Construction spending increased in December compared to both November and a year ago thanks to growing demand for residential construction, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on private nonresidential construction was flat for the month and down compared to a year ago while public sector construction spending fell for both the month and the year.

“Demand for new housing remains strong, while demand for nonresidential projects has been variable and most types of public sector investments in construction are declining,” said Ken Simonson, the association’s chief economist. “Contractors coping with rising materials prices and labor shortages are also dealing with the consequences of a nonresidential market that is, at best, uneven.”

Construction spending in December totaled $1.64 trillion at a seasonally adjusted annual rate, 0.2% above the November rate and 9.0% higher than in December 2020. Full-year spending for 2021 increased 8.2% compared to 2020.

Private residential construction spending rose 0.7% in December from a month prior and 12.7% from December 2020. For 2021 as a whole, residential construction spending jumped 23.2% from 2020, with gains of 32.8% for single-family spending and 15.6% for multifamily spending.

Private nonresidential construction spending was nearly unchanged from November to December but increased 9.1% from December 2020. For all of 2021, private nonresidential spending slipped 2.3% from 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 4.9% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--inched up 0.1% in December and jumped 18.4% year-over-year, driven by surging demand for distribution facilities. Manufacturing construction spending fell by 1.9% in December, after 11 consecutive months of growth, but posted a 30.4% gain above its year-earlier level.

Public construction declined 1.6% in December, with decreases in 11 of the 12 categories, and 2.9% year-over-year. For 2021 as a whole, public construction fell 4.2% from 2020. Highway and street construction increased 0.1% from November and rose 0.9% compared to December 2020. Educational construction slipped 1.4% for the month and skidded 8.5% year-over-year. Transportation construction spending fell 3.0% in December and 6.3% year-over year.

Association officials said one reason for the declines in public sector construction spending is that Congress has yet to appropriate most of the additional funds authorized in the Bipartisan Infrastructure Bill signed by President Biden last year. They urged Congress to quickly make those new funds available so state and local officials can make the investments needed to improve the nation’s aging infrastructure.

“The Bipartisan Infrastructure Package’s immediate promise is not being met because Congress has yet to appropriate much of the increased funding,” said Stephen E. Sandherr, the association’s chief executive officer. “It is time to improve our infrastructure and protect those who rely on it.”

Related Stories

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

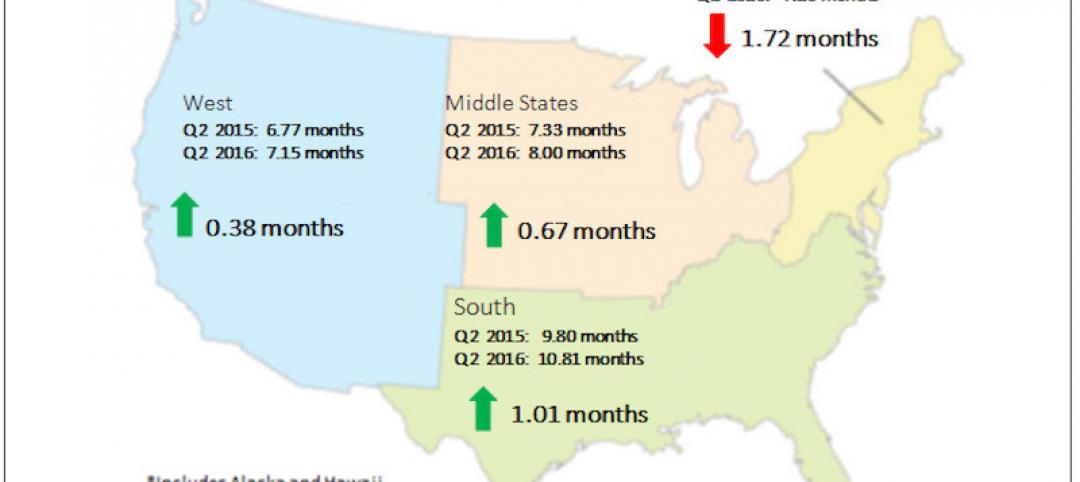

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

Market Data | Sep 2, 2016

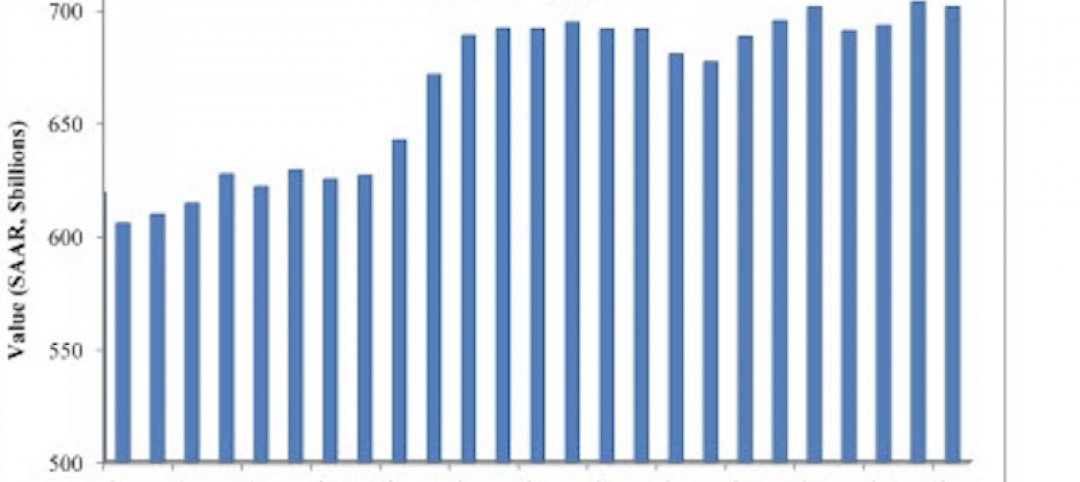

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.