Construction spending increased in December compared to both November and a year ago thanks to growing demand for residential construction, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on private nonresidential construction was flat for the month and down compared to a year ago while public sector construction spending fell for both the month and the year.

“Demand for new housing remains strong, while demand for nonresidential projects has been variable and most types of public sector investments in construction are declining,” said Ken Simonson, the association’s chief economist. “Contractors coping with rising materials prices and labor shortages are also dealing with the consequences of a nonresidential market that is, at best, uneven.”

Construction spending in December totaled $1.64 trillion at a seasonally adjusted annual rate, 0.2% above the November rate and 9.0% higher than in December 2020. Full-year spending for 2021 increased 8.2% compared to 2020.

Private residential construction spending rose 0.7% in December from a month prior and 12.7% from December 2020. For 2021 as a whole, residential construction spending jumped 23.2% from 2020, with gains of 32.8% for single-family spending and 15.6% for multifamily spending.

Private nonresidential construction spending was nearly unchanged from November to December but increased 9.1% from December 2020. For all of 2021, private nonresidential spending slipped 2.3% from 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 4.9% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--inched up 0.1% in December and jumped 18.4% year-over-year, driven by surging demand for distribution facilities. Manufacturing construction spending fell by 1.9% in December, after 11 consecutive months of growth, but posted a 30.4% gain above its year-earlier level.

Public construction declined 1.6% in December, with decreases in 11 of the 12 categories, and 2.9% year-over-year. For 2021 as a whole, public construction fell 4.2% from 2020. Highway and street construction increased 0.1% from November and rose 0.9% compared to December 2020. Educational construction slipped 1.4% for the month and skidded 8.5% year-over-year. Transportation construction spending fell 3.0% in December and 6.3% year-over year.

Association officials said one reason for the declines in public sector construction spending is that Congress has yet to appropriate most of the additional funds authorized in the Bipartisan Infrastructure Bill signed by President Biden last year. They urged Congress to quickly make those new funds available so state and local officials can make the investments needed to improve the nation’s aging infrastructure.

“The Bipartisan Infrastructure Package’s immediate promise is not being met because Congress has yet to appropriate much of the increased funding,” said Stephen E. Sandherr, the association’s chief executive officer. “It is time to improve our infrastructure and protect those who rely on it.”

Related Stories

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

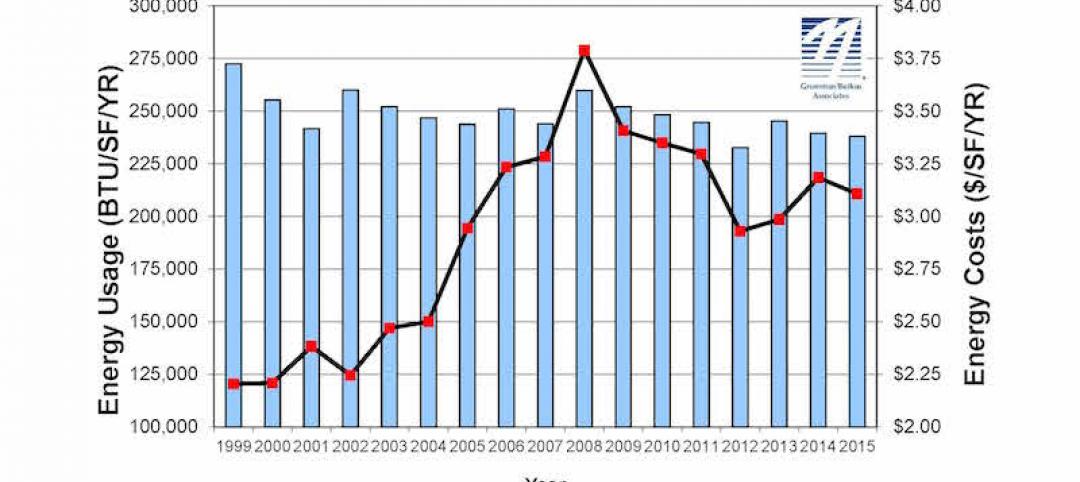

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

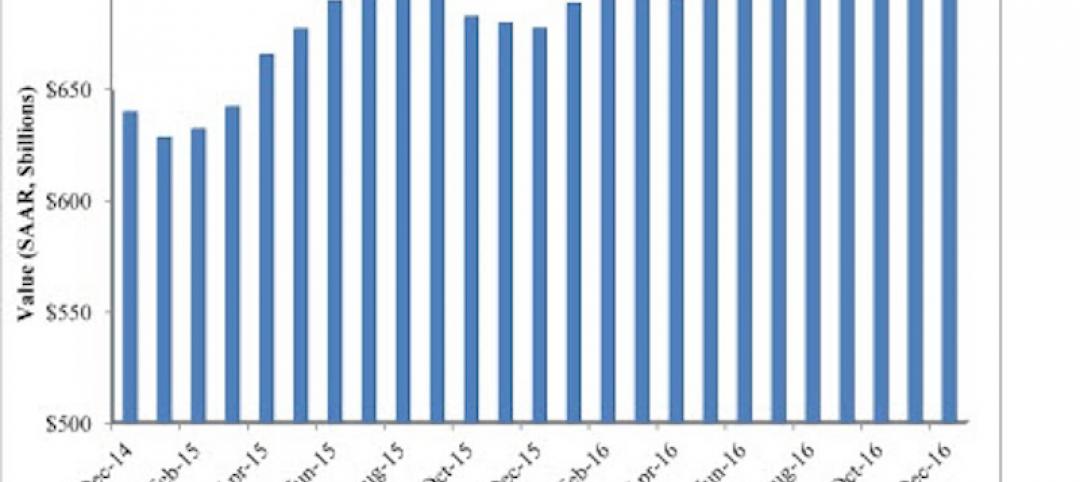

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.