates total U.S. investment volume in MOBs of at least 10,000 sf at $10.2 billion in 2016, compared to just under $4 billion in 2010. The investment total in 2016 exceeded the previous annual peak of $7.3 billion in 2006.

The Southeast and Western regions have captured a combined 44% of total MOB investment since 2010. California accounted for 56% of the western region MOB investment, with Greater Los Angeles alone representing 37% of the region’s total.

Consolidation has been a major driver of new medical office construction in recent years, as many markets lacked enough large blocks of space to meet the requirements of newly expanded health care provider groups, particularly within close to hospital campuses.

Construction has been abetted by the healthcare systems’ focus on value-based care rather than a fee-for-service approach, which has amplified the need for effective communication across provider teams, driving the need for efficient space that facilitates collaboration.

Over the past two years, completions were highest in the medical hubs of Boston and Houston, each with more than 1.2 million sf of new product delivered. Conversely, only four of the 30 markets analyzed—New York, San Francisco, Orange County, Calif., and Louisville—have had no new completions since Q2 2015.

Related Stories

| Mar 11, 2011

Research facility added to Texas Medical Center

Situated on the Texas Medical Center’s North Campus in Houston, the new Methodist Hospital Research Institute is a 12-story, 440,000-sf facility dedicated to translational research. Designed by New York City-based Kohn Pedersen Fox, with healthcare, science, and technology firm WHR Architects, Houston, the building has open, flexible labs, offices, and amenities for use by 90 principal investigators and 800 post-doc trainees and staff.

| Mar 11, 2011

Mixed-income retirement community in Maryland based on holistic care

The Green House Residences at Stadium Place in Waverly, Md., is a five-story, 40,600-sf, mixed-income retirement community based on a holistic continuum of care concept developed by Dr. Bill Thomas. Each of the four residential floors houses a self-contained home for 12 residents that includes 12 bedrooms/baths organized around a common living/social area called the “hearth,” which includes a kitchen, living room with fireplace, and dining area.

| Mar 3, 2011

HDR acquires healthcare design-build firm Cooper Medical

HDR, a global architecture, engineering and consulting firm, acquired Cooper Medical, a firm providing integrated design and construction services for healthcare facilities throughout the U.S. The new alliance, HDR Cooper Medical, will provide a full service design and construction delivery model to healthcare clients.

| Mar 1, 2011

New survey shows shifts in hospital construction projects

America’s hospitals and health systems are focusing more on renovation or expansion than new construction, according to a new survey conducted by Health Facilities Management magazine and the American Society for Healthcare Engineering (ASHE). In fact, renovation or expansion accounted for 73% of construction projects at hospitals responding to the survey.

| Feb 22, 2011

HDR Architecture names four healthcare directors

Four senior professionals in HDR Architecture’s healthcare program have been named Healthcare directors.

| Feb 17, 2011

HDR Architecture sponsors national effort to green operating rooms

HDR Architecture, Inc. has joined the group of corporate sponsors of Practice Greenhealth’s Greening the Operating Room Initiative. This sweeping and prescriptive path to green the nation’s operating rooms was launched earlier this year to reduce the environmental footprint of the operating suites in hospitals across the country, which can produce between 20 and 30% of a hospital’s total waste.

| Feb 11, 2011

Iowa surgery center addresses both inpatient and outpatient care

The 12,000-person community of Carroll, Iowa, has a new $28 million surgery center to provide both inpatient and outpatient care. Minneapolis-based healthcare design firm Horty Elving headed up the four-story, 120,000-sf project for St. Anthony’s Regional Hospital. The center’s layout is based on a circular process flow, and includes four 800-sf operating rooms with poured rubber floors to reduce leg fatigue for surgeons and support staff, two substerile rooms between each pair of operating rooms, and two endoscopy rooms adjacent to the outpatient prep and recovery rooms. Recovery rooms are clustered in groups of four. The large family lounge (left) has expansive windows with views of the countryside, and television monitors that display coded information on patient status so loved ones can follow a patient’s progress.

| Feb 11, 2011

Two projects seek to reinvigorate Los Angeles County medical center

HMC Architects designed two new buildings for the Los Angeles County Martin Luther King, Jr., Medical Center as part of a $360 million plan to reinvigorate the campus. The buildings include a 120-bed hospital, which involves renovation of an existing tower and several support buildings, and the construction of a new multi-service ambulatory care center. The new facilities will have large expanses of glass at all waiting and public areas for unobstructed views of downtown Los Angeles. A curved glass entrance canopy will unite the two buildings. When both projects are completed—the hospital in 2012 and the ambulatory care center in 2013—the campus will have added more than 460,000 sf of space. The hospital will seek LEED certification, while the ambulatory care center is targeting LEED Silver.

| Feb 9, 2011

Hospital Construction in the Age of Obamacare

The recession has hurt even the usually vibrant healthcare segment. Nearly three out of four hospital systems have put the brakes on capital projects. We asked five capital expenditure insiders for their advice on how Building Teams can still succeed in this highly competitive sector.